What Is The Richest Team In The NFL? Unpacking How Teams Build Massive Value

Have you ever wondered about the financial might behind your favorite NFL team? It's a pretty common question, really. When we think about wealth, our minds might first go to individuals like Elon Musk, who, you know, has been the richest person in the world since May 2024, or perhaps Larry Ellison, who, in a way, overtook Mark Zuckerberg for that second wealthiest spot. These folks have their fortunes tracked daily by sources like the Bloomberg Billionaires Index, which updates their net worth based on things like stock market performance and the wider economic conditions. But what about a massive sports enterprise, like an NFL team? How do we even begin to figure out which one holds the top spot in terms of sheer financial power?

It's a fascinating area, especially when you consider how much goes into building and maintaining a professional sports franchise. Just like the world's wealthiest individuals, whose fortunes are calculated using a blend of financial data, market valuations, and public records, NFL teams also have their value determined by a complex mix of factors. It's not just about how many games they win, though that certainly helps, is that right?

The concept of "richest" for an NFL team isn't simply about who has the most cash on hand. It's more about the overall franchise value, which includes everything from their revenue streams to their brand recognition and the market they play in. It's a very dynamic picture, too, similar to how the Bloomberg Billionaires Index or Forbes tracks the world's richest people, with figures constantly shifting. So, how do these colossal sports businesses stack up, and what makes one team more valuable than another?

- Who Gave Jlo The Most Expensive Ring

- Who Is The Oldest Coach In The Nfl

- Who Was The Rock Singer Whose Son Died

Table of Contents

- Understanding Team Wealth: More Than Just Wins

- The Big Money Makers for NFL Teams

- Market Size and Fan Loyalty

- Brand Value and On-Field Success

- How Valuations Shift, Just Like Billionaire Fortunes

- The Dynamic Nature of NFL Wealth

- Frequently Asked Questions

- What It All Means for the Richest NFL Team

Understanding Team Wealth: More Than Just Wins

When we talk about the "richest" NFL team, we're really looking at what's called "franchise value." This isn't just about how much money a team makes in a single year, but rather its total estimated worth, including all its assets, revenue potential, and brand power. It's a bit like how someone's net worth is calculated, factoring in their investments, properties, and overall financial standing. For individuals, you know, like the world's wealthiest person, Elon Musk, whose fortune stands at an estimated $342 billion as of March 7, 2025, a lot of that value comes from his companies and their market performance. Similarly, an NFL team's value reflects its business health and market appeal.

A team's wealth, in a way, is a reflection of its entire operation. This includes things like the value of its stadium, practice facilities, intellectual property (like team logos and trademarks), and perhaps most importantly, its ability to generate significant income. It's not just about being profitable; it's about the overall asset value that could be realized if the team were to be sold. This is very much in line with how Forbes ranks the richest people in the world, basing their net worth on a combination of financial data and market valuations, as of September 1, 2024, for their annual ranking of the richest Americans, for instance.

So, while the provided text gives us a great look at how personal wealth is measured and who the top billionaires are globally as of July 1, 2025, it doesn't actually list specific NFL team valuations. However, the *principles* it highlights are totally applicable. We can think about an NFL team's value as a sum of its parts, much like a billionaire's diverse portfolio. It's all about what the market would bear, what kind of revenue streams are flowing, and the overall strength of the brand. This is a bit like how the value of a company like Tesla affects Elon Musk's net worth, you know, with daily updates based on stock market performance and economic conditions.

- Did Jenna Ortega Have A Crush On Obama

- How Much Is Jennifer Lopezs Engagement Ring Worth

- People Also Search For

The Big Money Makers for NFL Teams

NFL teams generate massive amounts of money from various sources, and these income streams are a huge part of what drives their overall valuation. It's not just one thing, but a combination of several significant factors, much like how the richest individuals build their empires through diverse investments and ventures. You see, it's pretty complex.

Media Rights: The Giant Slice

Perhaps the biggest contributor to an NFL team's wealth comes from media rights. The league has incredibly lucrative deals with major television networks and streaming services. These agreements are often shared among all 32 teams, providing a substantial baseline of revenue for every franchise. This collective bargaining power is a unique aspect of the NFL's financial model, making it a very stable and profitable league for all its members. It's almost like a guaranteed income stream, which, you know, helps keep things pretty solid for all teams involved.

These media deals are constantly being renegotiated, and each new agreement tends to bring in even more money, reflecting the immense popularity of American football. Think about it: millions of viewers tune in every week, creating an incredibly valuable audience for advertisers. This steady flow of media revenue is a primary driver of overall team value, making even smaller market teams financially robust. It's a rather significant piece of the puzzle, actually.

Ticket Sales and Game Day Experience

While media rights are huge, local revenue streams are also incredibly important. Ticket sales, premium seating, and concessions at the stadium contribute significantly to a team's coffers. A team with a loyal, passionate fan base that consistently fills its stadium, especially one with modern amenities and luxury suites, will generate more game-day revenue. This direct interaction with fans is a vital part of the business model, offering a unique experience that can't be replicated on television. It's a little different from just tracking stock market performance, isn't it?

Teams that own their stadiums, or have favorable lease agreements, can also control more of these game-day revenues. They can invest in better facilities, which in turn can attract more fans and higher-paying clients for premium seating. This ability to control the fan experience and monetize it directly is a key differentiator in team valuations. It's pretty much a direct reflection of local market engagement, so to speak.

Sponsorships and Merchandise

Another major source of income comes from corporate sponsorships and merchandise sales. Companies pay big money to have their brands associated with NFL teams, whether through stadium naming rights, advertising during games, or official team partnerships. The stronger a team's brand and the larger its fan base, the more attractive it is to potential sponsors. This is where brand equity really translates into tangible financial gains. It's a bit like how a popular brand can increase a billionaire's overall wealth, you know, through market recognition.

Merchandise, like jerseys, hats, and other team gear, also brings in substantial revenue. Fans love to show their support, and teams with popular players or a strong winning tradition often see higher merchandise sales. These revenue streams, while perhaps not as massive as media rights, are crucial for a team's overall financial health and contribute significantly to its total valuation. They just add to the overall financial strength, really.

Stadium and Real Estate Ventures

Some NFL teams have taken their wealth generation a step further by investing in real estate around their stadiums. Developing entertainment districts, retail spaces, or even residential areas near their venues can create additional revenue streams beyond just game days. This kind of diversified investment strategy is quite similar to how the world's richest individuals, like Alice Walton, a Walmart heir whose fortune stands at an estimated $101 billion, build and maintain their wealth through various assets. It's about creating a comprehensive economic ecosystem, basically.

Owning and operating a state-of-the-art stadium also allows teams to host other events, such as concerts, college football games, or even other sporting events, generating additional income outside of the NFL season. This ability to leverage their physical assets for year-round revenue adds considerable value to the franchise. It's a pretty smart move, if you think about it.

Market Size and Fan Loyalty

The size and economic strength of the market an NFL team plays in are undeniably significant factors in its valuation. A team located in a large metropolitan area with a robust economy and a vast potential fan base generally has a higher valuation. This is because larger markets typically offer more opportunities for local sponsorships, higher ticket prices, and a broader reach for merchandise sales. It's a simple matter of scale, you know.

However, it's not just about population size; fan loyalty and engagement are also incredibly important. Some teams in smaller markets have incredibly passionate and dedicated fan bases that consistently support the team through ticket purchases, merchandise sales, and media consumption. This deep-rooted loyalty can sometimes offset the disadvantages of a smaller market, creating a stable and valuable franchise. It's almost like a unique cultural asset, really.

The history and tradition of a franchise also play a role here. Teams with a long, storied history and multiple championships often command a higher value due to their established brand and multi-generational fan support. This enduring appeal contributes to their financial stability and overall marketability, making them, in some respects, more resilient to economic downturns. It's a bit like how certain historical brands retain their value over time, isn't it?

Brand Value and On-Field Success

A strong brand is an invaluable asset for any NFL team. This includes everything from the team's logo and colors to its reputation and connection with its community. A powerful brand can attract more fans, better sponsorship deals, and higher merchandise sales. On-field success, naturally, plays a huge part in building and maintaining this brand value. Winning teams generate more excitement, attract more media attention, and cultivate a larger, more engaged fan base. This, in turn, boosts their financial standing. It's a pretty clear connection, you know.

While a single winning season won't instantly make a team the "richest," consistent success over time certainly contributes to a sustained increase in franchise value. Playoff appearances and Super Bowl victories elevate a team's national profile, leading to increased viewership, merchandise demand, and sponsorship interest. This cycle of success driving financial growth is a key dynamic in the NFL. It's basically a virtuous circle, actually.

However, it's worth noting that some teams with long histories and strong brands maintain high valuations even during periods of less on-field success, thanks to their established fan base and market presence. This shows the long-term impact of brand equity. It's a little like how some very established companies maintain their value even through market fluctuations. Learn more about on our site, and link to this page for additional insights.

How Valuations Shift, Just Like Billionaire Fortunes

Just like the net worth of the world's richest people, which is updated daily based on stock market performance and economic conditions by indices like the Bloomberg Billionaires Index, NFL team valuations are also dynamic. They aren't static figures. A team's value can go up or down based on a variety of factors, including new media deals, stadium developments, changes in ownership, market conditions, and, of course, on-field performance. It's a constantly moving target, you know.

For example, a new stadium deal that allows a team to generate significantly more local revenue can cause its valuation to jump. Similarly, a major economic downturn in a team's home market could potentially affect its value. These shifts reflect the underlying business health and market perception of the franchise, much like how the financial data, market valuations, and public records used by Forbes to rank the richest people globally are constantly updated. It's a very fluid situation, really.

The overall growth of the NFL as a league also contributes to rising team valuations. The league's popularity, its ability to secure massive media contracts, and its strong collective bargaining agreements with players all contribute to a rising tide that lifts all boats, so to speak. This broader economic environment for professional sports is a significant factor in why NFL teams continue to be some of the most valuable sports franchises in the world, even when compared to the world's most valuable soccer teams like Manchester United or Real Madrid. It's a rather powerful economic engine, basically.

The Dynamic Nature of NFL Wealth

The financial landscape of the NFL is, in a way, always moving. What might be the "richest" team one year could be surpassed by another the next, especially with new stadium projects, shifting market dynamics, or changes in team performance. It's not a fixed title, you know, but rather a reflection of ongoing financial health and strategic decisions. This constant evolution is a hallmark of major sports leagues, where competition isn't just on the field but also in the boardroom.

The sheer scale of wealth involved in the NFL is quite staggering. The league's overall revenue, driven by those massive media deals and the passion of its fan base, ensures that all 32 teams are incredibly valuable assets. Even the "least" valuable NFL team is worth billions, highlighting the immense financial success of the league as a whole. It's a pretty strong testament to the sport's appeal, actually.

Understanding what makes an NFL team rich goes beyond just looking at a single number. It's about appreciating the complex interplay of revenue streams, market forces, brand strength, and strategic management that contributes to their overall franchise value. It's a bit like exploring how the top 10 richest persons in the world in 2025 built their empires and what drives their massive net worths; it's rarely just one thing. This comprehensive view helps us grasp the true financial power of these sports giants. It's a really interesting topic, if you ask me.

Frequently Asked Questions

How is an NFL team's value calculated?

An NFL team's value, or franchise value, is generally calculated using a combination of financial data, market valuations, and public records. This includes assessing revenue from media rights, ticket sales, sponsorships, merchandise, and stadium operations. It also considers the team's assets, its market size, and its brand equity. It's a bit like how the Bloomberg Billionaires Index determines the net worth of individuals, you know, by looking at their various financial holdings and market performance.

Do winning teams always have higher valuations?

While on-field success certainly helps boost a team's brand and can lead to increased revenue from ticket sales and merchandise, it doesn't automatically mean a winning team is the "richest." Factors like market size, stadium ownership, and long-term media deals can sometimes give teams in less successful periods a higher valuation. However, consistent winning does tend to increase a team's overall appeal and financial potential over time. It's pretty much a contributing factor, really.

What are the biggest revenue streams for an NFL team?

The biggest revenue streams for an NFL team are typically shared media rights from the league, local revenue from ticket sales and premium seating, corporate sponsorships, and merchandise sales. Some teams also generate significant income from real estate developments around their stadiums or by hosting other events. These diverse income sources are what build a team's overall financial strength. It's a very comprehensive approach, basically.

What It All Means for the Richest NFL Team

So, while the provided information helps us understand how wealth is measured for individuals like Elon Musk and Larry Ellison, and even mentions valuable soccer teams, it doesn't pinpoint the single richest NFL team with specific figures. However, what we can gather is that the methodology for determining the "richest" NFL team involves a deep look into its total franchise value, which is a sum of its diverse revenue streams, market presence, and brand strength. It's a bit like understanding that someone's wealth comes from various investments, not just one bank account. This comprehensive view helps us appreciate the true financial might of these incredible sports enterprises. To really grasp which team is at the very top, one would need to consult current financial reports and sports business publications that specifically track NFL franchise valuations, which are updated regularly to reflect the dynamic nature of the market. It's a really interesting area of study, to be honest.

- Why Did Thats So Raven End

- How Many Kids Does Jessica On The Five Have

- What Singer Of Childrens Songs Died

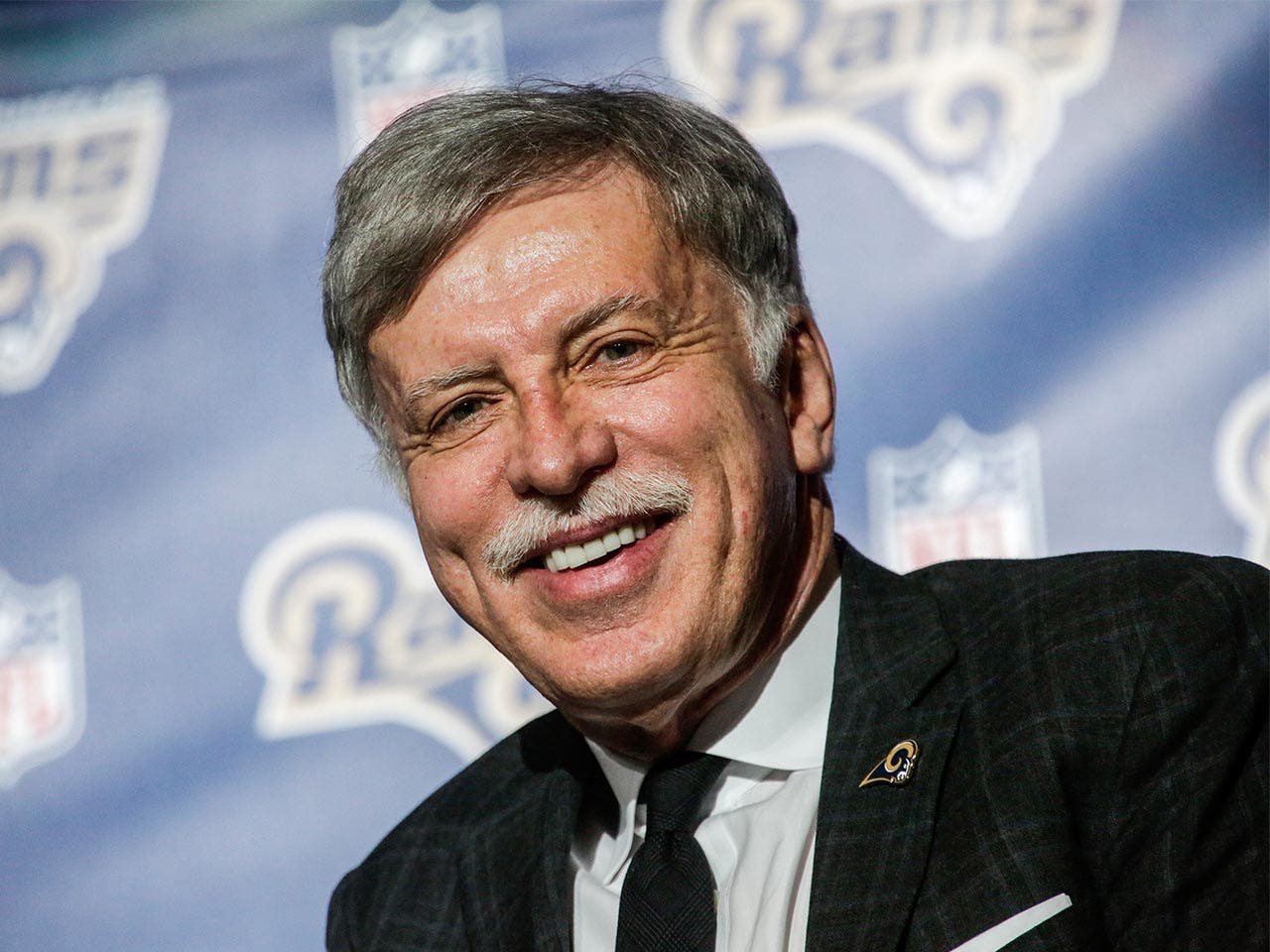

10 Richest NFL Team Owners in 2024 and Their Net Worth

10 Richest NFL Team Owners in 2024 and Their Net Worth

The 7 richest NFL team owners