How Much Money Did Michael Jackson Owe The IRS? A Look At His Estate's Tax Battle

The financial life of Michael Jackson, the legendary King of Pop, has always held a certain mystique, hasn't it? For so many people, his story includes not just incredible musical achievements but also, you know, some really big questions about his money matters. One question that still pops up, like, pretty often, is about his dealings with the tax folks, specifically the IRS. It's a topic that really gets folks wondering, and it's quite a tale, actually.

You see, while Michael Jackson created some of the most beloved songs and unforgettable performances the world has ever known, his personal finances were, in some respects, a bit more complicated. He earned truly vast sums of money throughout his career, but he also had a way of spending quite a lot, too, as a matter of fact. This often led to financial challenges, even for someone so incredibly famous.

So, when we talk about how much money Michael Jackson might have owed the IRS, it’s not just a simple number. It's really about a long, drawn-out disagreement over the true value of his incredible legacy after he passed away. This whole situation, honestly, brought about a rather significant legal fight, one that had people talking for a very long time.

- What Happened To Carolyn Bessette Kennedys Engagement Ring

- Which Celebrity Has The Biggest Ring

- Does Emily Compagno Have Any Children

Table of Contents

- Biography: The King of Pop's Life

- Personal Details and Bio Data

- The King of Pop's Financial World

- The IRS Comes Calling

- The Staggering Sum

- Paying the Piper

- Lessons from the Legacy

- Frequently Asked Questions

Biography: The King of Pop's Life

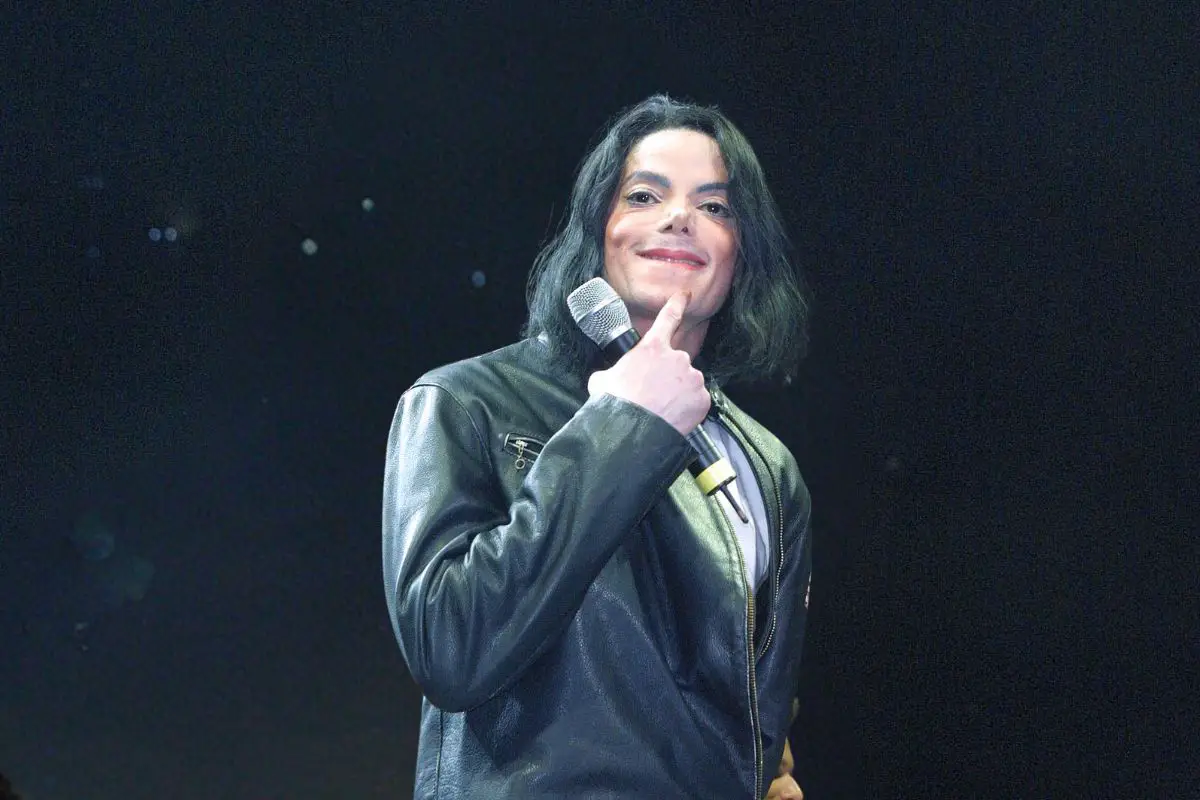

Michael Joseph Jackson, born in Gary, Indiana, on August 29, 1958, truly started his journey to superstardom at a very young age, you know. He first gained widespread notice as the charismatic lead singer of the Jackson 5, a family group that absolutely captivated audiences with their infectious energy and catchy tunes. From those early days, it was clear he possessed a truly special talent, a gift for performance that seemed, honestly, almost otherworldly.

As he grew, Michael embarked on a solo career that, quite frankly, redefined popular music for generations. Albums like "Off the Wall," "Thriller," and "Bad" didn't just sell millions of copies; they shattered records and reshaped the entire music industry. His innovative music videos, electrifying dance moves, and distinctive vocal style made him a global icon, a figure recognized and adored in nearly every corner of the planet. He was, in a way, a cultural phenomenon, someone who truly transcended boundaries.

His life, however, was also marked by intense public scrutiny and, you know, some deeply personal struggles. Despite the immense fame and adoration, he faced various challenges, including health issues and legal troubles that often overshadowed his musical achievements. Michael Jackson passed away on June 25, 2009, at the age of 50, leaving behind a monumental musical legacy and, as we'll see, a rather complex financial situation.

- What Condition Does Yung Gravy Have

- Does Adam Driver Use Social Media

- Who Is The Singer Who Lost His Voice

Personal Details and Bio Data

For those curious about the man behind the music, here are some key details about Michael Jackson, the King of Pop, which, you know, help paint a fuller picture of his life.

| Detail | Information |

|---|---|

| Full Name | Michael Joseph Jackson |

| Date of Birth | August 29, 1958 |

| Place of Birth | Gary, Indiana, USA |

| Date of Passing | June 25, 2009 |

| Age at Passing | 50 years old |

| Occupation | Singer, Songwriter, Dancer, Record Producer, Philanthropist |

| Notable Albums | Off the Wall, Thriller, Bad, Dangerous, HIStory |

| Children | Prince Michael Joseph Jackson Jr., Paris-Michael Katherine Jackson, Prince Michael "Blanket" Jackson II (Bigi) |

The King of Pop's Financial World

Michael Jackson's earnings were, without a doubt, absolutely massive during his peak years, you know. He made vast sums from record sales, concert tours, music publishing rights – especially his ownership stake in the Sony/ATV Music Publishing catalog, which included a huge collection of Beatles songs, which was, quite frankly, a really smart investment. This catalog alone generated a truly significant income stream for him, providing him with a rather substantial financial foundation.

However, despite these incredible earnings, Michael Jackson's spending habits were, well, equally legendary, in a way. He maintained a truly lavish lifestyle, complete with his famous Neverland Ranch, which was, basically, a sprawling estate featuring a private amusement park and a zoo. He also spent generously on art, antiques, gifts, and legal fees, which, you know, piled up over the years. These expenditures, quite naturally, created a significant drain on his finances, even with his high income.

So, while he brought in truly enormous amounts of money, his outgoings were also, honestly, incredibly large. This often meant that despite his fame and wealth, he found himself in situations where cash flow was a bit tight, or where he had, like, significant outstanding debts. This financial picture, basically, set the stage for the disagreements that would later arise with the tax authorities after his passing, which, as a matter of fact, became a pretty big deal.

The IRS Comes Calling

When Michael Jackson passed away in 2009, his estate, like any other, became subject to estate taxes. These taxes are levied on the transfer of a person's assets after their death, you know. The challenge, however, was figuring out the true worth of everything he left behind, which was, in some respects, a truly complex task. It wasn't just about bank accounts; it involved intellectual property, his image, his name, and so many other things.

The Initial Audit and Valuation

The IRS, as is their role, began an audit of Michael Jackson's estate, which is a pretty standard procedure for estates of this size and complexity. The main point of contention, the really big disagreement, centered on how to value his assets, especially the intangible ones. Things like his image, his likeness, his name, and his music catalog were incredibly valuable, but, you know, putting an exact dollar figure on them for tax purposes was, honestly, quite a challenge. The estate's representatives and the IRS had, like, wildly different ideas about what these things were truly worth.

For example, the estate initially valued Michael Jackson's image and likeness at a surprisingly low figure, like, just a couple of thousand dollars. They argued that at the time of his passing, his career was, arguably, in a downturn, and his public image had suffered due to various controversies. This valuation, you know, was a key point that the IRS simply did not agree with, and it set the stage for a really long and intense battle.

The Estate's Stance

The people managing Michael Jackson's estate took the position that many of his assets, particularly his image and likeness, held a much lower value at the time of his death. They pointed to the fact that he was, basically, heavily indebted and facing significant public relations challenges. They argued that his earning potential had, in a way, diminished, and therefore, the value of his future earnings from his image and brand should be considered less substantial for tax purposes. This was, honestly, a key part of their strategy to reduce the overall tax bill.

They presented a case that highlighted the financial struggles he experienced in his later years, suggesting that the public's perception of him had, in some respects, been damaged. This perspective, you know, aimed to convince the tax authorities that the future commercial potential of his name and image was, arguably, not as high as one might assume given his past fame. It was, essentially, an argument about timing and market conditions at the moment of his passing.

The IRS's View

The IRS, on the other hand, saw things very, very differently, as a matter of fact. They believed that the estate had drastically undervalued Michael Jackson's assets, especially his image and likeness. They argued that despite his personal difficulties, his status as a global superstar, the "King of Pop," was an enduring asset that would continue to generate enormous income long after his death. They looked at his potential for future earnings from music, merchandise, and licensing deals, and they saw a truly significant financial engine.

The tax agency asserted that the estate's valuation was, quite frankly, far too low and that the true value of his name and image was, like, hundreds of millions of dollars. They pointed to the fact that his music sales and popularity actually surged significantly immediately after his passing, which, you know, supported their view that his legacy was, in fact, incredibly valuable. This fundamental disagreement over valuation was the very heart of the entire tax dispute, leading to a really protracted legal fight.

The Staggering Sum

So, the big question remains: How much money did Michael Jackson owe the IRS? The dispute over the valuation of his assets, particularly his image and likeness, led to a truly monumental tax bill, you know. This wasn't just a small disagreement; it was a difference of hundreds of millions of dollars, which, quite honestly, is a staggering amount for anyone, let alone an estate trying to settle affairs.

The Tax Court Ruling

After years of legal arguments and a lengthy trial, the U.S. Tax Court finally issued its ruling in 2021. The court sided mostly with Michael Jackson's estate on the valuation of his image and likeness, but still found a higher value than the estate had initially claimed. The IRS had originally sought, like, over $700 million in taxes and penalties, based on their much higher valuations of his assets. This was, frankly, an incredibly large sum, one that would have been very difficult for the estate to manage.

The Tax Court determined that Michael Jackson's net worth at the time of his death was actually much lower than the IRS had argued. Specifically, for his image and likeness, the court valued it at about $4.15 million, which was significantly higher than the estate's initial claim of just $2,105, but also vastly lower than the IRS's assertion of $434 million. This ruling, you know, represented a partial victory for the estate, as it drastically reduced the overall tax liability, but it still meant a substantial amount was due.

So, what was the final amount? Based on the Tax Court's adjusted valuations, the estate owed, in some respects, an additional $111 million in tax deficiencies. This figure was a result of the court's re-evaluation of various assets, including his interest in the Mijac Music catalog and his image and likeness. This was, basically, the core amount of the tax bill that the court found was outstanding, a truly significant figure that still required careful management.

Interest and Penalties

It's important to remember that tax debts often come with more than just the principal amount; there are also interest and penalties, you know. The IRS had sought a substantial penalty for what they considered a "gross valuation misstatement" by the estate. This penalty alone could have added, like, tens of millions of dollars to the total bill, making the situation even more dire for the estate. This is a common feature of tax disputes, as a matter of fact, where penalties can really inflate the final sum.

While the Tax Court's ruling reduced the principal tax deficiency, it still meant the estate faced interest charges that had accrued over many years since Michael Jackson's passing. These interest charges, over such a long period, could easily add, like, many millions of dollars to the total amount owed. So, even with the reduced principal, the overall financial obligation remained, arguably, quite substantial due to these additional charges.

So, to answer the question directly, while the initial IRS claim was for hundreds of millions, the Tax Court ultimately found that Michael Jackson's estate owed, in terms of additional tax deficiencies, approximately $111 million. This amount did not include the interest that had accumulated since 2009, which, you know, added a truly considerable sum on top of that principal amount. The actual total paid by the estate would be that $111 million plus, basically, a very significant amount of interest, making the final payment a truly large figure.

Paying the Piper

The Michael Jackson estate has, in some respects, been remarkably successful in its efforts to generate income since his passing. This success has allowed them to pay down a truly substantial portion of his debts, including the amounts owed to the IRS. They have achieved this through various ventures, like, new music releases, documentaries, a popular Broadway show, and licensing deals for his image and music. This strategic approach has been, honestly, quite effective in turning around the estate's financial health.

The estate's administrators have worked diligently to revitalize Michael Jackson's brand and catalog, which, you know, has generated billions of dollars in revenue. This consistent income stream has been absolutely crucial for managing the estate's obligations, including the significant tax bill. It's a testament to the enduring power of his legacy that they've been able to accomplish so much, apparently, even after such a lengthy and challenging legal battle with the tax authorities.

So, while the initial IRS demands were, frankly, overwhelming, the estate has been able to meet its financial responsibilities through careful management and the continued commercial appeal of Michael Jackson's work. This ongoing effort means that the estate has, basically, been able to address the tax liabilities that arose from the valuation dispute, ensuring that Michael Jackson's legacy continues to be managed responsibly, which, you know, is a pretty big deal for his family and fans.

Lessons from the Legacy

The extensive tax dispute involving Michael Jackson's estate offers some pretty clear lessons, you know, for anyone dealing with significant assets, especially those involving creative works or personal brands. One key takeaway is that valuing intangible assets, like a celebrity's image or musical catalog, can be incredibly difficult, as a matter of fact. There's often a huge difference in how the estate sees the value versus how the tax authorities view it, leading to, like, very complex disagreements.

Another important point is the sheer importance of estate planning, particularly for individuals with substantial and diverse assets. Having a clear plan for how assets will be valued and managed after one's passing can, in some respects, help prevent long and costly legal battles. This situation truly highlights how a lack of clarity can lead to, honestly, years of litigation and significant financial strain on an estate. Learn more about estate planning on our site.

Finally, the Michael Jackson estate's story also shows the incredible resilience of a powerful brand and legacy. Despite the financial challenges and legal disputes, the careful stewardship of his estate has managed to generate vast sums, ensuring his family is provided for and his debts are settled. It's a powerful reminder that true artistic impact can, you know, continue to create value for a very, very long time. You might also find this page interesting: Understanding Celebrity Estates.

Frequently Asked Questions

Did Michael Jackson's estate pay his taxes?

Yes, Michael Jackson's estate has been actively working to pay down his tax liabilities and other debts since his passing, you know. Through very successful management of his music, image, and other assets, they have generated substantial revenue. This income has allowed them to settle a truly significant portion of the outstanding tax bill and other financial obligations, which, as a matter of fact, is a testament to their efforts.

How much was Michael Jackson's estate worth when he died?

The exact worth of Michael Jackson's estate at the time of his passing was, honestly, a major point of contention with the IRS. While the estate initially valued it at a much lower figure, the U.S. Tax Court eventually determined that his net worth was, in some respects, closer to $111 million in additional taxable value, primarily due to the higher valuation of his image, likeness, and music catalog. This figure was, basically, the amount that the tax authorities ultimately settled on after the lengthy legal battle.

What was the biggest dispute with the IRS regarding MJ's estate?

The biggest disagreement between Michael Jackson's estate and the IRS centered on the valuation of his intangible assets, particularly his image and likeness, you know. The estate argued these were worth very little at the time of his death due to his financial troubles and public image issues. The IRS, however, insisted they were worth hundreds of millions of dollars, leading to a truly significant difference in opinion and, ultimately, a lengthy and public court case that settled the matter, apparently, just a few years ago.

Michael Jackson's Children Targeted By IRS - AllHipHop

Michael Jackson Estate – IRS Case – Michael Jackson – Monkey Business

Michael Jackson Estate – IRS Case – Michael Jackson – Monkey Business