Who Did Robert Kardashian Leave His Money To? Unpacking A Family Legacy

When someone prominent passes away, a question often comes up: What happened to their estate? People, you know, are just naturally curious about these things. It's almost as if we want to understand how a person's life work, their financial efforts, are distributed once they are gone. Robert Kardashian, a figure known for his legal career and, later, for his family's growing public presence, passed away in 2003. His passing, very naturally, brought about questions regarding his financial arrangements and, well, who would benefit from what he had built up over the years.

It's a very common thing to wonder about the details of a will, especially when it involves someone who was, in a way, a public figure. You might be thinking about how assets are handled, or perhaps how a family navigates such personal matters during a time of great loss. This isn't just about money, really; it's also about the arrangements made for those left behind, and the careful planning that can go into protecting a family's future.

So, we're going to take a look at the specifics surrounding Robert Kardashian's estate. We'll explore the primary beneficiaries and how his wealth was managed after his death. It's a topic that, you know, still sparks interest, partly because of the continued public life of his children, and partly because it offers a glimpse into how even well-known individuals handle their personal finances for the next generation.

Table of Contents

- Robert Kardashian: A Look Back

- The Core Question: Who Received His Estate?

- Understanding the Will's Details

- What About Other Family Members?

- The Impact on His Children

- Beyond the Will: The Legacy

- People Also Ask About Robert Kardashian's Will

Robert Kardashian: A Look Back

Robert George Kardashian, a very notable American attorney and businessman, was born in Los Angeles, California. He became widely recognized for his legal involvement in the O.J. Simpson murder trial, where he served as a friend and defense attorney to Simpson. His professional life, you see, was quite impactful in legal circles, and he was known for his sharp mind and strategic thinking.

Outside of his legal career, Robert Kardashian was also a successful businessman, investing in various ventures that, you know, helped build his personal wealth. He was, in a way, a private person despite his public association with high-profile cases. His personal life, particularly his family, was a very central part of who he was. He had four children with his first wife, Kris Jenner, and they remained a significant part of his life until his passing.

He passed away on September 30, 2003, at the age of 59, after a battle with esophageal cancer. His death was a significant loss for his family and for those who knew him, leaving behind a legacy that, in some respects, continues to be discussed even today, especially regarding his children's careers and public presence. It's almost like his influence, though gone, still shapes parts of the world around us.

Personal Details and Bio Data

| Full Name | Robert George Kardashian |

| Born | February 22, 1944 |

| Died | September 30, 2003 (aged 59) |

| Place of Birth | Los Angeles, California, U.S. |

| Nationality | American |

| Occupation | Attorney, Businessman |

| Spouse(s) | Kris Jenner (m. 1978; div. 1991), Jan Ashley (m. 1998; div. 1999), Ellen Pierson (m. 2003) |

| Children | Kourtney Kardashian, Kim Kardashian, Khloé Kardashian, Rob Kardashian Jr. |

| Alma Mater | University of Southern California (B.S.), University of San Diego School of Law (J.D.) |

The Core Question: Who Received His Estate?

When it comes down to it, the main question people have is, "Who did Robert Kardashian leave his money to?" The answer, quite directly, is his four children. Robert Kardashian made arrangements in his will to ensure that his wealth would primarily benefit his children: Kourtney, Kim, Khloé, and Rob Jr. This was, you know, a very clear intention on his part to provide for their future, which is something many parents aim for.

His will, which was established some time before his passing, laid out specific instructions for the distribution of his assets. It wasn't just a simple handover of cash, though. Instead, he chose a method that, in some respects, offered protection and management for the funds, especially since his younger children were still quite young at the time of his death. This kind of planning is, you know, pretty standard for individuals with significant assets and young dependents.

So, the bulk of his estate was designated for his children. This included, for instance, various financial assets, properties, and other holdings that he had accumulated during his successful career. The legal documents made it quite plain that his children were the primary beneficiaries of his careful financial planning, which is a rather important point to consider.

The Role of Trusts

A key element in how Robert Kardashian's money was left to his children was through the establishment of trusts. This is a very common legal tool used for estate planning, especially when you want to manage how and when assets are distributed, or perhaps if the beneficiaries are minors. For his children, these trusts were set up to hold and manage the assets on their behalf until they reached certain ages or met specific conditions, which is a pretty smart way to do things, you know.

The trusts, in a way, acted as a protective mechanism. They ensured that the money would be managed responsibly by appointed trustees, rather than being given directly to young adults who might not yet have the experience to handle a large inheritance. This approach helps to preserve the wealth and ensures it is used for purposes like education, living expenses, or future investments, which is, you know, what many people hope for when leaving money to their kids.

So, while the money was indeed left to his children, it was channeled through these legal structures. This meant that while they were the ultimate beneficiaries, they didn't get immediate, unrestricted access to all of it right away. It was, basically, a phased approach to inheritance, designed to benefit them over the long term, which, frankly, makes a lot of sense.

Understanding the Will's Details

The details of Robert Kardashian's will, as with many such documents, were quite specific about how things would be handled. His estate was managed through a revocable living trust, which he had established. This type of trust, you know, allows a person to control their assets during their lifetime and then specifies how they will be distributed upon their death, all while avoiding the often lengthy and public probate process. It's a rather popular choice for estate planning, as a matter of fact.

The trust documents outlined the specific portions each child would receive and the conditions under which they would gain full access to their inheritance. This kind of detailed planning is, in a way, a testament to his foresight and desire to ensure his children's financial security. It shows a very deliberate thought process about how his wealth would best serve his family after he was gone, which is, you know, a very considerate thing to do.

While the exact amounts and specific distribution schedules are not fully public, it is widely understood that the trusts provided substantial financial support for Kourtney, Kim, Khloé, and Rob Jr. This support, you know, played a role in their lives as they grew up and started their own ventures, which is, honestly, a pretty big deal for anyone starting out.

Kris Jenner's Involvement

Robert Kardashian's former wife, Kris Jenner, played a significant role in the execution of his will and the management of the trusts for their children. She was appointed as the executor of his will and also as the guardian of the children's trusts. This meant she had the legal responsibility to oversee the distribution of assets according to Robert's wishes and to manage the funds within the trusts for the benefit of their children. It's a position that, you know, comes with a lot of responsibility and trust.

Her role was particularly important given that the children were still relatively young when their father passed away. For instance, Rob Jr. was only 16 at the time, and Khloé was 19. Kris's involvement ensured that the financial provisions Robert had made for his children were handled properly and that their interests were protected. This kind of arrangement is, you know, pretty typical when a parent passes away and leaves assets to minor children.

So, while the money was left to the children, Kris was instrumental in making sure those wishes were carried out effectively. Her oversight was, in a way, a continuation of Robert's care for his family, ensuring that his financial legacy was managed responsibly for the benefit of his kids, which is, you know, a pretty big task.

What About Other Family Members?

Naturally, when discussing a will, people often wonder about other family members, particularly spouses. Robert Kardashian was married three times. His first marriage was to Kris Jenner, the mother of his four children. Later, he married Jan Ashley and then, just weeks before his death, Ellen Pierson. The question of whether these other spouses received a portion of his estate is, you know, a very common one.

It's important to remember that a will typically reflects the testator's (the person making the will) intentions for their assets. In Robert Kardashian's case, his primary will, which was established well before his later marriages, focused on providing for his children. While there were some later claims, particularly from his third wife, Ellen Pierson, regarding alleged changes to his will, these claims were generally not upheld or recognized as valid by the courts. So, in fact, the original intent to benefit his children remained largely intact.

So, the vast majority of his estate, as per his established will and trusts, was indeed directed towards his four children. This is, you know, a pretty clear indication of where his financial priorities lay. His careful planning, it seems, made it difficult for later claims to significantly alter the distribution of his core assets, which is, you know, a sign of a well-structured estate plan.

The Impact on His Children

The financial provisions Robert Kardashian made for his children had a significant impact on their lives. The trusts provided a degree of financial security that, you know, allowed them to pursue their own interests and build their careers without immediate financial pressure. This kind of support can be, frankly, a huge advantage for young people trying to find their way in the world.

While the Kardashian children have, of course, gone on to build immense wealth through their own business ventures and media careers, the initial inheritance from their father provided a foundation. It's almost like a safety net that allowed them to take risks and explore opportunities that they might not have otherwise. This isn't to say it was the sole reason for their success, but it certainly played a part, which is, you know, a pretty fair assessment.

The funds from the trusts likely contributed to their education, early investments, and general well-being during their formative years and into early adulthood. This support, in a way, allowed them to focus on their passions and build their own empires, rather than having to worry about basic financial needs. It's a good example of how thoughtful estate planning can empower the next generation, which is, you know, a very positive outcome.

Beyond the Will: The Legacy

Robert Kardashian's financial legacy, while important, is only one part of his overall impact. His children often speak about the values he instilled in them, like hard work, family loyalty, and the importance of education. These intangible aspects of his legacy are, you know, arguably just as significant as any monetary inheritance. It's almost like the lessons he taught them continue to guide their lives.

His careful estate planning ensured that his children were financially secure, allowing them to focus on their personal and professional growth. This foresight is, in some respects, a lasting testament to his dedication as a father. Even today, you can see how his children, like your own family members, often credit their father for shaping who they are, which is, you know, a very touching thing to hear.

The way his estate was handled also highlights the importance of having a clear and legally sound will. It shows that, with proper planning, a person can ensure their wishes are carried out and their loved ones are provided for, which is, you know, a very valuable lesson for anyone to consider. For more details on Robert Kardashian's life and career, you might want to look at biographical sources like reputable biography sites.

Learn more about on our site, and link to this page

People Also Ask About Robert Kardashian's Will

What was Robert Kardashian's net worth at the time of his death?

While an exact public figure for Robert Kardashian's net worth at the time of his death is not officially disclosed, estimates vary widely. He was a successful attorney and businessman, so he had, you know, accumulated considerable wealth through his legal practice and various investments. It's generally understood that he left a substantial estate, primarily to his children, which was managed through trusts, as we discussed. So, it was, you know, a pretty significant sum.

Did Robert Kardashian have a will, and was it contested?

Yes, Robert Kardashian did have a comprehensive will and an established living trust, which outlined how his assets should be distributed. While there were, you know, some claims made by his third wife, Ellen Pierson, suggesting he had made changes to his will shortly before his death, these claims were generally not upheld in court. So, basically, the original provisions benefiting his children remained the effective legal framework for his estate.

How old were the Kardashian children when their father passed away?

When Robert Kardashian passed away in September 2003, his children were at different stages of their young lives. Kourtney was the oldest, at 24 years old. Kim was 22, and Khloé was 19. Rob Jr., the youngest, was 16 years old. So, you know, they were all either young adults or still teenagers, which is why the trust arrangements were, frankly, so important for their financial well-being.

- How Old Was Bob Barker When He Filmed Happy Gilmore

- Do Heidi Klum And Sofia Vergara Get Along

- Who Was The American Rock Singer Who Killed Himself

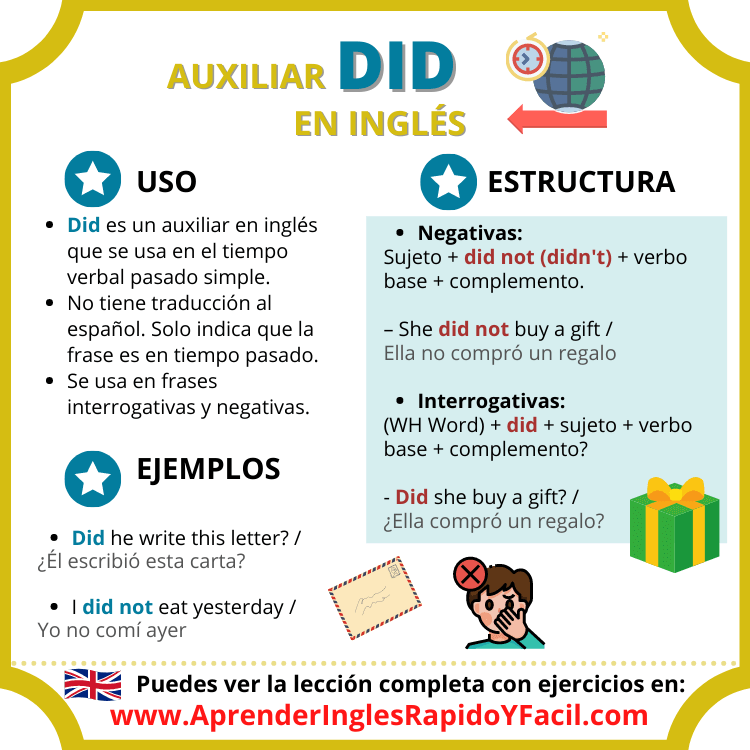

Cómo Usar el Verbo Auxiliar DID - YouTube

sonrojo válvula rumor reglas de was y were en ingles Mensurable Perenne

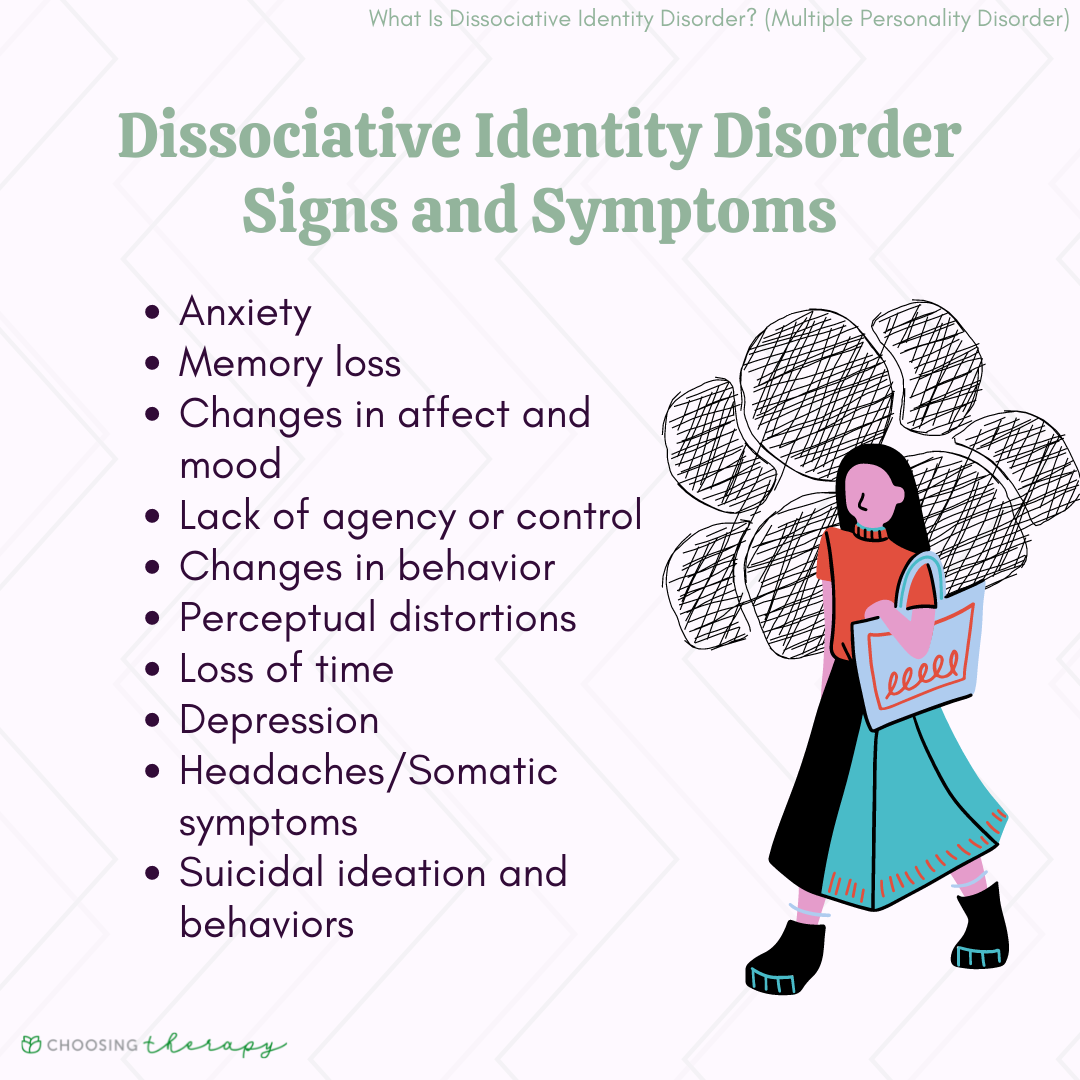

Dissociative Identity Disorder (DID): Symptoms, Causes, & Treatments