How To Separate When You Can't Afford It? Finding Your Way Forward

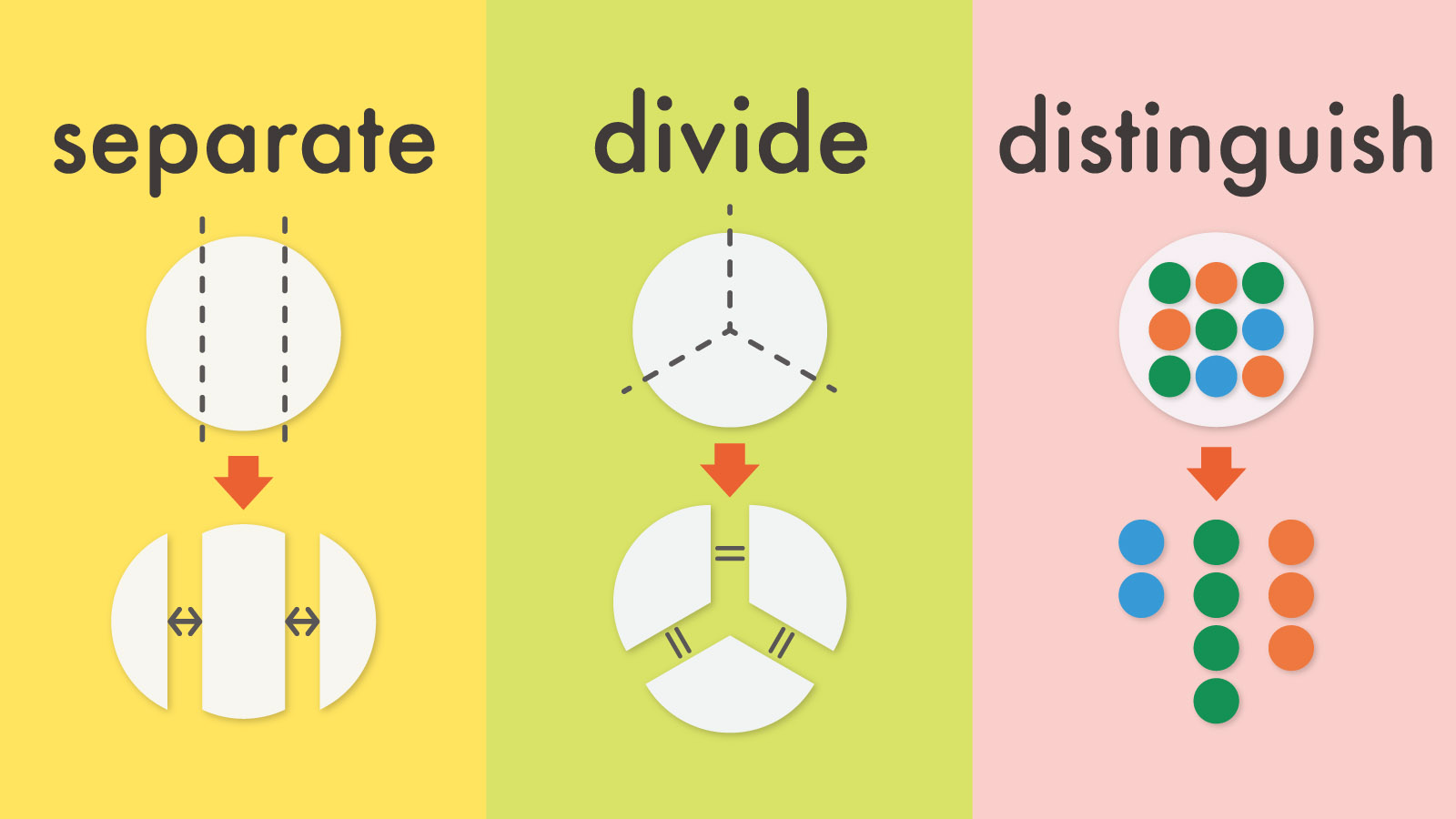

Feeling stuck in a relationship, perhaps even wanting to move on, but seeing a huge financial wall in front of you? That feeling, it's almost like being trapped, and it's a very real concern for so many people. The idea of setting yourself apart, or to distinguish your life from another's, is quite a significant step. In a way, the word 'separate' itself, meaning to set or keep apart, truly captures this moment of division, whether it's physically moving to a different space or just thinking of things as distinct. It's a big decision, and the money part can seem, well, insurmountable.

You are certainly not alone if you are feeling this way. So many individuals face this exact situation, where the desire for a new chapter clashes with the very practical realities of money. It's a common story, really, and it can feel pretty isolating. There are, however, paths you can explore, even when your financial resources seem quite limited. It just takes a bit of planning and, frankly, a lot of courage.

This article aims to help you figure out some steps you can take. We will look at ways to prepare yourself, both emotionally and financially, for such a big life change. You will find ideas for managing your money, finding support, and even exploring low-cost options for legal help. We want to show you that, yes, it is possible to move forward, even when you are starting with very little. It's about finding your footing, one small step at a time, you know?

Table of Contents

- Emotional Preparation for a Big Change

- Getting Your Finances in Order on a Budget

- Finding Affordable Housing Solutions

- Low-Cost Legal and Mediation Options

- Navigating Children and Shared Responsibilities

- Taking Care of Yourself Through the Process

- Frequently Asked Questions (FAQs)

- Taking the First Small Steps

Emotional Preparation for a Big Change

Before you even think about the practical stuff, it's pretty important to get your head around the emotional side of things. This is a huge shift, after all. So, you know, give yourself some grace and time to process what's happening. It’s a very big deal to even consider this path.

Understanding Your Feelings

It's totally normal to feel a mix of things when thinking about separating, especially if money is a worry. You might feel scared, sad, angry, or even a little bit hopeful. Just letting yourself feel these things, without judgment, is a really good first step. Maybe write them down, or just talk to someone you trust about them, you know?

Sometimes, just acknowledging that these feelings are valid can take a bit of the weight off. It’s not about fixing them right away, but rather, it's about recognizing them for what they are. This emotional groundwork, in a way, prepares you for the practical steps ahead, giving you a bit more resilience, perhaps.

Building a Support Network

You absolutely do not have to go through this alone, not really. Reaching out to friends, family members, or even a trusted community group can make a huge difference. They can offer a listening ear, practical advice, or even a temporary place to stay, which is very helpful.

Having people who believe in you and are there to cheer you on is incredibly valuable. It’s like having a safety net, so to speak. These connections can provide emotional strength and, sometimes, even help with some of the more immediate practical needs, like a ride or a meal. It's about leaning on your people, basically.

Getting Your Finances in Order on a Budget

Okay, so this is where a lot of the worry comes from, right? Money. But even with very little, you can start to get a clearer picture of your financial situation and make a plan. It’s about being smart with what you have, and looking for new ways to get more, too.

Assessing Your Current Money Situation

First things first, you need to know exactly where you stand financially. Gather up any bank statements, pay stubs, and bills you can find. Write down all your income and all your expenses, even the small ones. This might feel a bit overwhelming, but it's a really important step, honestly.

Understanding your current money flow, where it comes from and where it goes, is pretty fundamental. This isn't about judging your past spending, but rather, it's about gaining clarity for your future. It’s like mapping out the terrain before you start a long walk, you know?

Creating a Realistic Budget for Your New Life

Once you know your current situation, start thinking about what your expenses will look like on your own. This means housing, food, transportation, and any other necessities. Be brutally honest with yourself about what you can truly afford. This might mean making some tough choices, at least for a while.

Look for areas where you can cut back, even just a little bit. Can you cook more at home? Use public transport? Every small saving can add up. It’s about being resourceful and finding ways to make your money stretch further. This budget is your roadmap, so to speak, for your new financial independence.

Exploring Income Options

If your income is low, or if you don't have one, it's time to brainstorm ways to bring in some money. Could you pick up a part-time job? Do some freelancing or odd jobs? Sell things you no longer need? Even a small amount of extra cash can make a big difference when you are starting fresh.

Look into any government assistance programs you might qualify for, like unemployment benefits, food assistance, or housing aid. These programs are there to help people in your situation, so don't hesitate to explore them. There are, you know, resources available that can offer a bit of a boost.

Finding Affordable Housing Solutions

Where you will live is often the biggest hurdle when you are thinking about separating with limited funds. It can feel like there are no options, but sometimes, you just need to think a little differently about it. There are often more possibilities than you first imagine.

Temporary Shelter and Short-Term Options

In the immediate term, if you need to leave quickly, consider staying with friends or family. This can give you a safe place to land while you figure out your next steps. Women's shelters or community housing programs can also provide temporary, safe accommodation, especially in situations of domestic concern.

These temporary solutions are not meant to be permanent, but they offer a vital breathing space. They give you a chance to gather your thoughts and plan without the immediate pressure of finding a long-term home. It's like a pit stop on a long trip, you know?

Long-Term Affordable Living

For a more lasting solution, look into shared living arrangements. Renting a room in a shared house or apartment can be much more affordable than getting your own place. Community housing initiatives, often run by non-profits, might also offer reduced rent for those who qualify. It's about being open to different ways of living.

You could also explore income-based housing programs in your area. These often have waiting lists, but it's worth putting your name down. Finding a place that fits your budget is key to building a stable new life. It truly is a foundational piece of the puzzle.

Low-Cost Legal and Mediation Options

The legal side of separation can seem very expensive and complicated, which is often why people feel stuck. But there are ways to get legal guidance without spending a fortune. It's about knowing where to look and what questions to ask, basically.

Understanding Your Rights Without Breaking the Bank

Many communities have legal aid societies or pro bono programs that offer free or low-cost legal advice to people with limited incomes. These services can help you understand your rights and obligations regarding property, child custody, and support. It's a very good starting point, honestly.

Some law schools also run clinics where students, supervised by professors, provide legal assistance at reduced rates or for free. This is a pretty great way to get professional guidance without the high fees. You could also find a lot of useful information online from reputable legal resources, just to get a basic idea.

Exploring Mediation and Do-It-Yourself Approaches

Mediation is often a much cheaper alternative to going to court. A neutral third party helps you and your partner come to agreements on issues like finances and children. This can save a lot of money on legal fees and, often, reduce conflict. It's about finding common ground, you know?

For straightforward separations with no complex assets or children, some people choose to file for divorce themselves. This is called a "do-it-yourself" or "pro se" divorce. Court clerks can often provide forms and basic instructions, but they cannot give legal advice. You can learn more about low-cost legal options on our site, which might offer some helpful pointers.

Navigating Children and Shared Responsibilities

When children are involved, separating becomes even more complex, especially when money is tight. Your kids' well-being is probably your top priority, and there are ways to manage this transition with their needs at the forefront, even with limited resources. It's a bit of a balancing act, you see.

Prioritizing the Well-being of Your Children

Open and honest communication with your children, appropriate for their age, is really important. Reassure them that both parents still love them, even if you are living separately. Try to maintain as much routine as possible to give them a sense of stability. This can be very comforting for them.

Look for free or low-cost counseling services for children, if they are struggling with the changes. School counselors or community mental health centers can often provide support. It's about helping them adjust to the new family structure, which can be a bit challenging, you know?

Co-Parenting on a Tight Budget

Co-parenting effectively when money is scarce requires a lot of cooperation and creativity. You might need to share resources, like clothes or toys, between homes. Focus on practical solutions that benefit the children, rather than getting caught up in arguments about money or possessions. It's about putting the kids first, always.

Explore options for shared childcare or transportation to save money. If one parent has more financial stability, discuss how they might contribute to shared expenses in a way that is fair and sustainable for both of you. You might also find helpful resources on co-parenting strategies on our site, which could offer some useful tips.

Taking Care of Yourself Through the Process

This whole process can be incredibly draining, both emotionally and physically. It's absolutely crucial to prioritize your own well-being during this time. You can't pour from an empty cup, as they say, and you need to be strong for yourself and, if you have them, for your children.

Find healthy ways to manage stress. This could be anything from going for walks, listening to music, meditating, or connecting with friends. Don't feel guilty about taking time for yourself, even if it's just a few minutes each day. It's an investment in your future self, you know?

Consider seeking support from a therapist or counselor. Many offer sliding scale fees based on income, or you might find free support groups in your community. Talking through your feelings with a professional can provide valuable coping strategies and emotional resilience. It's a very helpful tool, honestly.

Remember, this is a journey, and there will be ups and downs. Be kind to yourself, celebrate small victories, and keep your eye on the goal of a more independent and fulfilling life. It's a process, and you are doing your best, which is what really matters. For more general advice on managing life changes, you might find some useful perspectives from a reputable mental health organization like the National Alliance on Mental Illness, for instance.

Frequently Asked Questions (FAQs)

Here are some common questions people ask when thinking about separating with limited funds.

How can I leave if I have no job or income?

Starting without an income is definitely tough, but it's not impossible. First, try to secure a temporary place to stay, perhaps with family or friends. Then, focus on finding immediate income sources, even if they are small, like odd jobs or selling items. Look into government assistance programs for unemployment, housing, or food aid. Many communities also have shelters or support services that can provide a safe, temporary space while you get on your feet. It's about building a foundation, you know, one step at a time.

What if my partner controls all the money?

If your partner controls all the money, this adds another layer of difficulty, but there are still ways to gain some financial independence. Start by secretly gathering information about shared accounts, debts, and assets, if it's safe to do so. Open a separate bank account in your name only, even if you can only deposit a small amount at first. Look for free financial counseling services that can help you create a budget and plan for financial independence. Sometimes, reaching out to a domestic violence support organization can also provide resources and safe planning strategies, as financial control can be a form of abuse. It's about taking back a bit of control, you see.

Can I get legal help for free or very cheap?

Yes, absolutely. Many legal aid societies and pro bono programs offer free or low-cost legal assistance for people with limited incomes. These services can help with understanding your rights regarding separation, child custody, and support. Some law schools also run legal clinics where students, supervised by attorneys, provide services at reduced rates. Mediation is another much more affordable option than traditional litigation, as it focuses on reaching agreements outside of court. It's worth researching these options in your local area, as there are often resources available to help you, you know, navigate the legal system without a huge financial burden.

Taking the First Small Steps

The idea of separating when you are worried about money can feel like a mountain, really. But remember, every big journey starts with just one small step. Maybe that step is talking to a trusted friend, looking up a local support group, or just making a list of your current expenses. It's about finding that first bit of momentum, you know?

Don't try to solve everything at once. Focus on one small, manageable action each day or week. Each tiny step forward builds on the last, and before you know it, you will have covered quite a bit of ground. You are capable of more than you think, and finding your way to a new, independent life is totally within your reach.

- Why Does Kate Middleton Not Wear Her Engagement Ring

- How Much Did Gwen Stefanis Engagement Ring Cost

- What Was Robert Kennedys Famous Quote

Is it over? 5 signs you should separate | C + K Family Lawyers

separate と divide と distinguish の違いとは?

Seperate or Separate: Here's the one that Makes you Look bad – INK Blog