What Assets Cannot Be Touched In Divorce? Protecting Your Property

Facing a divorce can feel like a storm, and one of the biggest worries for many people is figuring out what happens to their belongings and money. It's a very common question, that, is that, about what you get to keep and what might be split up. Understanding the difference between what's shared and what's truly yours can bring a lot of calm during a difficult time.

When a marriage ends, assets are typically divided between the two people. Yet, not everything you own is automatically on the table for division. There are certain things that, in many situations, stay with the person who brought them into the marriage or received them in a specific way. Knowing these distinctions can help you feel more prepared, you know, as you move forward.

This article will help you understand which assets are often considered off-limits during a divorce. We'll look at different kinds of property and how courts generally view them. It's really about knowing your financial picture and what might be protected, which, in some respects, is very important for your future.

Table of Contents

- What Are Assets, Anyway?

- The Big Picture: Marital Versus Separate Property

- Assets Often Protected from Division

- When Separate Assets Become Shared: Commingling and Transmutation

- Steps to Help Protect Your Assets

- Frequently Asked Questions

What Are Assets, Anyway?

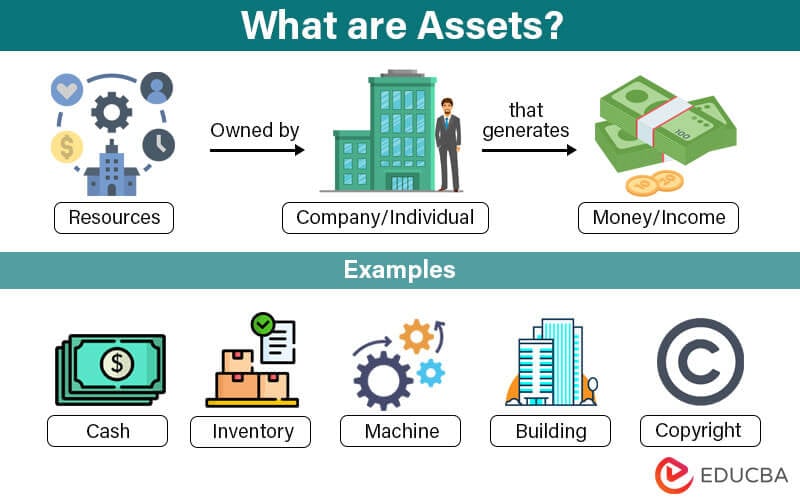

Before we talk about what cannot be touched in divorce, it helps to understand what "assets" mean in the first place. My text explains that assets are anything of value that an individual or a business owns. Basically, they are things you own that have economic worth and could be turned into cash if you needed to, you know.

Assets are resources owned or controlled, with the hope they will bring a positive economic benefit. They have a few key qualities: ownership, economic value, and they are a resource. Knowing what your assets are and their worth is the first step in figuring out your overall financial health.

These items can include many things, for example, property like a house or land, cash in the bank, different kinds of investments, jewelry, art, and even special collections. On the flip side, liabilities are things you owe, like student loans, car loans, mortgages, or credit card debt.

Different Kinds of Assets

My text also mentions that different kinds of assets are handled differently for various purposes, including legal situations like divorce. There are, generally speaking, four main types that are useful to know about. These are liquid assets, illiquid assets, tangible assets, and intangible assets.

Liquid assets are things that can be quickly and easily turned into cash, like money in a checking or savings account, or perhaps certain stocks. Illiquid assets, on the other hand, are not so easy to sell quickly, like real estate or some business interests. Tangible assets are physical things you can touch, such as a car, furniture, or a piece of art. Intangible assets are not physical but still have value, like patents, copyrights, or a business's good reputation, you know.

Understanding these different categories can really help you get a clearer picture of your financial standing, especially when you are considering what assets cannot be touched in divorce. Each type might have different rules about how it's handled during a separation, so, it's pretty important to know the distinctions.

The Big Picture: Marital Versus Separate Property

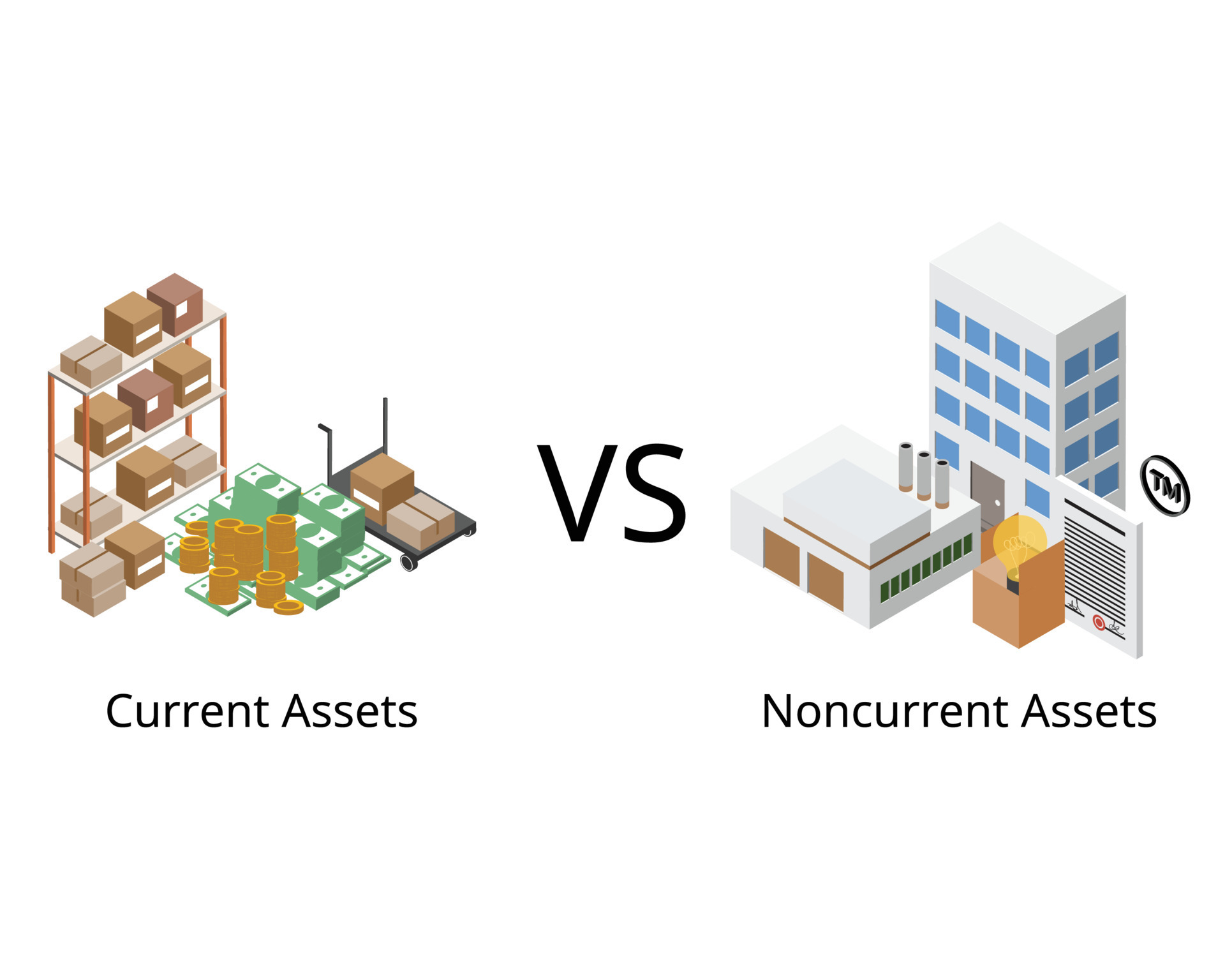

In a divorce, the main idea that helps decide what assets cannot be touched in divorce is the difference between "marital property" and "separate property." Marital property is usually anything acquired by either person during the marriage, no matter whose name it's in. This often includes income, things bought with that income, and even debts taken on during the marriage. This type of property is generally subject to division.

Separate property, however, is typically considered to be outside the marital estate and is not divided between the spouses. This is the category we are really interested in when we talk about what assets cannot be touched in divorce. The exact rules can vary a bit from place to place, but the general principles are pretty similar.

It's really important to remember that just because something was acquired during the marriage doesn't automatically make it marital property. There are specific exceptions, and that's where separate property comes into play. Knowing these exceptions can make a big difference, you know, in how your divorce settlement shapes up.

Assets Often Protected from Division

So, what assets cannot be touched in divorce? Generally, these are things that are considered separate property. Let's look at some common examples that typically fall into this protected category. It's worth noting that the details can get a little tricky, but the main ideas are quite clear.

Pre-Marriage Belongings

Anything you owned before you got married is usually considered your separate property. This includes money in your bank account, a house you owned outright, investments you had, or even a car. If you had it before the wedding, it's generally yours to keep. This is a pretty straightforward rule, actually.

For example, if you bought a small apartment years before you met your spouse, that apartment, along with any equity built up before the marriage, would likely be considered your separate property. However, if marital funds were used to pay the mortgage or improve the property during the marriage, that part could become marital property, which is a bit more complicated.

Keeping clear records of what you owned before the marriage can be very helpful. This might include bank statements, property deeds, or even photos that show when certain items were acquired. Documentation really helps to prove what assets cannot be touched in divorce, you know.

Gifts and Inheritances

Another type of asset that usually cannot be touched in divorce is a gift or an inheritance that was given specifically to one spouse. If your aunt left you money in her will, or if your parents gave you a sum of cash for your birthday, that money is typically seen as your separate property. This holds true even if you received it during the marriage.

The key here is that the gift or inheritance was intended for one person only, not for both spouses as a couple. If, for instance, a gift was given to "you both," it might then be considered marital property. This distinction is really important, you know, when trying to figure out what assets cannot be touched in divorce.

It's usually a good idea to keep inherited funds or significant gifts separate from joint marital accounts. If you deposit an inheritance into a shared bank account, or use it to buy something for both of you, it could potentially lose its separate property status. We'll talk more about that later, but it's something to think about, certainly.

Personal Injury Settlements

Money received from a personal injury settlement is often treated as separate property, at least in part. The portion of the settlement meant to cover things like pain and suffering, lost wages, or medical bills for the injured spouse is generally considered individual property. This is because it's compensation for a personal loss, you know.

However, if the settlement includes compensation for things like lost marital income or medical expenses paid from marital funds, those specific portions might be considered marital property and subject to division. It's a bit of a nuanced area, so, it's pretty important to look at the specifics of each case.

For example, if one spouse was in an accident and received money for their physical pain, that part of the settlement would likely be their separate asset. But if the settlement also covered income they would have earned during the marriage, that income could be seen as shared. This shows how complex what assets cannot be touched in divorce can become.

Pre- and Post-Nuptial Agreements

One of the most direct ways to ensure what assets cannot be touched in divorce is through a prenuptial agreement (before marriage) or a postnuptial agreement (during marriage). These legal documents allow a couple to decide how their assets and debts will be divided if they ever divorce. They essentially define what will be considered separate property, overriding standard state laws.

These agreements can protect specific assets, like a family business, an inheritance, or property owned before the marriage. They can also spell out how future income or assets acquired during the marriage will be treated. For an agreement to be valid, it must meet certain legal requirements, like being fair and transparent, you know.

For instance, if one person owns a business before marriage and wants to ensure it remains theirs entirely, a prenuptial agreement can specify this. This is a very powerful tool for protecting what assets cannot be touched in divorce, providing clarity and avoiding potential disputes later on.

Specific Trusts and Some Retirement Funds

Assets held in certain types of trusts might also be protected. If a trust was set up specifically for one spouse, and the funds were never mixed with marital assets, they could remain separate. The terms of the trust itself play a big role here.

Regarding retirement funds, the portion accrued before the marriage is typically separate property. However, any contributions or growth that happened during the marriage are usually considered marital property and can be divided. This means that while the whole account might not be divided, a significant portion of it very well could be, you know.

For example, if you had a 401(k) with $50,000 in it when you got married, that $50,000 plus any growth on that specific amount might remain separate. But if you added another $100,000 to it during the marriage, that additional amount would likely be marital property. This is a common area where things get a bit complicated when looking at what assets cannot be touched in divorce.

When Separate Assets Become Shared: Commingling and Transmutation

This is where things can get tricky. Even if an asset starts as separate property, it can sometimes become marital property through a process called "commingling" or "transmutation." Commingling happens when separate funds are mixed with marital funds. For instance, if you inherit money and put it into a joint bank account where marital income is also deposited, it can become very hard to distinguish your separate funds from the shared ones.

Transmutation occurs when separate property is intentionally changed into marital property, or vice versa. An example might be if you use your separate inheritance to make a down payment on a house that is then titled in both spouses' names. In many places, this act can be seen as an intention to turn that separate money into a shared asset. This is a rather common way for what assets cannot be touched in divorce to become touchable.

The key takeaway here is that maintaining clear boundaries between separate and marital property is crucial if you want to protect what assets cannot be touched in divorce. If you're not careful, your separate belongings could lose their protected status. It really pays to be mindful of how you handle your finances during marriage, you know.

Steps to Help Protect Your Assets

Knowing what assets cannot be touched in divorce is one thing; actually protecting them is another. Here are some practical steps you can take to help safeguard your separate property, which, honestly, is pretty important for peace of mind.

First, keep meticulous records. This means having documentation for anything you owned before the marriage, any gifts you received individually, or any inheritances. Bank statements, deeds, titles, and gift letters can all serve as proof. The more evidence you have, the stronger your case will be, you know.

Second, keep separate property separate. If you receive an inheritance, put it in a separate bank account that is only in your name, and do not mix it with marital funds. Avoid using separate funds to pay for joint expenses or to improve marital property unless you have a clear agreement about it. This is a very direct way to protect what assets cannot be touched in divorce.

Third, consider a prenuptial or postnuptial agreement. As we discussed, these agreements are powerful tools for defining what assets cannot be touched in divorce. They offer clarity and can prevent disputes down the road. It's often a good idea to discuss this with your partner and get legal advice.

Fourth, seek professional advice early. If you are contemplating marriage or divorce, or if you have significant separate assets, talking to a family law attorney is crucial. They can help you understand the specific laws in your area and advise you on the best strategies to protect your assets. Learn more about asset protection on our site, and you might also find useful information on financial planning during divorce.

For example, an attorney can help you understand how your state views things like appreciation on separate property or the use of separate funds for marital expenses. This guidance is very valuable for ensuring what assets cannot be touched in divorce truly remain yours.

Finally, understand that laws can vary. What assets cannot be touched in divorce might depend heavily on where you live. Some states are "community property" states, where assets acquired during marriage are generally split 50/50. Other states are "equitable distribution" states, where assets are divided fairly, but not necessarily equally. Knowing your state's specific rules is pretty important. For more general information about asset types, you can look up resources from financial institutions or legal aid sites, like perhaps this article from Investopedia on assets.

Frequently Asked Questions

Here are some common questions people often ask about what assets cannot be touched in divorce:

Can I protect my retirement account in a divorce?

Usually, the part of your retirement account that you built up before the marriage is considered your separate property. However, any money you added to it, or any growth it experienced during the marriage, is typically seen as shared marital property and could be divided. It really depends on when the contributions were made, you know.

What happens if I used inherited money to pay for joint expenses?

If you use inherited money, which is typically separate property, to pay for shared expenses or to buy something for both of you, it can sometimes lose its separate status. This is called "commingling" or "transmutation." It becomes very hard to argue that it's still your separate money if it's been mixed with marital funds.

Are gifts received during the marriage always separate property?

Gifts are generally separate property if they were given specifically to one spouse. If a gift was given to both spouses, or if it was intended for the couple, it would likely be considered marital property. The intention behind the gift is pretty important here, you know.

- How Much Did Melanie Trumps Engagement Ring Cost

- Why Does Matt Smith Not Have Social Media

- Why Does Mikey Madison Not Have Social Media

What are Assets? Types, Formulas, Examples, Valuation & Ratios

Personal Asset and Liability Management To Boost Net Worth - FotoLog

Current Assets