How Much Money Did Michael Jackson Owe The IRS? Unpacking A King-Sized Tax Battle

When we think about Michael Jackson, our minds often go to his incredible music, his groundbreaking performances, and that undeniable global influence. Yet, beneath the dazzling stage lights and record-breaking sales, there was, so to speak, a very real financial story unfolding, particularly after his passing. People often wonder about the financial health of big stars, and perhaps, just perhaps, one of the most talked-about aspects of his estate has been the considerable disagreement with the United States tax authority. It's a situation that truly highlights how much of a complex business managing a celebrity's wealth can be.

It's not just about what a person earns, but what their legacy is worth, especially when they are no longer with us. The question, "How much money did Michael Jackson owe the IRS?" isn't a simple one with a quick number. Instead, it opens up a rather fascinating look into the world of estate taxes, valuations, and the long, often quiet, legal battles that happen behind the scenes. This particular financial disagreement became one of the biggest and longest-running tax cases involving a deceased celebrity, actually.

This article will take a closer look at the significant financial discussions between Michael Jackson's estate and the IRS, exploring the amounts involved, the reasons for the disagreement, and the eventual outcomes. We'll explore how something as seemingly straightforward as a tax bill can turn into a decade-long legal struggle, and what it all meant for the King of Pop's lasting financial legacy. You know, it's quite a tale of numbers and legal arguments.

Table of Contents

- Michael Jackson: A Brief Look at His Life

- The IRS and Michael Jackson's Estate: The Initial Showdown

- Understanding Estate Taxes and Celebrity Valuation

- The Heart of the Dispute: Image and Likeness

- Other Key Assets Under Scrutiny

- The Long Road to Court and the Ruling

- What the Final Decision Meant

- Frequently Asked Questions About Michael Jackson's IRS Case

- Conclusion: A Legacy and Its Financial Footprint

Michael Jackson: A Brief Look at His Life

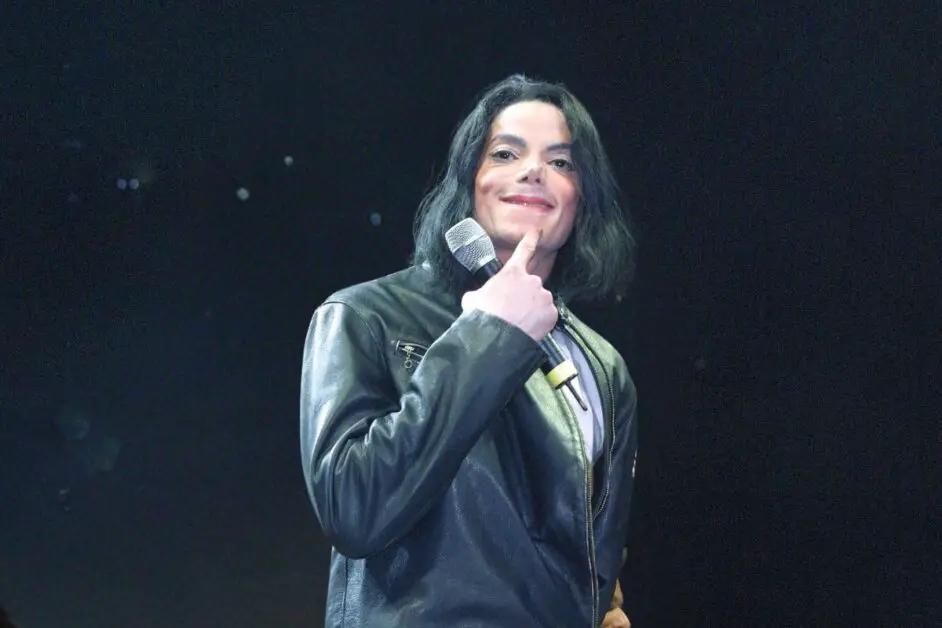

Before we get into the nitty-gritty of the tax situation, it's probably good to remember a little about the man himself. Michael Joseph Jackson was, you know, a true phenomenon. Born in Gary, Indiana, on August 29, 1958, he started his music journey at a very young age with his brothers in the Jackson 5. His solo career, however, is where he truly became a global icon, releasing albums like "Thriller," which remains one of the best-selling records of all time. His influence on music, dance, and popular culture is, in a way, just immense.

He was known for his incredible stage presence, his unique vocal style, and his pioneering music videos. Beyond the music, he was also a humanitarian, supporting various charities throughout his life. His sudden passing on June 25, 2009, sent shockwaves around the world, leaving behind a massive musical catalog and, as it turned out, a rather complicated financial picture for his family and estate to sort out. It was, apparently, a very significant moment for many people.

Personal Details and Bio Data

| Full Name | Michael Joseph Jackson |

| Born | August 29, 1958 |

| Birthplace | Gary, Indiana, U.S. |

| Died | June 25, 2009 (aged 50) |

| Cause of Death | Acute Propofol and Benzodiazepine Intoxication |

| Occupation | Singer, Songwriter, Dancer, Philanthropist |

| Years Active | 1964–2009 |

| Spouse(s) | Lisa Marie Presley (m. 1994; div. 1996) Debbie Rowe (m. 1996; div. 1999) |

| Children | 3 (Prince, Paris, Blanket) |

| Notable Albums | Off the Wall, Thriller, Bad, Dangerous, HIStory |

The IRS and Michael Jackson's Estate: The Initial Showdown

So, the big question: How much money did Michael Jackson owe the IRS? Well, the situation wasn't that he owed money *before* he passed away in the traditional sense, but rather that his estate faced a colossal estate tax bill *after* his death. The IRS, which is the United States' tax collection agency, felt that the value of his estate at the time of his passing was, you know, much higher than what his estate administrators reported. This difference in opinion led to a very significant disagreement, as a matter of fact.

- Did The Pope Attend Jfks Funeral

- Who Is Madisons Baby Daddy

- Who Is Adam Sandlers Daughter In Happy Gilmore 2

When someone with a lot of assets passes away, their estate has to pay a tax on the total value of what they leave behind. This is called an estate tax. The challenge for someone like Michael Jackson is figuring out the exact worth of everything from his music catalog to his personal belongings, and even his fame itself. The IRS initially claimed that the estate owed a truly staggering amount in taxes and penalties, suggesting a total bill that could have been well over $700 million. This was, basically, a huge number that shocked many people.

The estate, on the other hand, had a very different idea about what everything was worth. They believed the value was much lower, which would mean a much smaller tax payment. This gap between the two valuations was, quite frankly, enormous. It set the stage for a lengthy legal battle that would unfold over more than a decade, proving that even after death, financial matters can be incredibly complex. It's almost like a financial detective story, you know?

Understanding Estate Taxes and Celebrity Valuation

To really get a grip on "How much money did Michael Jackson owe the IRS?", it helps to understand a little about how estate taxes work. When a person passes, the value of their property, money, and other assets gets added up. This total sum is called their "gross estate." After certain deductions, like debts and administrative costs, the remaining amount is what's subject to federal estate tax. The tax rate can be, apparently, quite high for very large estates. For celebrities, this process gets, you know, much more complicated.

Think about it: how do you put a price tag on someone's fame, their face, their voice, or the potential earnings from their image long after they're gone? This is where the concept of "image and likeness" comes into play. For most people, this isn't a major part of their estate. But for a global icon like Michael Jackson, his image, his name, and his musical legacy were, arguably, his most valuable assets. Determining the fair market value of these intangible things at the exact moment of death is, seriously, a very difficult task.

The IRS and the estate often use different methods and assumptions to come up with their valuations. The IRS might look at future earnings potential, while the estate might argue for a lower value based on market conditions at the time of death, or perhaps, existing debts. This fundamental difference in how "much" something is worth is what often leads to these major disagreements. It's not just about counting money; it's about, basically, predicting the future value of a person's lasting impact.

The Heart of the Dispute: Image and Likeness

The core of the dispute over how much money Michael Jackson's estate owed the IRS really came down to the value of his "image and likeness." This refers to the commercial value of his name, voice, signature, photograph, and other identifying characteristics. The IRS took a very aggressive stance, initially claiming that this particular asset was worth an astonishing $434 million at the time of his passing. That's, you know, a truly immense figure for something so abstract.

The estate, however, presented a dramatically different view. They argued that at the time of his death in 2009, Michael Jackson's career was, in some respects, in decline, he was deeply in debt, and his public image had suffered due to various controversies. They believed his image and likeness were worth a comparatively tiny sum: just $2,105. This was, literally, a difference of hundreds of millions of dollars, highlighting how much disagreement there was on this one point. It's almost hard to believe the gap was so wide, right?

This huge disparity wasn't just about numbers; it was about how each side viewed Michael Jackson's commercial viability at that specific moment in time. The IRS saw a dormant goldmine, ready to explode after his death, while the estate saw a troubled artist facing significant financial and reputational challenges. The court would eventually have to step in and make a decision on this incredibly complex and, you know, very important valuation. It was a really central part of the entire financial argument, you know?

Other Key Assets Under Scrutiny

While the image and likeness valuation was a central point, the IRS also challenged the estate's valuation of other significant assets. One of these was Neverland Ranch, Michael Jackson's famous property in California. The estate valued it at a certain amount, while the IRS believed it was worth, you know, much more. The ranch had been a major part of his public persona, but its actual market value at the time of his passing was a subject of much debate, apparently.

Another major asset was Michael Jackson's interest in the Sony/ATV music publishing catalog. This catalog included a vast collection of songs, not just his own, but also many by other famous artists like The Beatles. He had purchased a significant stake in this catalog years earlier, and it was, arguably, one of his most valuable financial holdings. The IRS and the estate also had differing opinions on how much this particular asset was worth, adding another layer of complexity to the overall tax calculation. It's like, you know, trying to put a price on a treasure chest with many different kinds of jewels inside.

These additional disagreements, combined with the primary dispute over his image and likeness, meant that the total amount the IRS claimed was owed was, quite honestly, a very substantial figure. The estate had to fight on multiple fronts to prove their valuations were accurate and fair, considering the circumstances at the time of his death. It was a comprehensive review of, basically, everything he owned or had a stake in, which, you know, takes a lot of effort and time.

The Long Road to Court and the Ruling

Because the IRS and Michael Jackson's estate couldn't agree on the value of his assets, the case ended up in U.S. Tax Court. This meant years of legal arguments, presenting evidence, and expert testimony from both sides. The estate had to demonstrate why their lower valuations were correct, bringing in financial experts and appraisers to support their claims. The IRS, similarly, presented their own experts to justify their higher figures. It was, truly, a very lengthy process that required a lot of patience from everyone involved.

The case, known as *Estate of Jackson v. Commissioner*, finally saw a significant ruling in 2021, more than a decade after Michael Jackson's death. This ruling was a major win for the estate. The Tax Court judge sided largely with the estate on the valuation of Michael Jackson's image and likeness. Instead of the IRS's claimed $434 million, the court determined the value was, in fact, a much lower $4.15 million. This was a massive reduction, essentially validating the estate's arguments about his financial state at the time of his passing. It's almost like a financial victory, you know?

The court also ruled in favor of the estate on the valuation of Neverland Ranch and Michael Jackson's interest in the Sony/ATV music catalog. These decisions significantly reduced the total value of the estate as determined by the court, which in turn, meant a drastically lower estate tax bill than what the IRS had initially demanded. It was, apparently, a very important moment for the estate's financial future, allowing them to manage his legacy more effectively. You can learn more about estate taxes and their implications on our site.

What the Final Decision Meant

The Tax Court's decision was a game-changer for Michael Jackson's estate. While the estate still had to pay a substantial amount in taxes, the final bill was dramatically less than the IRS's initial claim of over $700 million in taxes and penalties. This ruling effectively saved the estate hundreds of millions of dollars, allowing more of Michael Jackson's post-mortem earnings to go towards his children and other beneficiaries, as well as managing his ongoing legacy. It was, in a way, a very clear victory for the estate's legal team.

This case also set a very important precedent for how celebrity estates are valued, particularly regarding intangible assets like image and likeness. It showed that while a celebrity's fame might seem boundless, its commercial value at the exact moment of death can be, you know, much more nuanced and potentially lower than one might assume, especially if their career was in a difficult spot. It highlighted the complexities of valuing a human life's commercial output, even after it has ended. This sort of thing is, actually, quite complex.

The resolution of this long-running dispute means that the estate can now focus more clearly on managing Michael Jackson's immense musical and cultural heritage, rather than being bogged down in continuous legal battles over tax liabilities. It’s a powerful example of how much legal effort goes into preserving a superstar's financial legacy, ensuring that their work continues to benefit those they left behind. To be honest, it's a testament to persistent legal work. We have more information on this very page for you.

Frequently Asked Questions About Michael Jackson's IRS Case

How much was Michael Jackson's estate initially valued at by the IRS?

The IRS initially valued Michael Jackson's estate at a much higher amount than his executors did, leading to a claim of over $700 million in unpaid taxes and penalties. They believed his image and likeness alone were worth $434 million at the time of his passing, which was, you know, a very large sum.

What was the key disagreement between the estate and the IRS?

The main point of contention was the valuation of Michael Jackson's image and likeness at the time of his death. The IRS believed it was worth hundreds of millions, while the estate argued it was worth only a tiny fraction of that due to his financial troubles and public image issues at the time. It was, essentially, a dispute over how much his fame was worth when he died.

What was the outcome of the Tax Court ruling?

The U.S. Tax Court largely sided with Michael Jackson's estate in 2021. The court significantly reduced the valuation of his image and likeness to $4.15 million, and also lowered the valuations for Neverland Ranch and his share of the Sony/ATV music catalog. This decision meant the estate owed a much smaller amount in taxes than the IRS had originally demanded, saving them, you know, hundreds of millions of dollars. For more details on the court's decision, you can refer to reputable financial news sources or legal publications like the Forbes article on the ruling.

Conclusion: A Legacy and Its Financial Footprint

The story of "How much money did Michael Jackson owe the IRS?" is more than just a tale of numbers; it's a profound look at the enduring value of a cultural icon and the complex world of estate law. It shows that even after a person's passing, their financial affairs can be, you know, much like a living entity, constantly evolving and requiring careful management. The long battle with the IRS underscores the challenges faced by estates of high-profile individuals, especially when trying to put a price tag on something as intangible as global fame. It was, frankly, a very important case that will likely influence future similar situations.

The eventual resolution of this major tax dispute allows Michael Jackson's legacy to continue to thrive, with his estate better positioned to honor his memory and support his family. It's a testament to the fact that while fame can bring immense wealth, it also comes with, you know, a very unique set of financial and legal responsibilities that can extend far beyond a lifetime. This case, basically, highlights how much financial planning and legal expertise are needed to handle such a significant estate.

- Whats The Cut Off Age For The Voice

- Who Is The Oldest Coach In The Nfl

- Why Doesnt Jennifer Lawrence Have Social Media

How Much Money Did Michael Jackson Make? A Look at The King of Pop’s

I owe the IRS money, what are my options? - Maxwell Dunn, PLC

Michael Jackson's Children Targeted By IRS - AllHipHop