How Does Mara Make Money? Unpacking A Bitcoin Mining Success Story

Have you ever wondered how a company focused on digital currencies manages to turn a profit, especially when the market can be, you know, a bit up and down? It's a really interesting question, and for a company like Mara Holdings, formerly known as Marathon Digital, their way of making money is quite specific. They've really made a name for themselves in the world of digital assets, and it's something many folks are curious about, particularly with how the financial landscape changes so quickly. So, we're going to explore just what makes their business tick and how they generate their earnings.

Mara, or Marathon Digital Holdings, has actually surprised a lot of people in the financial community with how well they've done. They recently reported some really good numbers, which showed unexpected profits. This kind of performance definitely catches the eye of investors and those who follow the tech world, as a matter of fact. It speaks to a business model that, for them, is clearly working out.

Their core activity, it turns out, is deeply tied to the very foundation of the digital currency space. They are, in essence, a leader in the cryptocurrency mining sector, focusing quite a bit on the Bitcoin ecosystem. This means they play a direct role in creating new Bitcoin, and that's a pretty central part of their income stream, you know. We'll get into the details of what that all means for their finances.

- What Country Singer Died Of Parkinsons

- How Much Is Taylor Swifts Ring

- What Coach Has The Most Nba Rings

Table of Contents

- Mara Holdings: A Snapshot

- The Heart of Mara's Earnings: Bitcoin Mining

- Driving Profits Through Smart Operations

- Breaking Down the Revenue Records

- Mara's Standing in the Digital Asset Space

- Frequently Asked Questions About Mara's Business

- Looking Ahead: What This Means for You

Mara Holdings: A Snapshot

Mara Holdings, which you might know better as Marathon Digital, is a digital asset technology company. They really put their energy into mining cryptocurrencies, with a special emphasis on the Bitcoin ecosystem. This isn't just a small operation; they are quite a significant player in this field, actually. Their work involves a lot of specialized equipment and strategic planning to get those digital coins.

They've been around for a while, and their recent financial results really highlight their journey. It's almost like they've found a very effective way to make this complex process pay off. This company has shown that there's real potential in focusing on the underlying technology of digital money. They are, in a way, building the foundation for the future of finance, so to speak.

Key Company Details

| Company Name | Mara Holdings, Inc. (formerly Marathon Digital Holdings) |

| Primary Business | Cryptocurrency Mining (focused on Bitcoin ecosystem) |

| Sector | Digital Asset Technology, Cryptocurrency |

| Key Focus | Driving innovation and efficiency in Bitcoin mining operations |

| Recent Performance Highlight | Unexpected profits, record revenue, net income, and adjusted EBITDA in Q4 and full fiscal year |

The Heart of Mara's Earnings: Bitcoin Mining

So, how does a company actually "mine" Bitcoin? It's not like digging for gold, obviously. Bitcoin mining involves powerful computers solving very complex mathematical puzzles. When a computer solves one of these puzzles, it gets to add a new block of transactions to the Bitcoin blockchain, and in return, the miner receives newly created Bitcoin as a reward. This process is how new Bitcoin enters circulation, you know.

- What Country Singer Had A Child That Died

- How Much Is Meghan Markles Ring Worth

- What Did Bill Belichick Do

For Mara, this is their main way of bringing in money. They invest in and operate a large number of these specialized computers, often called "rigs" or "miners." The more computing power they have, the higher their chances of solving these puzzles and earning Bitcoin. It's a bit like a lottery, but one where your odds increase significantly with more tickets, or in this case, more processing power, that's what it is.

Once they earn Bitcoin, they can hold onto it, hoping its value goes up, or they can sell it on the open market to convert it into traditional currency. This decision is a big part of their financial strategy. They have to balance the potential for future gains against their immediate operational costs, which can be quite substantial, especially for things like electricity. This is where their focus on efficiency really comes into play, as a matter of fact.

Driving Profits Through Smart Operations

Making money in Bitcoin mining isn't just about having a lot of computers; it's also about running them as efficiently as possible. Mara has actually made a point of "driving innovation and efficiency" in their operations. This means they are constantly looking for ways to reduce their costs and improve their output. One key area they mention is achieving "direct energy," which is a pretty big deal.

Direct energy often means they've secured their own power sources or have very favorable agreements with energy providers. Since electricity is the single largest operational expense for Bitcoin miners, getting this right can make a huge difference to the bottom line, very much so. Imagine saving a significant percentage on your biggest bill; that's exactly what they are aiming for. This strategic approach helps them keep more of the Bitcoin they mine as profit.

Beyond energy, efficiency also comes from managing their mining hardware. This involves keeping their machines running smoothly, upgrading to newer, more powerful models when it makes sense, and ensuring their facilities are optimized for cooling and maintenance. It's a continuous effort to stay ahead in a very competitive space. They are, in a way, like a high-tech factory, just producing digital assets instead of physical goods, you know.

Breaking Down the Revenue Records

The text mentions that Mara "surprised Wall Street with unexpected profits" and "had records for revenue, net income and adjusted EBITDA in Q4 and for the full fiscal year." These are really strong financial indicators that show the company is doing well. Let's break down what these terms generally mean in a business context, so you can get a better picture of their success, you know.

Revenue is simply the total amount of money a company brings in from its primary activities, which for Mara is mining and potentially selling Bitcoin. When they report "record revenue," it means they earned more money than ever before in a given period. This suggests they are successfully mining and monetizing a significant amount of Bitcoin, that is that.

Net income, on the other hand, is what's left after all expenses, including operating costs, taxes, and interest, are paid. "Record net income" means they not only brought in a lot of money but also managed their costs effectively to keep a larger portion of it as profit. This is a crucial measure of a company's overall financial health, very much so.

Finally, adjusted EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. The "adjusted" part means certain one-time or non-recurring expenses might be excluded to give a clearer picture of the company's core operational profitability. Achieving record adjusted EBITDA suggests their primary business operations are incredibly strong and generating significant cash flow, arguably. These strong figures are why Wall Street was so surprised and impressed, as a matter of fact. You can view Mara's financial statements in full on a reputable financial news site to see these numbers for yourself, for example, on Finance Insights.

Mara's Standing in the Digital Asset Space

Marathon Digital Holdings is often seen as a leader in the cryptocurrency mining sector. This leadership comes from their commitment to innovation and efficiency, which we've already discussed. They are not just participating in the Bitcoin ecosystem; they are actively shaping it through their scale and operational choices. This position gives them a certain advantage in the market, in a way.

Being a "digital asset technology company" means they are deeply involved in the tech side of things, not just the financial trading aspect. They are building and managing the infrastructure that supports digital currencies. This focus on the underlying technology and operations is a key differentiator for them, and it's something that really sets them apart from other companies in the space, you know. They are, essentially, an industrial player in the digital economy.

Their transformation into a "vertical" bitcoin miner implies they are trying to control more aspects of their operations, perhaps from energy sourcing to hardware management. This kind of integration can lead to even greater efficiencies and cost savings, further boosting their profitability. It's a strategic move to secure their supply chain and reduce reliance on external factors, basically. This helps them maintain their leadership position and keep making money consistently, that is what it is.

Frequently Asked Questions About Mara's Business

People often have questions about how companies like Mara operate. Here are a few common ones, drawing from what we've learned:

1. What exactly is Mara Holdings?

Mara Holdings, also known as Marathon Digital Holdings, is a digital asset technology company. They make money primarily by mining cryptocurrencies, with a very strong focus on Bitcoin. They operate large-scale computer systems to solve complex puzzles, earning new Bitcoin as a reward, you know. It's their main business activity, actually.

2. Is Marathon Digital a profitable company?

Yes, based on recent reports, Marathon Digital has shown significant profitability. The text specifically mentions "unexpected profits" and "records for revenue, net income and adjusted EBITDA" in their most recent earnings report. This indicates they are indeed making money and managing their operations effectively, very much so.

3. How does Bitcoin mining generate revenue for a company like Mara?

Bitcoin mining generates revenue by earning newly minted Bitcoin as a reward for solving cryptographic puzzles and validating transactions on the Bitcoin network. Once Mara earns this Bitcoin, they can either hold it as an asset or sell it on the market for traditional currency, which then becomes their income. Their ability to do this efficiently, especially with direct energy, is key to their earnings, you know. Learn more about digital asset operations on our site.

Looking Ahead: What This Means for You

Understanding how a company like Mara makes money gives us a clearer picture of the digital asset economy. It shows that there are real, tangible ways to generate income within this relatively new financial space, you know. Their success highlights the importance of operational efficiency, strategic investment in technology, and a clear focus on a specific part of the market.

For anyone interested in how the world of digital currencies works, Mara's story offers a compelling example. It's not just about trading; it's about the underlying infrastructure and the effort that goes into creating these digital assets. Their ability to achieve unexpected profits and record revenues shows that, with the right approach, this kind of business can be very successful, that is what it is. You might find it interesting to explore other aspects of cryptocurrency businesses on this very site.

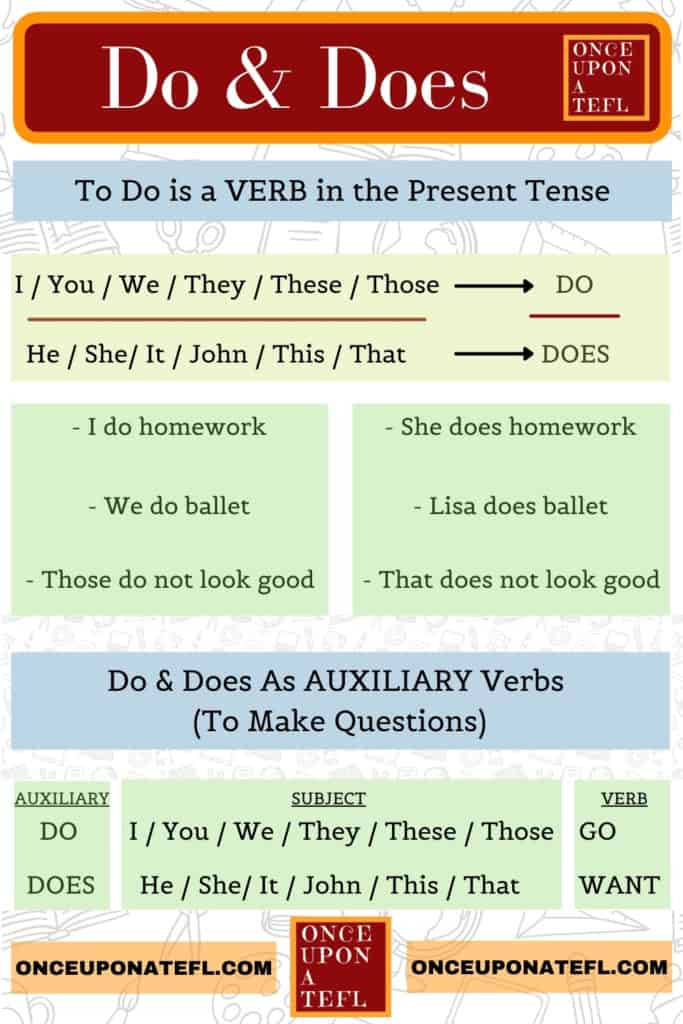

Do vs. Does: How to Use Does vs Do in Sentences - Confused Words

Do Vs Does: How To Use Them Correctly In English

Using Do and Does, Definition and Example Sentences USING DO AND DOES