Understanding Taxes For 504 Divorced Or Separated Individuals

Going through a divorce or a separation can feel like a really big life change, and it’s true that it brings with it many adjustments. One area that often causes a lot of questions, understandably, is how it affects your taxes. For many, figuring out the tax implications when you become one of the 504 divorced or separated individuals can seem a bit overwhelming, but there’s actually a very helpful guide from the IRS that makes things much clearer.

This guide, IRS Publication 504, is a rather important resource for anyone dealing with the financial side of a split. It helps explain what you need to know about filing your tax return, how to choose your correct filing status, and what happens with things like dependents, alimony,

- How Many Rings Does Andy Reid Have

- What Did Bill Belichick Do

- Was Emilys Compagno An Nfl Cheerleader

IRS Publication 504 – Divorced or Separated Individuals - Sessums Black

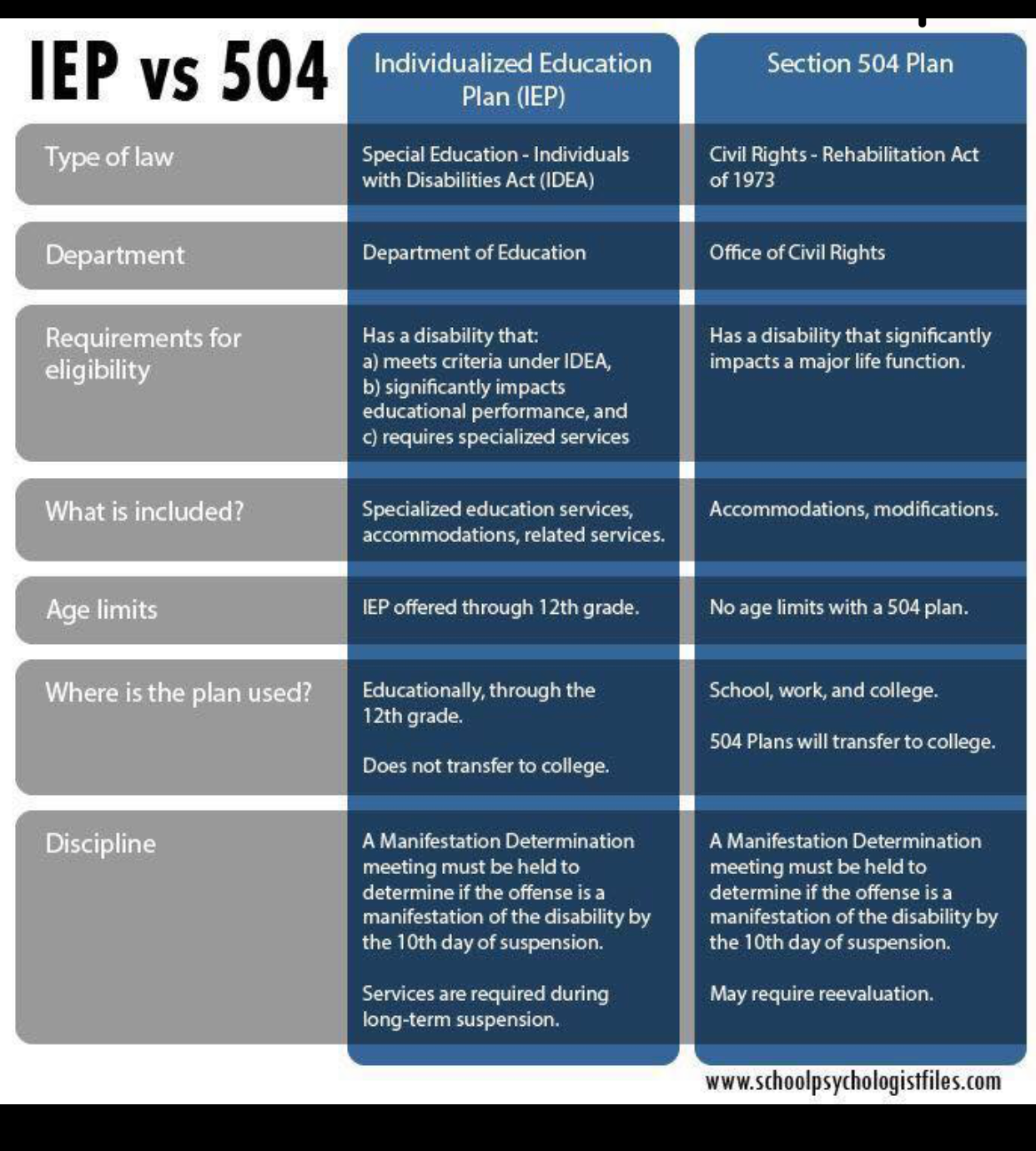

Section 504

Section 504 Plan — Garden City SEPTA