Does FTX Still Exist? Unpacking The Crypto Exchange's Current Status

The world of digital finance saw a rather big shake-up a while back, and many people are still trying to figure out what happened. For a good number of folks, the name FTX brings up a lot of questions and maybe a bit of worry. It was, after all, once a very prominent player in the digital asset space, making headlines for its rapid growth and, then, its even more rapid fall. So, it's almost natural to wonder: Does FTX still exist in any real way today?

That question, you know, it pops up quite a bit for those who followed the news or, perhaps, had some funds tied up with the company. The story of FTX is a bit of a complex one, involving a lot of moving parts and some truly surprising turns of events. It's not just about a company going out of business; it's about a whole series of events that sent ripples through the entire digital currency market.

This piece aims to clear up some of that confusion. We'll look at what happened, where things stand right now, and what the future might hold for anything connected to the FTX name. You'll get a better idea of the current situation and, hopefully, a clearer picture of whether that digital exchange is still around in any meaningful sense, or if it's mostly a thing of the past.

Table of Contents

- The FTX Saga: A Brief Look Back

- Does FTX Still Exist? The Current Reality

- The Legal Aftermath: Sam Bankman-Fried and Others

- The Future of FTX (or its Remnants)

- Frequently Asked Questions

- Looking Ahead

The FTX Saga: A Brief Look Back

To really get a grip on whether FTX still exists, it helps to remember what it was and how things went so wrong. FTX, you know, burst onto the scene as a really big name in the world of digital money exchanges. It was set up to let people buy, sell, and trade various digital coins and tokens, and for a while, it grew incredibly fast, attracting a lot of users and quite a bit of attention.

It was seen as a pretty reliable place for many people to keep their digital assets. The company, as a matter of fact, had a very public face, with its founder often appearing in interviews and at big events. This helped build a lot of trust, and that, in a way, made its eventual downfall even more surprising and impactful for so many.

From Crypto Giant to Catastrophe

The turn for FTX, you see, was rather sudden and quite dramatic. What started as whispers about its financial health quickly turned into a full-blown crisis. There were reports about how FTX was supposedly using customer funds in ways that were, well, not entirely clear or appropriate. This raised some very serious questions about how the company was handling people's money.

The concerns grew very quickly, leading to a sort of panic among users who started pulling their money out all at once. This kind of rush, sometimes called a "bank run" but for a digital exchange, put an immense strain on FTX's ability to pay everyone back. It became clear, pretty quickly, that the company simply didn't have enough liquid assets to meet all the withdrawal requests, and that, basically, led to the whole thing falling apart.

Does FTX Still Exist? The Current Reality

So, to answer the big question directly: the FTX digital exchange, as it once operated, does not exist anymore. It's not a place where you can go today to trade digital currencies, or, you know, store your assets. The platform stopped functioning in its previous capacity when it faced its massive financial troubles and had to halt all customer withdrawals. That was a really big moment for everyone involved.

What remains of FTX is mostly a legal entity going through a very long and complex process. This process is all about trying to sort out its debts, recover assets, and, if possible, return some value to the many people who lost money. It's a far cry from being an active trading platform, that's for sure. The name "FTX" now mostly refers to this ongoing legal and financial clean-up, rather than a live business.

The Bankruptcy Proceedings

After the collapse, FTX, along with many of its related companies, filed for what's known as Chapter 11 bankruptcy protection in the United States. This legal step, you know, is a way for companies facing huge debts to reorganize their affairs under court supervision. It's a very formal process designed to give a company a chance to sort things out, possibly pay back creditors, or, in this case, liquidate assets in an orderly fashion.

A new management team was put in place to oversee this process, and their main job has been to find whatever assets FTX had, figure out who is owed money, and then try to distribute what's recovered. This work has been quite involved, with the new team trying to track down funds that were, in some cases, rather hard to locate. It's been a very slow and deliberate effort to untangle a complex financial mess.

What About User Funds?

For many people, the most pressing question is what happened to their money. The good news, in some respects, is that the bankruptcy team has made significant progress in recovering assets. They've been working hard to identify and secure various forms of wealth that belonged to FTX, including digital assets and other investments. This has been a really central part of their efforts.

However, getting money back to users is a very complicated task. There are many different types of creditors, and the legal process decides who gets paid first and how much. While there's been talk of a plan to return a good portion of the funds to customers, it's a long road. The specific details of how much people will get back and when are still being worked out, and it's a process that, you know, can take quite a bit of time.

The Legal Aftermath: Sam Bankman-Fried and Others

The story of FTX isn't just about the company; it's also very much about the people who ran it. Sam Bankman-Fried, the founder, became a very central figure in the legal proceedings that followed the collapse. He faced a number of serious charges related to how FTX and its sister company, Alameda Research, were managed. The accusations included things like fraud and conspiracy, basically saying that he misled investors and misused customer money.

His trial, you know, was a really high-profile event that drew a lot of public interest. After a period of legal arguments and witness testimonies, he was found guilty on several counts. This outcome sent a very clear message about accountability in the digital finance space. Other individuals connected to FTX and Alameda also faced legal consequences, with some entering plea deals and cooperating with authorities, which, you know, helped shed more light on the inner workings of the collapse.

The legal actions, basically, aim to bring justice for the people who were harmed and to deter similar actions in the future. The conviction of Bankman-Fried was a significant moment, showing that even in the relatively new world of digital money, legal rules and consequences apply. It really underlined the seriousness of the financial missteps that happened at FTX.

The Future of FTX (or its Remnants)

So, if FTX as a trading platform is gone, what about its future? The current focus is entirely on the bankruptcy process and trying to maximize recoveries for those who lost out. There's been some talk, you know, about the possibility of perhaps restarting the exchange in some form, or selling off its technology and customer base to another company. However, these are just ideas at this point, and nothing is set in stone.

Any potential revival would be under completely new management and very strict oversight. It would be a totally different entity from the FTX that once operated, with a strong emphasis on transparency and proper financial controls. The name "FTX" itself might carry too much negative history for a successful relaunch, but, then again, the underlying technology and user data could still hold some value for another business looking to enter or expand in the digital asset market.

What's Next for the FTX Estate?

The group managing the FTX bankruptcy, often called the "FTX Debtors" or the "FTX Estate," is continuing its work. Their primary goal is to gather all available assets, settle claims, and distribute funds to creditors. This involves a lot of very detailed financial work, including selling off various investments, digital tokens, and other holdings that FTX had. It's a rather massive undertaking, to be honest.

They also have to deal with various legal disputes and challenges that arise during such a large bankruptcy. The process is very transparent, with regular updates provided to the court and the public about their progress. The aim is to complete this process in a way that is fair to all parties involved, which, you know, is a really big challenge given the scale of the collapse. The hope is that, eventually, this work will bring some closure and financial relief to the many people affected.

Frequently Asked Questions

Many people have similar questions about FTX's current situation. Here are some of the most common ones:

Is FTX still operating as a cryptocurrency exchange?

No, the FTX cryptocurrency exchange, as it once was, is no longer operating. It stopped all customer withdrawals and trading activities when it filed for bankruptcy. What remains is a legal entity focused on managing the bankruptcy process and recovering assets. This is, you know, a very important distinction to make.

Will FTX users get their money back?

The bankruptcy team is working very hard to recover assets and aims to return funds to users. Significant progress has been made in gathering assets. However, the exact amount users will receive and the timeline for these distributions are still being determined through the legal bankruptcy process. It's a long and rather involved procedure, but there is a clear effort to make people whole.

What is the current status of Sam Bankman-Fried?

Sam Bankman-Fried, the founder of FTX, was found guilty on multiple charges related to the collapse of FTX and Alameda Research. He is currently awaiting sentencing for his role in the events. This outcome, you know, was a very significant development in the entire saga.

Looking Ahead

The story of FTX is a very stark reminder of the potential risks in rapidly developing financial spaces. While the original FTX exchange does not exist as an operational platform, its legacy lives on through the ongoing bankruptcy proceedings and the legal actions against those involved. The efforts to recover assets and distribute them to affected individuals are still very much in progress, offering a glimmer of hope for those who lost funds.

The future of any part of the FTX name, or its underlying technology, remains quite uncertain. It will depend heavily on the outcome of the bankruptcy process and whether any new entity sees value in what remains. For now, the focus is squarely on the past, on making things right, and on understanding the lessons learned from such a significant financial event. You can learn more about the legal outcomes of the FTX case from official sources. Also, to learn more about digital asset regulations on our site, and link to this page understanding financial collapses.

- What Happened To Mariah Careys Voice

- Who Does Julie Have A Baby With

- Why Was John Daly In Happy Gilmore 2

Do vs. Does: How to Use Does vs Do in Sentences - Confused Words

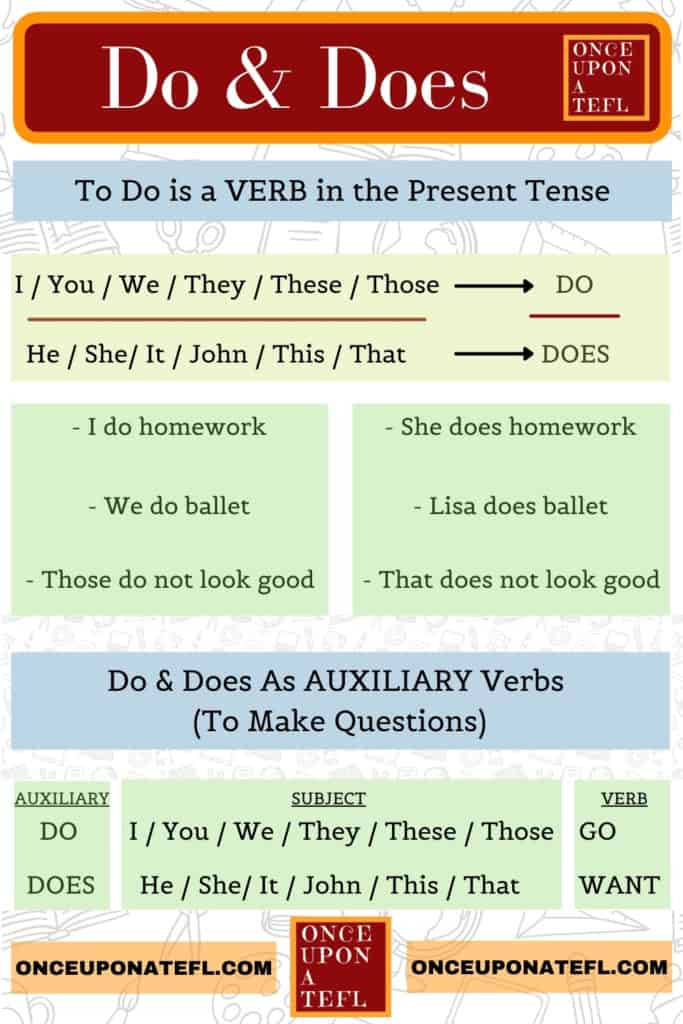

Do Vs Does: How To Use Them Correctly In English

Using Do and Does, Definition and Example Sentences USING DO AND DOES