Does The IRS Forgive Tax Debt From A Deceased Person? What Families Need To Know Today

Losing someone dear is a profoundly tough experience, so that is just a little bit of what many people go through. It brings a wave of emotional pain and, quite often, a mountain of practical matters to sort out. Among these, you might find yourself wondering about financial obligations, especially if there is any talk of money owed to the government. This can feel like adding a heavy burden to an already difficult time, so it's understandable to seek clarity.

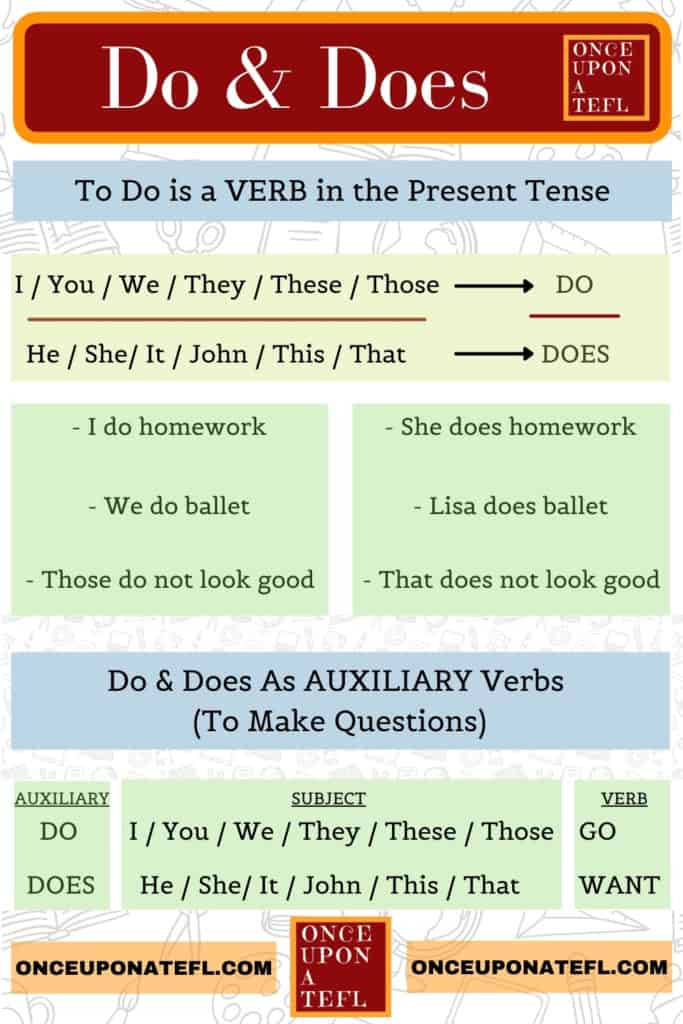

One very common and very important question that comes up for families is about tax debt. Specifically, people often ask, "Does the IRS forgive tax debt from a deceased person?" This phrasing, using the word "does," correctly asks about an action taken by a singular entity, the IRS. It's a critical query for anyone dealing with the aftermath of a loved one's passing, and getting a clear answer can help ease some worries.

Today, as of November 25, 2023, we're going to explore this topic together. We'll look at what really happens to tax debt when someone dies and what steps families or estate representatives might need to take. This information aims to give you a clearer picture and help you manage things with a bit more confidence, you know, during a time that can feel pretty overwhelming.

- Who Was The Painter Who Killed Himself

- Whats The Cut Off Age For The Voice

- How Much Is Emily Compagnos Ring Worth

Table of Contents

- Understanding Deceased Tax Debt: The Basics

- Does the IRS Forgive Tax Debt? The Real Story

- Who is Responsible for a Deceased Person's Tax Debt?

- Steps to Take When a Loved One Leaves Tax Debt

- Important Deadlines and Forms

- Preventing Future Issues

- Frequently Asked Questions

Understanding Deceased Tax Debt: The Basics

What Happens to Debt When Someone Passes?

When a person passes away, their personal debts, including any money owed to the IRS, don't just disappear. Instead, these debts become a responsibility of their "estate." The estate is basically everything the person owned at the time of their passing, like their money, property, and other possessions. It's a collection of all their assets, you know, before they are given to anyone.

Before any heirs receive what was left to them, the estate usually has to settle all outstanding debts. This means that tax debts, along with other financial obligations, are typically paid from the estate's resources. So, in a way, the debt still needs to be addressed, but it shifts from the individual to their collected assets, so that's how it works.

The Role of the Estate

The estate is like a temporary holding place for a deceased person's assets and debts. It's managed by someone appointed to that role, often called an executor or personal representative. This person has the job of gathering all assets, paying off any legitimate debts, and then distributing what's left according to the person's will or state law. That's a pretty big job, actually.

- What Actress Just Revealed She Has Alzheimers

- How Old Is Ari On The Voice

- Did Brian Billick Win A Super Bowl

For tax purposes, the estate is considered a separate legal entity. It might even need its own tax identification number. This is because it has to file its own tax returns and handle any tax liabilities the deceased person had, or that the estate itself generates. It's a distinct process, you know, that has to be followed carefully.

Does the IRS Forgive Tax Debt? The Real Story

When Debt is Generally Not Forgiven

The straightforward answer to "Does the IRS forgive tax debt from a deceased person?" is usually "no," not automatically. The IRS generally expects any tax debt to be paid. They don't just wipe it away because the person who owed it is no longer alive. The debt typically transfers to the deceased person's estate, as we talked about earlier. So, the expectation is that the estate will use its assets to cover these obligations.

This means that if there are assets in the estate, the IRS will seek payment from those assets. It's a bit like any other creditor. They have a claim against the estate for the money owed. This is why it's so important for the executor to understand the full financial picture of the estate, you know, to make sure everything is handled properly.

Situations Where the IRS Might Adjust Debt

While the IRS doesn't just forgive debt, there are some very specific situations where they might adjust or reduce the amount owed. These are not automatic forgiveness but rather formal processes that the estate or its representative would need to pursue. It's not a simple wave of a hand, if you get what I mean.

These situations are usually tied to the estate's ability to pay or other special circumstances. It requires careful documentation and a formal request to the IRS. So, it's not something that just happens by itself; you have to ask for it, basically.

Offer in Compromise (OIC) for Deceased Estates

One possible avenue is an Offer in Compromise, or OIC. An OIC allows certain taxpayers to resolve their tax liability with the IRS for a lower amount than what they originally owed. This can apply to deceased estates too. The IRS will consider an OIC if there's doubt about the estate's ability to pay the full amount, or if there's doubt about the correctness of the amount owed, or if collecting the full amount would create an unfair situation. It's a formal proposal, you know, that needs to be carefully put together.

For an OIC to be accepted, the estate must show that it cannot pay the full tax debt. This usually means providing detailed financial information about the estate's assets and liabilities. The IRS will look at the estate's ability to pay, its equity in assets, and its income. It's a thorough review, so you need to be prepared with all the facts.

Inability to Pay

If an estate has no assets, or very few assets, to pay the tax debt, the IRS might deem the debt "currently not collectible." This isn't forgiveness, but it means the IRS won't actively pursue collection at that time because there's nothing to collect. This happens when the estate is essentially insolvent, meaning its debts are more than its assets. So, there's just no money there to get.

This situation is different from an OIC because it's about the practical reality of collection. If the estate has nothing, the IRS can't get blood from a stone, as the saying goes. However, if assets are discovered later, the debt could become collectible again. It's not a permanent write-off, you know, just a pause.

Who is Responsible for a Deceased Person's Tax Debt?

The Executor's Duties

The primary responsibility for dealing with a deceased person's tax debt falls on the executor or personal representative of the estate. This person is legally appointed to manage the estate. Their duties include identifying all assets and debts, filing necessary tax returns, and paying legitimate debts from the estate's assets. This is a very serious role, with specific legal duties.

An executor must act in the best interest of the estate and its creditors, including the IRS. If an executor distributes assets to heirs before paying tax debts, they could potentially become personally liable for the unpaid taxes. This is a significant risk, so it's really important to get it right and pay debts in the correct order.

Heirs and Their Responsibilities

Generally, heirs are not personally responsible for a deceased person's tax debt. This means that if you inherit money or property, the IRS cannot come after your personal funds to pay your loved one's tax debt. The debt is tied to the estate, not to the individual heirs. So, your own bank account is usually safe.

However, there's a big exception. If an heir receives assets from the estate before all debts, including tax debts, are paid, they might be liable up to the value of the assets they received. This is why the executor's role is so important, to ensure debts are settled before distribution. It's a way, you know, to protect everyone involved.

Steps to Take When a Loved One Leaves Tax Debt

Gathering Information

The first step when facing potential tax debt from a deceased loved one is to gather all relevant financial information. This includes bank statements, investment records, property deeds, and any past tax returns. You need to get a clear picture of what the person owned and what they owed. This is basically your starting point.

Look for any correspondence from the IRS or state tax authorities. This might give you clues about outstanding tax issues. The more information you have, the better equipped you'll be to handle the situation. It's a bit like putting together a puzzle, you know, piece by piece.

Contacting the IRS

Once you have a good grasp of the financial situation, it's wise to contact the IRS directly. You'll need to inform them of the death and inquire about any outstanding tax liabilities. Be prepared to provide the deceased person's Social Security number and a copy of the death certificate. They need this information, obviously, to verify things.

The IRS can provide information about any tax returns that still need to be filed or any taxes that are owed. They can also explain the options available to the estate. This direct communication is really important for getting accurate information and understanding the next steps, so don't shy away from it.

Seeking Professional Help

Dealing with a deceased person's tax debt can be complex. It often involves legal and financial intricacies that are hard to navigate alone. This is where professional help becomes invaluable. Consider consulting with an estate attorney or a tax professional who specializes in estate matters. They can offer guidance and help ensure all legal and tax obligations are met. It's a situation where expert advice can save a lot of trouble, you know, and potential errors.

These professionals can help you understand the specific laws that apply in your state, assist with filing necessary forms, and even communicate with the IRS on behalf of the estate. They can also help determine if the estate qualifies for any relief options. It's a smart move, really, to get someone on your side who understands all the rules.

Important Deadlines and Forms

Final Tax Returns

A final income tax return (Form 1040) must be filed for the deceased person for the year of their passing. This return covers the period from January 1st up to the date of their death. The due date for this final return is generally April 15 of the year following the person's death. So, if someone passed in October 2023, their final 2023 return would be due April 15, 2024.

This return reports all income earned and deductions taken up to the date of death. It's a critical step in settling the deceased person's tax affairs. The executor is responsible for preparing and filing this return. It's one of those things that really needs to be done on time.

Estate Tax Returns

In addition to the final income tax return, some estates might need to file an estate tax return (Form 706). This is separate from income tax and is only required for very large estates. For 2023, an estate tax return is generally required only if the gross estate and prior taxable gifts exceed $12.92 million. So, most estates won't need to file this form.

If an estate tax return is necessary, it is generally due nine months after the date of death. There can be extensions available, but it's important to be aware of this deadline if the estate is substantial. This is a much less common requirement, you know, but it's good to be aware of it just in case.

Preventing Future Issues

Good Record Keeping

One of the best ways to make things easier for those left behind is to maintain excellent financial records. This means keeping track of all income, expenses, investments, and tax documents in an organized manner. If someone has good records, it makes it much simpler for their executor to handle their affairs, including tax matters. It's a really helpful thing to do for your loved ones.

Having clear, accessible records can save a lot of time and stress for the executor. It helps them quickly identify assets, liabilities, and any potential tax issues. This foresight, you know, can make a huge difference during a difficult period.

Estate Planning

Thoughtful estate planning is another powerful tool for preventing future tax headaches. This involves creating a will, setting up trusts, and making decisions about how your assets will be managed and distributed after your passing. Good planning can help minimize tax liabilities and ensure your wishes are carried out smoothly. It's about taking control of your legacy, basically.

Working with an estate planning attorney can help you structure your affairs in a way that protects your assets and simplifies the process for your loved ones. They can help you understand potential estate taxes and strategies to reduce them. It's a proactive step that offers peace of mind, so it's really worth considering.

For more general tax information, you can always visit the official IRS website. This can be a helpful resource for various tax-related questions and forms. You can learn more about tax obligations on our site, and link to this page for additional guidance on estate matters.

Frequently Asked Questions

Can the IRS collect tax debt from heirs?

The IRS generally cannot collect a deceased person's tax debt directly from their heirs' personal funds. The debt is typically owed by the deceased person's estate. However, if an heir receives assets from the estate before all tax debts are paid, they might be responsible for the debt up to the value of the assets they received. This is a very specific situation, you know, that needs careful attention.

What if there are no assets in the estate?

If a deceased person's estate has no assets, or very few assets, to cover their tax debt, the IRS might consider the debt "currently not collectible." This means they won't actively pursue collection because there's nothing to collect. It's not true forgiveness, but rather a recognition of the estate's inability to pay. So, in that case, there's nowhere for the money to come from.

How long does the IRS have to collect deceased tax debt?

The IRS generally has a 10-year period from the date a tax is assessed to collect it. This is known as the Collection Statute Expiration Date (CSED). This time limit still applies even if the taxpayer passes away. However, certain actions, like filing an Offer in Compromise, can pause this collection period. It's a fixed timeframe, you know, that the IRS works within.

Do vs. Does: How to Use Does vs Do in Sentences - Confused Words

Do Vs Does: How To Use Them Correctly In English

Using Do and Does, Definition and Example Sentences USING DO AND DOES