Does My Husband Have To Pay The Bills Until We Are Divorced?

Facing a separation or the idea of divorce brings a whole lot of feelings, and very often, a big one is worry about money. You might be wondering, quite naturally, about the household bills. It's a really common question for folks going through this tough time: does my husband have to keep paying the bills until we are officially divorced? That's a huge concern for many, and getting some clarity on it can help ease a little of that stress, you know?

When a marriage starts to unravel, financial worries can feel like a heavy blanket. Things that used to be shared responsibilities suddenly feel uncertain. Who pays for the house, the car, the utilities, or even the groceries? These are the kinds of questions that keep people up at night, and it's completely understandable to feel a bit lost in the shuffle, especially when things are changing so fast.

This article aims to shed some light on this tricky topic. We'll explore what usually happens with financial duties during separation, what factors might change things, and why getting good advice is, honestly, a very smart move. We'll talk about what the law might say and how your situation could be a bit different, too it's almost.

- Malcolm Jamal Warner Cause Of Death

- Is Alice Baxter Corys Daughter

- Who Was The Little Boy Saluting At Jfks Funeral

Table of Contents

- What Happens Financially During Separation?

- No Formal Agreement, What Then?

- Temporary Orders: A Helping Hand

- Understanding Your Financial Responsibilities and Rights

- Spousal Support: A Look at the Basics

- Child Support: What You Should Know

- Shared Debts: Who's on the Hook?

- The Role of State Laws in Bill Payment

- What If He Stops Paying Bills?

- Getting Legal Guidance: A Smart Move

What Happens Financially During Separation?

When a couple decides to go their separate ways, but aren't yet legally divorced, there's often a period of separation. During this time, the question of who pays for what can get, well, pretty messy. There isn't always a straightforward answer that fits everyone, you know? It really depends on a few things, like where you live and what kind of agreements, if any, you have in place. Often, people try to keep things as they were financially, at least for a little while, to maintain some stability, but that's not always possible, or even fair, for that matter.

No Formal Agreement, What Then?

Without a formal agreement or court order, things can feel a bit up in the air. Generally speaking, both spouses are still considered financially responsible for marital debts and household expenses. This means that if a bill is in both your names, both of you are still on the hook for it, even if one person isn't living in the house anymore. It's not uncommon for one person to continue paying the mortgage or rent, for example, especially if they're still living in the family home. However, there's no strict rule that says one person *has* to keep paying everything unless a court has ordered it, or you've both agreed to it. It's a bit of a grey area, really, and can lead to arguments if not handled carefully, you know.

Consider a situation where one spouse moves out. They might assume the other spouse will take over all the bills for the home, but that's not always how it works. The legal obligation for joint debts doesn't just disappear because someone moved. It's like, if you both signed a lease, you're both still responsible for the rent until that lease is over, or until a new agreement is made. This can be a source of real tension and financial strain for the person left with the bills, obviously.

Temporary Orders: A Helping Hand

To avoid some of this financial chaos, many people ask the court for "temporary orders" during the separation period. These orders are put in place to manage things like who pays which bills, temporary custody of children, and even temporary spousal support, or child support, until the final divorce is settled. Getting a temporary order can bring a lot of peace of mind because it clearly spells out who is responsible for what. It’s a way to make sure things are fair and that everyone's basic needs are met while the divorce process moves along. This is often a very good step to take, as a matter of fact.

A temporary order might say that one spouse must continue to pay the mortgage, utilities, and car payments, for instance. It could also specify that one spouse gets a certain amount of money each month from the other to help cover living expenses. These orders are not permanent, but they provide a structured way to handle finances during what can be a very uncertain time. It's like a financial roadmap for the immediate future, which can be incredibly helpful, you know.

Understanding Your Financial Responsibilities and Rights

When you're separating, it's not just about who pays the immediate bills. There are bigger financial pictures to look at, too. Things like spousal support, child support, and how shared debts will be handled are all very important parts of the puzzle. Knowing your rights and responsibilities in these areas can really help you plan for your future. It's a lot to take in, I mean, but it's worth understanding, honestly.

Spousal Support: A Look at the Basics

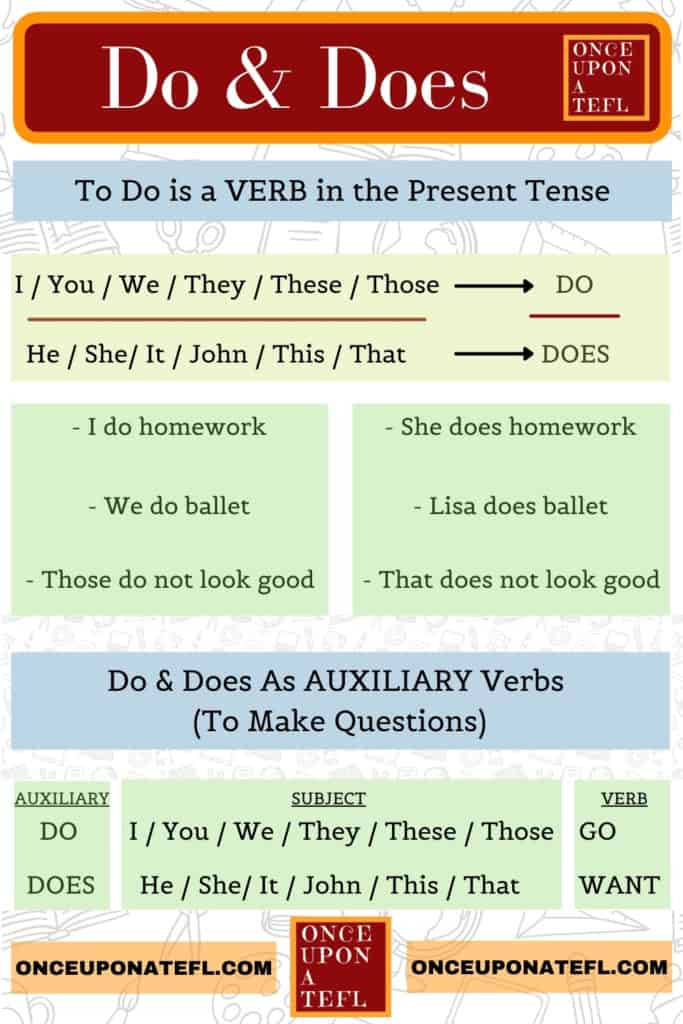

Spousal support, sometimes called alimony or maintenance, is money paid by one spouse to the other after a separation or divorce. The idea is to help the spouse who might have less income maintain a similar standard of living to what they had during the marriage, at least for a period. It's not automatically granted in every case, though. Courts look at a lot of factors, like how long the marriage lasted, each person's income and earning potential, and their health and age, among other things. It's meant to be fair, you know, but "fair" can mean different things to different people. This is where understanding what the law *does* require, in terms of financial duties, becomes really important. Just as understanding the word "does" means knowing what someone "performs" or "achieves," understanding spousal support means knowing what financial duties one spouse might be required to perform for the other.

For example, if one spouse stayed home to raise children for many years and now has limited job skills, they might be a candidate for spousal support. The goal is often to help them get back on their feet, perhaps by going back to school or getting training, so they can become self-supporting. It's not meant to be a permanent handout in most cases, but rather a temporary bridge. The amount and duration of spousal support can vary a lot, you know, so it's not a one-size-fits-all situation.

Child Support: What You Should Know

Child support is money paid by one parent to the other to help cover the costs of raising their children. This is usually determined by state guidelines, which consider both parents' incomes, the number of children, and how much time each parent spends with the kids. Unlike spousal support, child support is almost always ordered when there are minor children involved, because courts prioritize the well-being of the kids above all else. It's a fundamental responsibility, really, that parents have to their children, regardless of their marital status. This is one area where the law is pretty clear about what a parent *does* have to do.

Child support covers things like food, clothing, shelter, education, and medical care for the children. Even if one parent isn't working, they might still have a child support obligation based on their potential earning capacity. It's designed to ensure that children continue to receive the financial support they need from both parents, even after the parents separate. So, this is a very important part of the financial picture during and after a divorce, you know, and it's pretty much non-negotiable.

Shared Debts: Who's on the Hook?

During a marriage, couples often accumulate shared debts, like mortgages, car loans, credit card balances, and personal loans. When you separate, these debts don't just disappear. Who is responsible for paying them until the divorce is final, and then after, is a big question. Generally, if a debt is in both your names, both of you are legally responsible for it. This means if one person stops paying, the creditor can come after the other person for the full amount. It's a pretty scary thought for many, actually.

A divorce decree will usually specify how marital debts are divided between the spouses. However, that agreement only binds you and your spouse; it doesn't necessarily bind the creditor. For instance, if your divorce decree says your husband is responsible for the credit card debt, but the card is in both your names, and he stops paying, the credit card company can still pursue you for the money. This is why it's so important to address shared debts very carefully during the divorce process, you know, perhaps by refinancing or closing joint accounts. It's a bit of a complex situation, and you really want to avoid any nasty surprises down the road, to be honest.

The Role of State Laws in Bill Payment

The rules about who pays what during separation can vary a lot depending on which state you live in. Some states have "community property" laws, where assets and debts acquired during the marriage are generally split 50/50. Other states follow "equitable distribution," which means assets and debts are divided fairly, but not necessarily equally. This difference can significantly impact how bills and financial responsibilities are handled during separation and divorce. So, what applies to your friend in another state might not apply to you, you know? It's really state-specific.

For example, in a community property state, if a mortgage was taken out during the marriage, both spouses are typically considered equally responsible for it, even if only one person's name is on the loan. In an equitable distribution state, a judge would look at many factors to decide who should pay, like each person's income, their contributions to the marriage, and their future earning potential. This is why getting advice that's specific to your location is, honestly, so very important. You can learn more about family law on our site, and also find specific information related to your area on this page.

What If He Stops Paying Bills?

This is a very real fear for many people, and it can throw your life into a tailspin. If your husband stops paying bills that he was previously responsible for, especially joint bills or bills related to the family home, you need to act pretty quickly. First, try to understand why he stopped. Is it because he can't afford it, or is it a tactic? Regardless of the reason, your immediate concern is to protect your credit and ensure essential services aren't cut off. You might have to step in and pay some bills yourself, even if it feels unfair, to prevent late fees, damage to your credit score, or even foreclosure. It's a tough spot to be in, obviously.

If he stops paying, and there's no court order in place, you should consider filing a motion for temporary orders with the court. This can compel him to pay certain expenses. If there *is* already a temporary order and he's violating it, you can file a motion to enforce the order. This means asking the court to make him comply with what was already decided. Ignoring court orders can have serious consequences for him, too, like fines or other penalties. It's a serious matter, really, and you shouldn't just let it slide, you know.

Getting Legal Guidance: A Smart Move

Dealing with finances during a separation and divorce is incredibly complex, and trying to figure it all out on your own can be overwhelming. This is where a good family law attorney becomes your best friend. They can explain the laws in your state, help you understand your rights and obligations, and guide you through the process of getting temporary orders for bill payment and support. They can also help you negotiate a fair settlement for the final divorce, ensuring that debts and assets are divided appropriately. It's like having a very skilled guide through a difficult maze, you know?

An attorney can also help you understand the long-term financial implications of any agreements you make. For example, they can advise you on how selling the family home might affect your taxes, or how retirement accounts are divided. They can also help you if your husband is not being cooperative or is trying to hide assets. While it might seem like an added expense, getting legal advice can save you a lot of money and heartache in the long run. It's a pretty important investment in your future, honestly, especially when so much is on the line.

So, the question "Does my husband have to pay the bills until we are divorced?" doesn't have a simple yes or no answer. It depends on many things, including your state's laws, any agreements you've made, and whether a court has issued temporary orders. The most important thing is to protect yourself financially and understand your options. Don't hesitate to seek out professional legal help to make sure you're making the best decisions for your future. Staying informed and proactive is your best defense during this challenging period. It's truly vital to take care of yourself during this time, you know, and good advice can make all the difference, really.

- Who Is Andy Reids New Wife

- What Singer Of Childrens Songs Died

- What Country Singer Had A Child That Died

Do vs. Does: How to Use Does vs Do in Sentences - Confused Words

Do Vs Does: How To Use Them Correctly In English

Using Do and Does, Definition and Example Sentences USING DO AND DOES