What Is The Equitable Spouse Relief? Finding Fairness In Tax Debt

When you file a joint tax return, there's a big responsibility that comes with it. You and your spouse, or even former spouse, become jointly and severally liable for the entire tax bill. This means the IRS can come after either of you for the full amount, regardless of whose income it was. For many people, this can feel incredibly unfair, especially if one person was unaware of tax issues or was in a difficult situation. That's where something called equitable spouse relief can, in a way, come into play, offering a potential lifeline for those feeling burdened by a shared tax debt that doesn't truly feel shared.

Imagine, if you will, a situation where you've done everything right, yet find yourself facing a tax bill because of someone else's actions or omissions on a joint return. It's a tough spot, and the IRS, to its credit, does recognize that life isn't always fair. This relief option is, you know, designed for those specific circumstances where holding you responsible for a tax debt would simply be inequitable. It's about finding a fair path forward when you're caught in a financial bind that wasn't your doing.

So, if you've ever wondered how the IRS might offer a way out of a tax problem that feels unjust, then understanding equitable spouse relief is a very good place to start. It's a vital part of the innocent spouse relief program, but it stands apart as a flexible option for many. We'll explore what it means, who it helps, and how you might, as a matter of fact, seek this particular kind of help from the tax authorities.

- Why Did Pete Carroll Retire

- What Was The Sudden Death Of The American Idol Singer

- Why Is Raven Divorced

Table of Contents

- What is Equitable Spouse Relief?

- Who Can Seek This Relief?

- When Equitable Relief Is Not An Option

- Understanding Joint and Several Liability

- Equitable Relief vs. Other Spouse Reliefs

- How to Request Equitable Relief

- Factors the IRS Considers

- Community Property States and Equitable Relief

- Next Steps for Seeking Relief

What is Equitable Spouse Relief?

Equitable spouse relief is a remedy provided by the Internal Revenue Service (IRS) that can release a person from this shared responsibility for tax debt. It's a form of tax relief that is available to taxpayers who do not qualify for other forms of relief, such as innocent spouse relief. This type of relief can help taxpayers who are facing a tax burden that, under all the facts and circumstances, would be unfair to hold them accountable for.

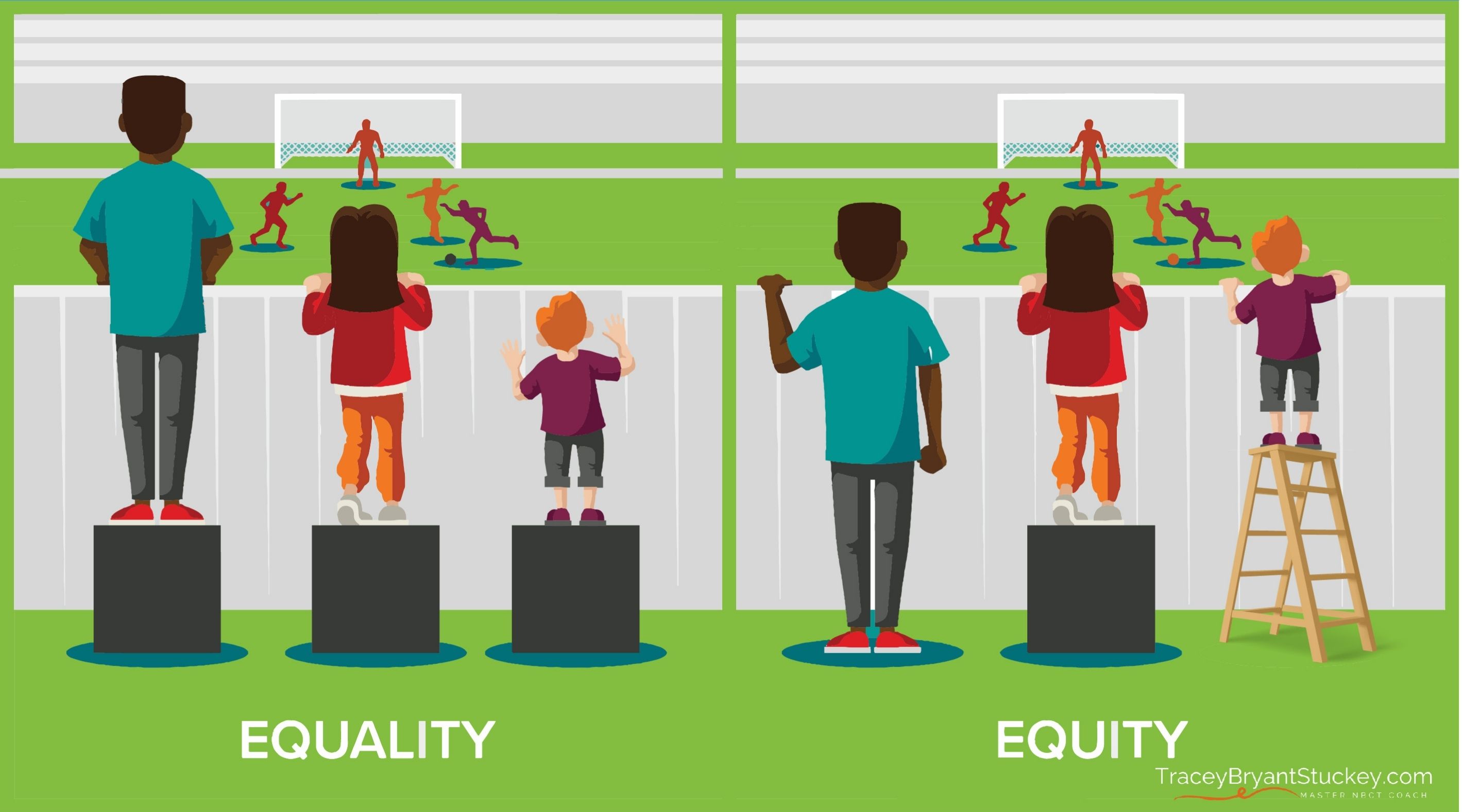

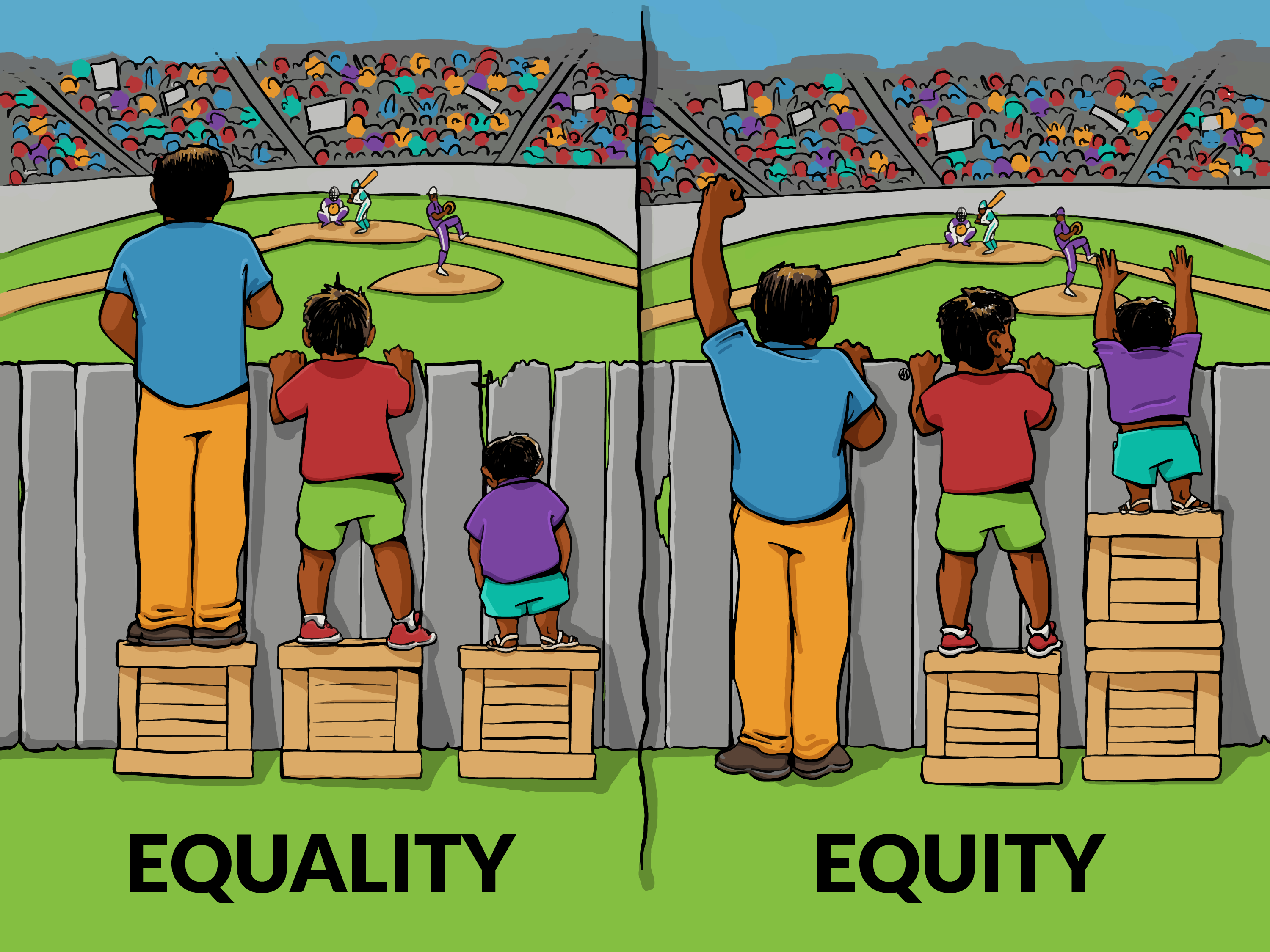

Basically, equitable relief is when the IRS decides that it's unfair to hold you responsible for your spouse or former spouse's tax debt on your joint return. This form of innocent spouse relief is the only one that is, in a way, flexible enough to cover a wide range of situations where other specific criteria might not be met. It's about fairness, pure and simple, and giving equal treatment to everyone in a just manner.

The meaning of "equitable" itself is having or exhibiting equity. It means dealing fairly with all concerned, or being fair in a way that accounts for and attempts to offset disparities in the way people are treated. Something that is equitable is fair and reasonable, providing equal treatment to everyone. This concept is commonly used in legal, social, and ethical contexts to represent fairness and justice, so it's, you know, a very important word here.

- What Were Robert Kennedys Last Words

- Who Is Andy Reids Twin Brother

- Whose Baby Is Madison Pregnant With

Who Can Seek This Relief?

Equitable relief is generally granted only for taxes due on your spouse's income and assets. This means the debt you're seeking relief from must be tied to something your spouse earned or owned, not something that was clearly yours. It's a flexible option for those who do not qualify for the other two types of relief, and it can apply to both understatements of tax and underpayments, which is tax that was, you know, simply not paid.

This relief is for situations where it would be truly unfair to hold someone responsible. For instance, equitable relief can be a lifeline for taxpayers unfairly burdened with a spouse’s tax debt, especially in financial deception or abuse cases. It's a recognition that not all joint returns are created equal in terms of responsibility, and that sometimes, one person is simply caught in a difficult situation.

To qualify for equitable relief, it must be found that under all the facts and circumstances, it would be unfair to hold the spouse liable for the deficiency or underpayment of tax. This is a rather broad standard, allowing the IRS to consider a variety of personal situations and hardships. It's not a guaranteed path, but it is, you know, a real possibility for many.

When Equitable Relief Is Not An Option

While equitable relief offers a broad path to fairness, there are some specific situations where you simply can't claim this type of relief. For example, you can't claim relief for taxes due on individual shared responsibility payments. These are payments related to health care coverage, and they are, in a way, treated differently from income tax debts.

Also, trust fund recovery penalties for employment taxes are generally not eligible for equitable relief. These penalties are very serious and are assessed against individuals responsible for collecting, accounting for, and paying over certain taxes, like payroll taxes. They are, you know, seen as a different category of liability.

So, it's important to understand that while equitable relief is flexible, it's not a universal solution for every type of tax debt. It's specifically aimed at income tax liabilities arising from joint returns where, as a matter of fact, holding one spouse responsible would be truly unfair.

Understanding Joint and Several Liability

When you file a joint income tax return, the law makes both you and your spouse responsible for the entire tax liability. This is called joint and several liability. It means that the IRS can pursue either spouse, or both, for the full amount of any tax, interest, or penalties due on that return. It doesn't matter who earned the income or who caused the error; both are equally on the hook, you know, for the entire amount.

This concept is the very reason why spouse relief options exist. Without them, an innocent spouse could be financially ruined by a partner's actions. Joint and several liability is, in a way, a fundamental principle of joint tax filing, and it's what makes relief programs like equitable relief so necessary for fairness.

It's a rather significant commitment to make when you sign a joint return, and many people don't fully grasp the depth of this shared responsibility until a problem arises. That's why understanding equitable relief and other options is, you know, so important for anyone who has filed, or plans to file, jointly.

Equitable Relief vs. Other Spouse Reliefs

Equitable relief is one of three forms of innocent spouse relief available to married, or formerly married, taxpayers. Taxpayers who filed joint returns are generally jointly and severally liable, as we've discussed. However, the IRS offers different avenues for relief, and it's helpful to know how equitable relief fits in with the others. Section 6015 (b) and (c) specifies two sets of circumstances under which relief from joint and several liability is available, and then there's equitable relief under 6015(f).

Injured Spouse Relief

Injured spouse relief lets you reclaim money taken from your tax refund to cover your spouse's debts. This is different from tax liability. For instance, if your spouse owes child support, a student loan, or state income tax, and your joint refund is seized to pay it, you might be an injured spouse. This relief is about your portion of the refund, not the tax debt itself. It's, you know, a very specific kind of relief.

Innocent Spouse Relief

Innocent spouse relief relieves you from liability for tax, interest, and penalties if your spouse (or former spouse) understated tax on your joint return, and you didn't know about it, and it would be unfair to hold you responsible. This is the first of four types of tax relief that protect individuals from being held responsible for errors or misreporting on a joint tax return by their spouse or ex. It has stricter criteria than equitable relief, focusing on understatements of tax due to erroneous items.

Separation of Liability

This type of relief allows you to divide the tax liability on a joint return between you and your former spouse. It's generally available if you are divorced, widowed, or legally separated, or if you did not live in the same household as your spouse at any time during the 12-month period ending on the date you request relief. It separates the liability, so you are only responsible for your portion, which is, you know, a very direct approach.

Equitable relief is a flexible option for those who do not qualify for the other two types of relief, innocent spouse relief or separation of liability. It can apply to both understatements of tax and underpayments, which is tax that was simply not paid. This makes it a broader option for many who find themselves in a tough spot with the IRS, providing a path when other, more specific, avenues are closed.

How to Request Equitable Relief

To request relief, you generally file Form 8857, Request for Innocent Spouse Relief. This form covers innocent spouse relief, separation of liability, and equitable relief, so you don't have to try to figure out which specific type you qualify for before you start. You just fill out this one form, and the IRS will consider all applicable options for you, which is, you know, quite helpful.

To apply for IRS equitable relief, a taxpayer must submit Form 8857, Request for Innocent Spouse Relief, to the IRS. The form must be submitted within two years of the first collection activity the IRS takes against you for the tax debt, or within two years of when the IRS first tells you they plan to collect the tax from you. This type of relief must be requested during the period the IRS can collect the tax from you, so timing is, you know, very important.

Applying for relief can be complicated, and it often involves providing a lot of personal and financial information to the IRS. It's a detailed process where you must lay out all the facts and circumstances that make it unfair to hold you responsible. This means gathering documents, writing statements, and, you know, being very clear about your situation.

Factors the IRS Considers

Under the innocent spouse/equitable relief program, the IRS can discharge an individual of liability if it would be unfair to hold the individual liable for any unpaid tax or any deficiency. When considering equitable relief under Section 6015 (f), the IRS may grant it if, under the facts and circumstances, it would be inequitable to hold the requesting spouse liable for any unpaid tax or deficiency. They look at a lot of things to make this decision.

Some factors the IRS might consider include whether you knew or had reason to know about the tax issue, whether you received any significant benefit from the unpaid tax, and whether you are experiencing economic hardship if forced to pay the tax. They also look at whether you were abused by your spouse, or if you are divorced, separated, or widowed, which is, you know, a very human approach.

The IRS also considers whether you made a good faith effort to comply with tax laws after the joint return was filed, and whether you are currently in compliance with all tax laws. It's a holistic review, meaning they look at the whole picture of your life and circumstances to determine if it's truly unfair to hold you responsible. This process is, you know, designed to be fair and reasonable.

Community Property States and Equitable Relief

Married people who did not file joint returns, but who lived in community property states, may also request relief from liability for tax attributable to an item of community income. In community property states, income earned by either spouse during the marriage is generally considered community property, meaning it belongs to both spouses equally. This can create unique tax situations even if a joint return wasn't filed.

So, even if you filed separately, if you live in a community property state and find yourself facing a tax debt related to community income that you believe is unfair to hold you responsible for, equitable relief might still be an option. It's a specific provision that addresses the unique aspects of community property laws and their impact on tax liability. This is, you know, a very important detail for those in such states.

Next Steps for Seeking Relief

If you believe you might qualify for equitable spouse relief, your first step is to gather all your relevant financial and personal documents. This includes tax returns, divorce decrees, bank statements, and any evidence supporting your claim that it would be unfair to hold you responsible. The more information you can provide, the better your chances of a positive outcome, which is, you know, a very practical approach.

Your next step is to complete and submit Form 8857, Request for Innocent Spouse Relief. Remember, this form covers all types of innocent spouse relief, including equitable relief, so you don't need to choose a specific category beforehand. Be sure to fill out the form completely and accurately, providing a clear explanation of your situation.

Consider seeking advice from a tax professional who understands these relief programs. While you don't have to, having someone guide you through the process can be very helpful, especially given the complexities involved. They can help you present your case in the best possible light and ensure you meet all the requirements. Learn more about tax relief options on our site, and you can also find more information about filing IRS forms and procedures there too.

Remember, the IRS aims for fairness, and equitable relief is a testament to that goal. It's a chance for taxpayers to get a fresh start when a shared tax burden feels truly unjust. So, if you're facing such a situation, exploring this option is, you know, a very good idea to consider.

Frequently Asked Questions About Equitable Spouse Relief

What is the difference between innocent spouse relief and equitable relief?

Innocent spouse relief generally applies when there's an understatement of tax on a joint return due to erroneous items, and you didn't know about it. Equitable relief is a broader, more flexible option that applies when you don't qualify for other types of relief, and it would simply be unfair to hold you responsible for a tax debt, whether it's an understatement or an underpayment. It's, you know, the "catch-all" for fairness.

How long do I have to request equitable relief?

You generally have two years from the date the IRS first begins collection activities against you for the tax debt, or from the date they first notify you of their intent to collect. It's important to act quickly once you become aware of the collection efforts, as this period is, you know, quite firm.

Can I get equitable relief if I didn't file a joint return?

Generally, equitable relief is for those who filed joint returns. However, if you live in a community property state and did not file a joint return, you may still be able to request relief from liability for tax attributable to an item of community income. This is a very specific exception for community property states, so it's, you know, worth checking if that applies to you.

- Is Johnny Cash Still Alive

- Did Eddie And Chelsea Ever Date

- Which Country Singer Drank Himself To Death

How Do I Upload My National Board Certification Documents - Jacobs

Equitable Definition

Equitable Definition