Does Tax Debt Affect Your Spouse? What You Need To Know Today

Finding out about a spouse's tax debt can bring up a lot of questions and, well, a bit of worry, you know? It's a situation that many people face, and it's absolutely normal to wonder if their past financial obligations might somehow become yours. This kind of situation, it can feel like a really big deal, and figuring out what it means for your shared future is, frankly, pretty important.

So, does tax debt affect your spouse? The answer, like many things with money and rules, isn't a simple yes or no. It really depends on a few key things, such as how you file your taxes as a couple, when the debt actually came about, and even where you live. Understanding these points can make a huge difference in how you approach the situation, and that's, like, really helpful.

This article will help you sort through these important details. We'll look at different scenarios, from debts incurred before you said "I do" to those that pop up after marriage, especially when you file your taxes together. Our goal is to give you a clear picture of what you might be responsible for and, just as important, what steps you can take to protect your own financial well-being. So, let's get into it, shall we?

Table of Contents

- Understanding Spousal Tax Debt: Is It Yours Too?

- Protecting Your Finances: Steps to Take

- When You Might Be Held Responsible: Key Situations

- Seeking Relief: Options for Unfair Situations

- Frequently Asked Questions About Spousal Tax Debt

Understanding Spousal Tax Debt: Is It Yours Too?

When you hear about tax debt, it can feel like a very heavy cloud, especially if it involves someone you care about deeply, like your spouse. The big question on everyone's mind is usually whether their partner's financial past becomes their present burden. Well, you know, it’s not always a straightforward thing, and a lot hinges on the details of your situation. This part will help make that a little clearer.

When You're Not Liable: Separate Finances and Sole Debt

There are times when your spouse's tax debt is truly just theirs, and you won't be on the hook for it. This happens, for instance, if the debt is solely in their name, and you haven't taken on any joint responsibility for it. In such cases, your own income and the money you earn are generally safe from things like wage garnishments, which is, honestly, a big relief for many.

What this really means is that if the debt was created before you married, or if it's from a period when you filed taxes completely separately, and there was no joint filing that caused the problem, then your personal earnings are protected. The government, in a way, sees that as their individual obligation. So, that's a key point to remember.

- Who Is Travis Kelce In Happy Gilmore 2

- What Is Kate Middletons Ring Worth

- Where Does Adam Sandler Live Full Time

It’s important to understand that if you are not jointly liable for the debt, the government cannot just reach into your personal bank account or take a piece of your paycheck. This is a significant safeguard for many people. This protection is, actually, a fundamental aspect of how tax debt works when it's not a shared responsibility, which is pretty good to know.

The Impact of Joint Tax Returns: Shared Responsibility

Now, things change quite a bit if you've filed a joint tax return. When you both sign off on that document, you are, essentially, telling the government that you are both equally responsible for everything on it. This means that if that joint return ends up with tax debt, then both spouses are legally on the hook for it, and that's a serious matter, you know.

This shared responsibility isn't just about the original amount owed. It also includes any penalties and interest that might pile up because of the unpaid taxes. The government, in this scenario, can collect the money from either one of you, or both. It’s a bit like having a shared bank account where either person can withdraw funds; here, either person can be asked to pay the debt. This can, obviously, impact your financial status after marriage quite a lot.

So, the decision to file jointly carries a very significant weight. It means that any tax obligations that arise from that specific return become a shared burden, and this can affect both partners in a marriage. It’s a common situation, and it’s why so many people have questions about this very topic. Knowing this upfront is, in a way, super important for planning.

Community Property States: A Special Consideration

If you happen to live in what's called a community property state, there's an extra layer to consider when it comes to shared debts, including tax debt. In these states, generally, most assets and debts acquired during the marriage are considered to belong equally to both spouses. This can, literally, change how tax debt is handled, even if it might seem to be just one person's problem.

This means that even if a tax debt wasn't initially incurred through a joint filing, but it arose during the marriage, it could still be treated as a shared obligation. The rules here can be a bit more complicated, and they vary from state to state, so it’s always a good idea to understand your local laws. It's, basically, another reason why tax obligations aren't just individual concerns but can affect both partners.

For couples in these states, the concept of "shared debt" takes on a much broader meaning. It’s not just about what you signed together on a tax form; it’s about the legal framework of your marriage and how property and debt are viewed. So, this is a very specific situation that needs careful attention, you know, to make sure you're fully aware of what's what.

Protecting Your Finances: Steps to Take

When you're dealing with the possibility of a spouse's tax debt affecting you, it's natural to want to take steps to protect your own financial standing. Nobody wants to be unexpectedly responsible for someone else's past dues, right? Luckily, there are some practical things you can do to keep your money safe, and that's, like, pretty reassuring to know.

Pre-Marital Debt: What Happens Before "I Do"?

One of the biggest worries for people marrying someone with existing tax debt is whether they'll suddenly inherit that financial burden. The good news here is that generally, you are not held responsible for debt that your spouse incurred before you were married. This applies not only to tax debt but to other kinds of debt as well, which is, basically, a pretty standard rule.

Most states recognize this principle, meaning that a spouse is not liable for premarital debt incurred by the other spouse. This provides a clear line of separation for financial obligations that existed before your union. It's a way the law helps ensure that you don't start your married life with an unexpected financial handicap, which is, honestly, a sensible approach.

So, if your partner has back taxes from their single days, that debt typically remains their individual responsibility. This is a really important point for anyone considering marriage or who has recently tied the knot. Knowing this can, obviously, ease a lot of the initial stress that might come with discovering such a situation.

The Choice to File Separately: A Smart Move for Some

One of the most direct ways to protect yourself from your spouse's existing tax debt is to file your taxes separately. Tax experts often suggest that it is best for you to file your taxes separately if your spouse owes back taxes, especially until their debt is fully repaid. This is a very practical piece of advice, and it can save you a lot of trouble.

When you file separately, you effectively create a firewall between your tax obligations and theirs. If you file jointly in this case, you may not receive your tax refund, because the government can use it to offset your spouse's debt. By filing separately, your refund, if you have one, comes directly to you, untouched by their past dues, which is, you know, a clear benefit.

This strategy means that you'll have no liability for your spouse’s outstanding federal tax debts. It's a clear cut way to ensure that their financial past doesn't directly impact your current tax situation or your ability to receive your own refund. It’s a choice that many couples make to manage existing debt issues, and it’s, honestly, a very effective one.

Reviewing Filings and Keeping Finances Apart

Beyond filing separately, there are other proactive steps you can take to protect yourself if your spouse has tax debt. One really important thing is to review tax filings very carefully. Understanding what's on those forms and what liabilities might exist is a crucial first step, and it can, basically, give you a much clearer picture of things.

Keeping your finances separate where possible is another wise move. This doesn't mean you can't have joint accounts for household expenses, but it does suggest maintaining individual accounts for your income and savings. This separation can make it much clearer to the government what assets belong to whom, which is, in a way, a good layer of protection.

Considering legal relief, such as innocent spouse relief, is also something to look into if you find yourself in a difficult situation due to a joint return. These steps, combined with open communication about financial matters, can help you manage the impact of a spouse's tax debt. It’s all about being prepared and taking sensible actions, you know, to safeguard your future.

When You Might Be Held Responsible: Key Situations

While there are ways to protect yourself, it's equally important to understand the specific situations where you could be held responsible for your spouse's tax debt. This isn't about scaring anyone, but rather about giving you the full picture so you can make informed choices. Knowing these scenarios is, like, really key to avoiding unexpected problems down the line.

Debt Incurred During Marriage and Joint Filing

This is perhaps the most common scenario where you become fully responsible for your spouse's tax debt. Any tax debt incurred during your marriage, especially when filing jointly, makes you and your spouse individually and collectively responsible for the debt. This means you’re 100% legally on the hook, and that's a very clear rule, you know.

When you file taxes jointly as a married couple, both of you are responsible for the dues. In plain English, that means the government can collect the taxes owed from both spouses. It doesn't matter who earned the income or who made the mistake on the return; by signing that joint form, you both agreed to share the responsibility. This is, honestly, a very significant commitment.

This liability extends to all aspects of the debt, including the original tax amount, any penalties, and interest that accrue. The government has the right to pursue either spouse for the full amount. So, this particular situation highlights just how important it is to be aware of what's on your joint tax return, because it really does bind you together financially.

Impact on Your Tax Refund

Yes, your spouse’s tax liability can absolutely affect your tax refund, especially if you file jointly. This is a very common concern for many couples. If your spouse owes money to the government and you file jointly, you both become responsible for each other’s taxes, penalties, liability, and levies. This means your shared refund might just disappear, which is, you know, a tough pill to swallow.

The government can use your joint tax refund to offset any outstanding tax debt that either spouse has. So, even if the refund is mostly due to your income and withholdings, if your spouse has an old tax bill, that refund can be seized to cover it. This is why tax experts often suggest filing separately in such situations, to protect your portion of any refund. It’s, basically, a direct financial consequence.

This can feel very unfair if you weren't aware of the debt or if it wasn't yours initially. However, the act of filing jointly creates that shared responsibility. Understanding how your spouse owing back taxes may impact your federal tax return is, frankly, something every couple should be aware of, so you can plan accordingly and avoid surprises.

Seeking Relief: Options for Unfair Situations

Sometimes, even with the best intentions, you might find yourself in a situation where you're held responsible for a spouse's tax debt that feels incredibly unfair. This can happen, for example, if you signed a joint return but had no idea about errors or omissions your spouse made. Fortunately, there are specific circumstances that may offer you some relief, and that's, like, a really important option to know about.

Understanding Relief for Unfair Situations

When it comes to taxes, few things are worse than finding out that you’re on the hook for your spouse’s tax debt, especially if you feel it's not truly yours. The government does recognize that sometimes, one spouse might not have known about certain issues on a joint return. This is where options like "innocent spouse relief" come into play, which can, basically, help in very specific situations.

This type of relief is for when you filed a joint return, but you can show that you didn't know, and had no reason to know, about an understatement of tax caused by your spouse's incorrect items. It's designed for situations where it would be unfair to hold you responsible for the debt. It's a way to get out from under a tax burden that genuinely wasn't yours to bear, which is, honestly, a very fair consideration.

Applying for this kind of relief involves a process where you present your case to the government. They look at all the facts and circumstances to decide if it would be unfair to hold you liable. This guide explains how spousal tax debt works in a variety of situations, and understanding these relief options is a key part of that. For more information, you might look at official government tax resources, like the ones provided by the IRS.

Frequently Asked Questions About Spousal Tax Debt

It's totally normal to have a lot of questions when thinking about spousal tax debt. Here are some common ones people ask, along with some straightforward answers to help you out, you know, to clear things up.

Can my spouse's tax debt affect my credit?

Generally, federal tax debt itself doesn't directly show up on your personal credit report like a credit card debt or a loan would. However, if the government places a federal tax lien on property that you jointly own, or if they pursue collection actions that become public record, that could, indirectly, affect your ability to get credit in the future. So, it's not a direct hit, but it can have consequences, you know, in a roundabout way.

A tax lien is a legal claim against your property, and it can make it harder to sell or borrow against that property. If you're applying for a mortgage or a car loan, lenders will definitely look at public records, and a lien could be a red flag. So, while it's not on your credit score in the traditional sense, it can still impact your financial standing quite a bit, which is, honestly, something to be aware of.

It's important to separate the idea of a credit score from your overall financial health and ability to get loans. While the tax debt itself might not be a line item on your report, its effects, especially if collection actions are taken, can certainly be felt in your broader financial life. This is, basically, why addressing tax debt quickly is always a good idea.

What if I didn't know about my spouse's tax debt?

If you genuinely didn't know about your spouse's tax debt, especially if it relates to issues on a joint tax return you signed, you might have options for relief. This is exactly what "innocent spouse relief" is for. It's designed for situations where you can prove you had no actual knowledge, or no reason to have knowledge, of the understatement of tax, and that it would be unfair to hold you responsible.

This type of relief is not automatically granted; you have to apply for it and meet specific criteria set by the government. They will look at things like whether you significantly benefited from the understatement, if you were coerced into signing the return, and other factors. It’s a process, but it can offer a way out of a very difficult situation. So, it's worth exploring, you know, if you find yourself in that spot.

The key here is demonstrating your lack of knowledge and the unfairness of being held liable. This is why reviewing tax filings, keeping your finances separate where possible, and considering legal relief are such important proactive steps. If you didn't know, there might be a path for you, and that's, like, pretty good news for many people.

How do I find out if my spouse has tax debt?

Discovering if your spouse has existing tax debt can be a sensitive topic, but it's an important conversation to have for your financial well-being. The most direct way is to simply ask them. Open and honest communication about finances is, basically, always the best first step in any marriage. It sets a good foundation, you know, for everything else.

If direct conversation isn't providing clear answers, or if you need to verify information, you could suggest that you both consult with a tax professional. A qualified tax expert can help review past filings, understand any outstanding obligations, and advise on the best way forward for both of you. They can, honestly, provide a lot of clarity and guidance in these situations.

For official information, your spouse can request their tax transcripts from the government, which would show their tax account history, including any balances due. You can also learn more about tax liability and marriage on our site, and also find helpful information about managing shared finances. It’s all about getting the facts so you can make informed decisions together.

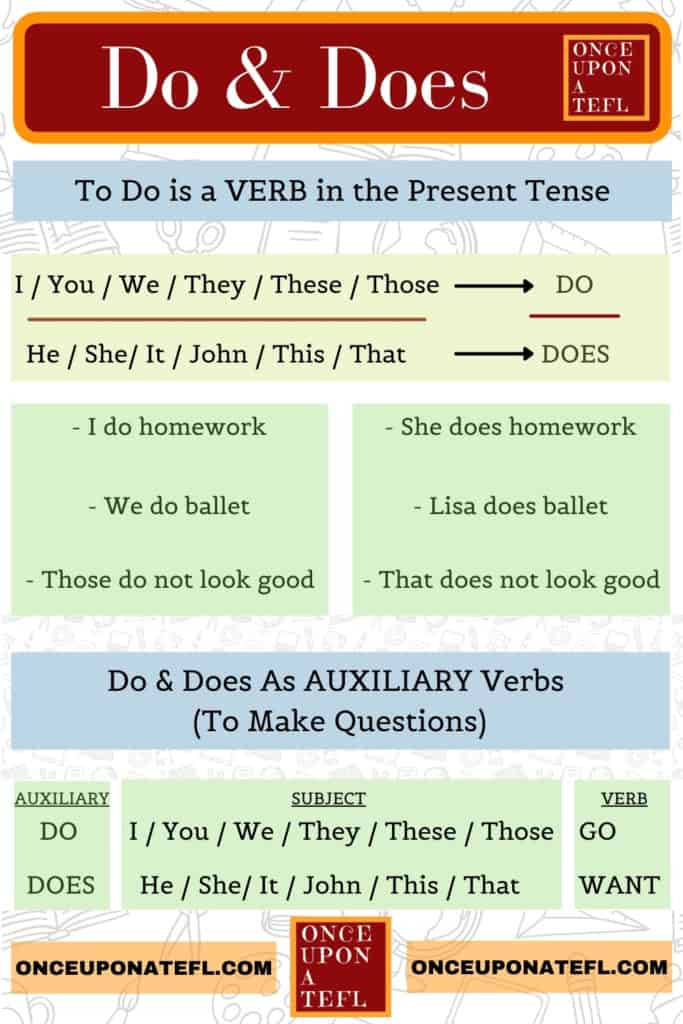

Do vs. Does: How to Use Does vs Do in Sentences - Confused Words

Do Vs Does: How To Use Them Correctly In English

Using Do and Does, Definition and Example Sentences USING DO AND DOES