Does Tax Debt Get Split In A Divorce? What You Need To Know

Going through a divorce can feel like navigating a stormy sea, and when you add financial matters, especially something as tricky as tax debt, it gets even more complicated. Many people wonder, and quite rightly so, "Does tax debt get split in a divorce?" It's a really important question, you know, because the answer can significantly shape your financial future after a separation. Knowing what to expect with shared money obligations, particularly those owed to the government, is pretty much essential for anyone stepping into this kind of life change.

This whole situation can be incredibly stressful, and it's understandable to feel a bit overwhelmed by all the legal and financial jargon. You might be asking yourself, "Will I be on the hook for my ex-partner's past tax mistakes?" or "How do we even begin to sort this out?" These are very common concerns, and honestly, they're valid. The way tax debt is handled during a divorce isn't always straightforward, and it really depends on a few key things, like how you filed your taxes when you were together and the specific laws in your area, so it's worth getting clear on it.

We're here to shed some light on this often confusing topic. We'll talk about what usually happens with tax debt when a marriage ends, and we'll give you some useful information to help you understand your situation a bit better. This article aims to help you grasp the various possibilities and steps you can take, offering some clarity during what is, for most people, a very challenging time. So, let's explore this together, shall we, and try to make sense of it all.

Table of Contents

- Understanding Marital Debt in Divorce

- Joint Tax Returns and Shared Responsibility

- Options for Dealing with Tax Debt

- Practical Steps for a Smoother Process

- Frequently Asked Questions About Tax Debt and Divorce

Understanding Marital Debt in Divorce

When a marriage ends, separating assets and debts is a big part of the process, you know. It's not just about who gets the house or the car; it's also about figuring out who owes what. Marital debt, basically, is any debt that you and your partner took on together during your marriage. This could be anything from credit card balances to mortgages, and yes, it often includes tax debt. So, understanding this concept is really important for a fair split, or at least one that feels fair to both parties.

What Counts as Marital Debt?

Generally speaking, marital debt includes any financial obligation acquired by either spouse from the wedding day up until the date of separation, or sometimes even the date the divorce is finalized. This means if you or your partner took out a loan, ran up a credit card, or, indeed, accumulated tax debt during that time, it's typically considered shared. It doesn't always matter whose name is specifically on the account, you know; if the debt was for the benefit of the marriage or the household, it's often seen as a joint responsibility. This is a key point because it does affect how things are divided.

For example, if one person took out a personal loan for home improvements while married, that loan would almost certainly be seen as marital debt. Similarly, if there's a tax bill from a joint tax return filed during the marriage, that's usually right in the middle of what's considered marital debt. So, it's pretty clear that these shared financial burdens are on the table for division. It's a bit like sharing a pizza, you know, everyone gets a slice of the good and the not-so-good.

- Did The Pope Attend Jfks Funeral

- Why Does Mikey Madison Not Have Social Media

- How Much Is Jackie Kennedys Engagement Ring Worth

However, there are exceptions, of course. Debts incurred before the marriage, or those taken on by one spouse purely for their own separate benefit, might not be considered marital debt. For instance, if one partner had student loans before getting married, those typically remain their individual responsibility. It really does depend on the specific circumstances and how a court might interpret them, which is why it's never quite as simple as it seems.

How Courts View Tax Debt

When it comes to tax debt, courts generally view it in the same way they view other marital debts, especially if it arose from joint tax returns. If you filed together, you're both usually held responsible for the accuracy of that return and any resulting tax obligations, you know, even if one person handled all the paperwork. This is a really significant point because it means both parties can be on the hook for the full amount owed to the IRS, or state tax authorities, regardless of who actually earned the income or caused the debt.

However, how the debt is *divided* between the spouses in the divorce settlement is a separate matter from who the IRS holds responsible. A divorce court might decide that one spouse should pay a larger share, or even all, of the tax debt based on various factors, like their current income, their ability to pay, or who was primarily responsible for the tax issue. But, and this is a big "but," this court order doesn't automatically release the other spouse from their responsibility to the IRS. The IRS still sees both parties as liable for joint returns, which is a pretty crucial distinction to grasp, honestly.

This is why understanding the nuances of tax law and divorce law is so important. A family court judge can order your ex-partner to pay the tax debt, but if they don't, the IRS could still come after you. So, in a way, you're still tied to that debt unless you take specific steps with the tax authorities. It's a bit of a tricky situation, actually, and it highlights why getting good advice is so valuable.

Joint Tax Returns and Shared Responsibility

Filing taxes jointly often makes sense for married couples, offering certain benefits and typically resulting in a lower overall tax bill. However, it also creates a shared responsibility, and this is where things can get complicated during a divorce. When you sign a joint tax return, you're both, basically, agreeing to be jointly and severally liable for any tax, interest, or penalties that might come up, even if you later separate or divorce. This means the IRS can pursue either one of you for the full amount owed, regardless of your divorce agreement, which is a pretty serious implication.

The Impact of Filing Together

The act of filing a joint tax return means that both spouses are equally responsible for the accuracy of the information on that return and for paying any tax liability that arises. This shared responsibility continues even after a divorce is finalized. So, if the IRS later finds an error or an underpayment on a joint return from years past, they can, you know, come after either spouse for the entire amount. It's not like they'll split it down the middle for you; they just want their money, pretty much, from whoever they can get it from.

This can be a real shock for some people, especially if one spouse was the primary income earner or managed all the finances and tax preparation. You might think, "Well, I didn't even look at the numbers," but unfortunately, signing that joint return usually means you're accepting that shared burden. It's a legal commitment, after all. So, it really does underscore the importance of reviewing any document you sign, particularly something as significant as a tax return, before putting your name on it.

The IRS doesn't typically care about your divorce decree when it comes to collecting a joint tax debt. While your divorce agreement might state that your ex-partner is solely responsible for a certain tax bill, that agreement is between you and your ex, not between you and the IRS. The IRS still has the right to collect from either of you, which, you know, can feel incredibly unfair if your ex doesn't pay up. This is why many people seek ways to protect themselves from such liabilities.

When One Spouse is More Responsible

Even if one spouse was clearly more responsible for the tax debt – perhaps they misreported income, claimed improper deductions, or simply failed to pay taxes on their earnings – the other spouse can still be held liable by the IRS if they filed jointly. However, there are situations where the IRS might provide relief, especially if one spouse truly had no idea about the errors or omissions that led to the debt. This is where the concept of "innocent spouse relief" comes into play, which is a rather important consideration for many people.

For instance, if one partner ran a business and didn't report all the income, and the other partner had no knowledge of this, the "innocent" spouse might be able to get relief from the tax debt. It's not an automatic thing, though; you have to apply for it and meet specific criteria. The IRS does look at the facts and circumstances of each case, trying to determine if it would be unfair to hold one spouse responsible for the other's actions. So, it's not a guarantee, but it is an avenue worth exploring, you know, if you find yourself in that kind of situation.

The process of proving that you were an "innocent spouse" can be pretty involved, requiring documentation and a clear explanation of why you shouldn't be held responsible. It's not just about saying "I didn't know"; you really have to show that you couldn't have known, or that it would be unfair to hold you accountable. This is where getting professional help can make a real difference, as they can guide you through the application process and help you present your case effectively, which is, honestly, a big help for many.

Options for Dealing with Tax Debt

Facing tax debt during a divorce can feel like an extra burden on an already heavy load. But, you know, there are several avenues you can explore to manage or even alleviate this financial pressure. Understanding these options is pretty key to protecting your financial well-being moving forward. It's not a lost cause, absolutely not, and there are specific programs and strategies that might apply to your situation, which is good to know.

Innocent Spouse Relief: A Lifeline

For many, innocent spouse relief is a critical option. This provision by the IRS can provide relief from additional tax owed on a joint return if your spouse (or former spouse) understated tax due to erroneous items, and you didn't know, and had no reason to know, about the understatement. It's designed to protect taxpayers who were genuinely unaware of their spouse's financial misdeeds. You basically need to show that it would be unfair to hold you accountable for the debt, which is a pretty high bar to meet, but certainly possible.

There are three main types of relief under the innocent spouse provisions: innocent spouse relief, separation of liability relief, and equitable relief. Each has its own set of rules and criteria. For instance, with separation of liability, you can allocate the deficiency on a joint return between you and your former spouse. Equitable relief is a bit broader and can apply if you don't qualify for the other two, but it would be unfair to hold you liable for the tax. It really does depend on your specific circumstances and how they align with the IRS guidelines.

Applying for innocent spouse relief involves submitting Form 8857, Request for Innocent Spouse Relief, to the IRS. You'll need to provide detailed information about your situation, including why you believe you qualify. This process can be lengthy and requires careful attention to detail, so getting help from a tax professional is often a very good idea. They can help you gather the necessary documentation and present your case effectively, which, honestly, can make all the difference in the outcome.

Offer in Compromise and Payment Plans

If innocent spouse relief isn't an option, or if you still have a share of the tax debt, other avenues exist. An Offer in Compromise (OIC) allows certain taxpayers to resolve their tax liability with the IRS for a lower amount than what they originally owe. The IRS considers your ability to pay, your income, expenses, and asset equity when determining if they will accept an OIC. It's not for everyone, you know, but it can be a viable solution if you're facing significant financial hardship and can't pay the full amount.

Another common approach is setting up a payment plan, also known as an installment agreement, with the IRS. This allows you to make monthly payments over a set period, typically up to 72 months. This option is generally available if you owe a combined total of $50,000 or less in tax, penalties, and interest, and you've filed all required tax returns. It's a way to manage the debt without the immediate pressure of a large lump sum, which can be a real relief for many people, especially during a divorce.

For those who don't qualify for an OIC or need a more flexible payment structure, exploring these payment options with the IRS is a sensible step. You can often set up a short-term payment plan for up to 180 days if you can pay the full amount within that time, or a long-term installment agreement. It's about finding a solution that fits your current financial reality, and the IRS does have mechanisms in place to help taxpayers manage their obligations, which is, you know, a good thing.

Negotiating Debt Division in Your Divorce Settlement

While the IRS holds both spouses liable for joint tax debt, your divorce settlement can specify how this debt will be divided between you and your ex-partner. This is where you can, basically, agree on who pays what portion of the tax debt. For example, the agreement might state that one spouse will pay 100% of a particular tax liability, or that it will be split 50/50, or some other arrangement. This part of the divorce process is where you have some control over the internal division of responsibilities, you know, even if it doesn't directly affect the IRS's right to collect.

It's really important to include clear language about tax debt in your divorce decree. This document is a legal contract between you and your ex-spouse. If one party fails to uphold their end of the agreement – for instance, by not paying the tax debt they agreed to pay – the other party can take them back to court to enforce the order. This doesn't stop the IRS from coming after you, but it does give you legal recourse against your ex-partner, which is, you know, a pretty important protection to have.

When negotiating, consider all aspects of the tax debt, including any potential future liabilities or audits. It's also a good idea to discuss how any tax refunds will be handled. Some couples agree to split refunds, while others use them to offset shared debts. A comprehensive agreement that addresses all financial aspects, including current and potential tax issues, can save a lot of headaches down the road. So, taking the time to get this right is definitely worth it, as a matter of fact.

Practical Steps for a Smoother Process

Dealing with tax debt during a divorce can feel like a really heavy burden, but taking proactive steps can make the process much smoother. It's about being prepared and knowing what you need to do, you know, to protect yourself financially. There are some practical things you can start doing right away to get a better handle on the situation and move forward with more confidence, which is, honestly, a huge relief for many.

Gathering Financial Records

One of the most crucial first steps is to gather all relevant financial records. This includes past tax returns (at least the last three to five years), W-2s, 1099s, bank statements, credit card statements, and any documentation related to income, deductions, or tax payments. Having these documents readily available will help you understand the full scope of any tax debt and will be essential for your legal and tax professionals. It really does make a big difference when you have all the facts at your fingertips.

Without complete records, it can be very difficult to accurately assess the situation or apply for relief programs like innocent spouse relief. The IRS, after all, will require documentation to support your claims. So, start by collecting everything you can find, even if it seems insignificant at first. If you don't have copies of past tax returns, you can request them directly from the IRS, which is a pretty common thing to do, actually, for people in this situation.

Creating an organized system for these documents will also be incredibly helpful. Whether it's a physical folder or a digital file, knowing where everything is will save you time and stress. This organized approach basically helps you present a clear picture of your financial history, which is essential for both your divorce proceedings and any dealings with the tax authorities. So, take the time to get your paperwork in order; it really does pay off.

Seeking Professional Guidance

Given the complexities of both divorce law and tax law, seeking professional guidance is almost always a good idea. A qualified divorce attorney can advise you on how marital debt, including tax debt, is typically handled in your state and help you negotiate a fair settlement. They can also explain your rights and obligations within the divorce process. So, finding a lawyer who understands these financial nuances is pretty important, you know, for getting the best outcome possible.

In addition to legal counsel, consulting with a tax professional, like a Certified Public Accountant (CPA) or an enrolled agent, is highly recommended. These experts can help you understand the specifics of your tax debt, explore options like innocent spouse relief or payment plans, and represent you before the IRS if needed. They have a deep understanding of tax regulations and can provide strategies tailored to your unique situation. It's really about getting specialized advice from someone who does this kind of work every day.

Many people find that having both a divorce attorney and a tax professional working together provides the most comprehensive support. Your attorney can focus on the divorce settlement, while the tax expert handles the intricacies of the tax debt itself. This collaborative approach can ensure that both your legal and financial interests are well-protected, which, at the end of the day, is what you really want. So, don't hesitate to reach out for help; it's a smart move.

Communicating with Your Ex-Partner

While divorce can be an emotionally charged time, maintaining open and honest communication with your ex-partner about financial

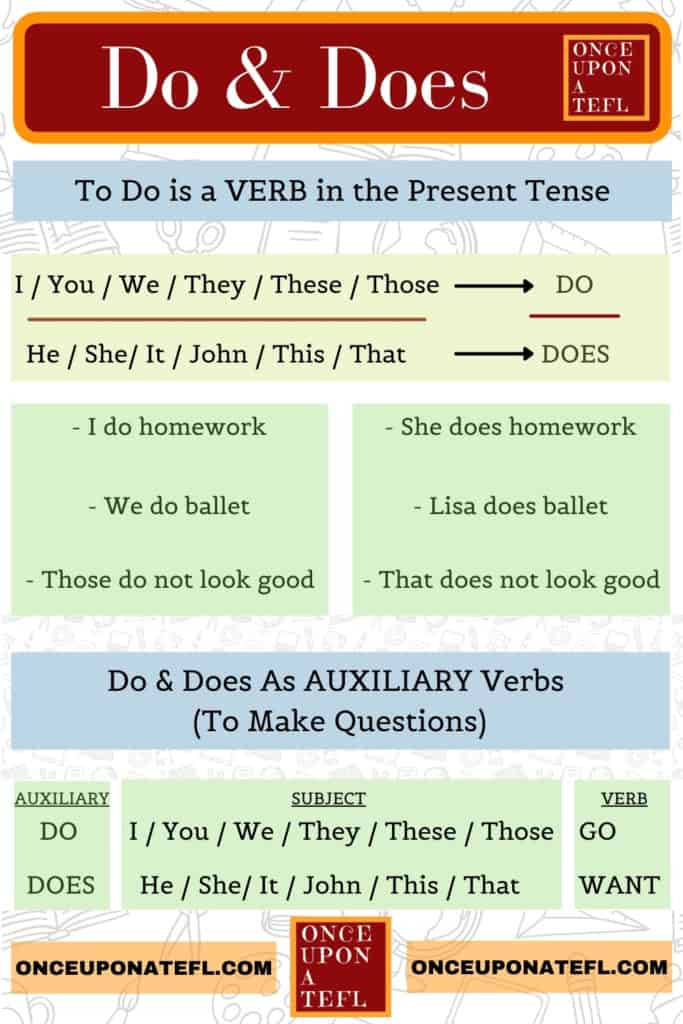

Do vs. Does: How to Use Does vs Do in Sentences - Confused Words

Do Vs Does: How To Use Them Correctly In English

Using Do and Does, Definition and Example Sentences USING DO AND DOES