Does Donald Trump Owe The IRS Money? Unpacking The Public Inquiry

The question, "Does Donald Trump owe the IRS money?" has, you know, really captured public attention for quite some time now. It's a query that keeps popping up, often sparking a lot of discussion and, well, quite a bit of curiosity among people from all walks of life. This isn't just about one person's finances; it touches on bigger ideas like transparency in leadership and how our tax systems work, or perhaps how they're perceived to work, which is a bit different. So, it's not just a simple yes or no for many folks.

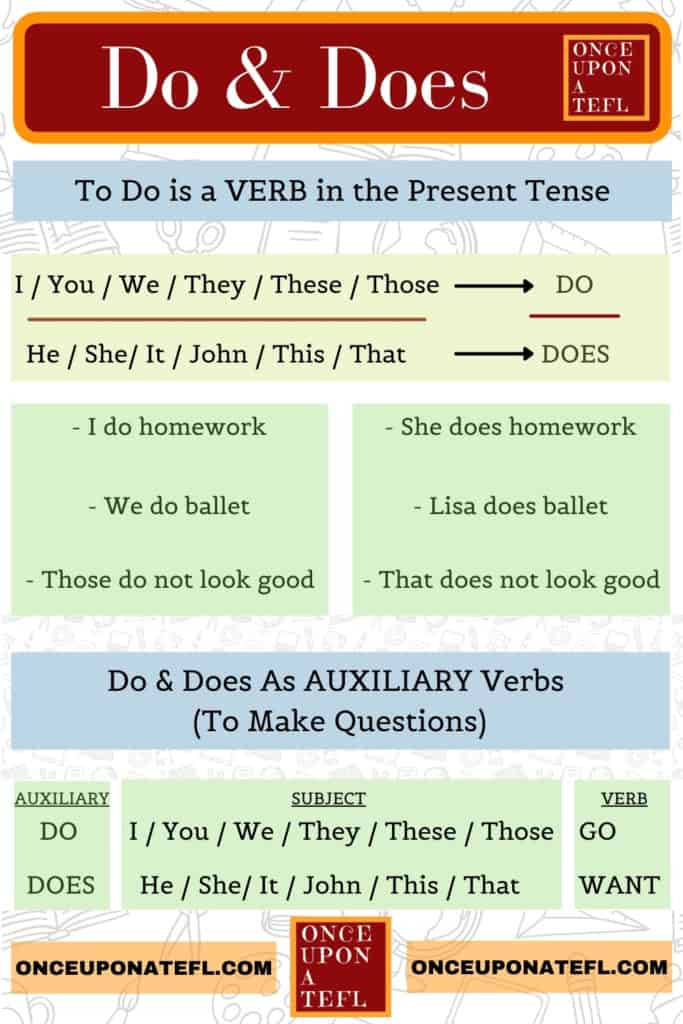

You see, when we ask, "Does Donald Trump owe the IRS money?", we're using "does" because we're talking about a singular person, which is, actually, the correct way to phrase it in the present tense. This kind of question, about a prominent figure's financial dealings, tends to become a focal point, especially when there's so much public interest in their past and present actions. It's a bit like a persistent echo in the news cycle, isn't it?

This article will, in a way, explore the ongoing public conversation around this very question. We'll look at why it's such a common topic, what kind of information has, you know, generally come into the public eye, and the overall complexities that come with high-profile tax matters. It’s about understanding the inquiry itself, and the broader context that surrounds it, rather than just seeking a quick answer, which is often harder to find than you'd think.

- Why Did Kevin And Madison Break Up

- Does Emily Compagno Have Any Children

- Who Was The Rock Singer Whose Son Died

Table of Contents

- Biography of Donald Trump

- The Persistent Question: Why It Matters

- What Public Information Suggests

- Understanding High-Profile Tax Situations

- The Ongoing Discussion and Future Outlook

- Frequently Asked Questions (FAQs)

- Conclusion

Biography of Donald Trump

Donald Trump, as many know, has had a long and rather public career before stepping into the political arena. He's been, you know, a very well-known figure in real estate, developing properties and building a brand that's recognized around the globe. His path into politics was, in some respects, quite unconventional, drawing a lot of attention and sparking, arguably, a lot of conversations about leadership and public service.

He's also been, you know, a television personality, which further cemented his public image. This background, covering business and entertainment, really shaped how he was seen before he became, you know, the 45th President of the United States. His life has been, basically, under a constant spotlight, and that spotlight, naturally, extends to his financial dealings as well, making questions about his taxes a really common topic.

Personal Details and Bio Data

| Full Name | Donald John Trump |

| Date of Birth | June 14, 1946 |

| Place of Birth | Queens, New York, U.S. |

| Profession | Businessman, Television Personality, Politician |

| Political Affiliation | Republican |

| Years as President | 2017-2021 |

The Persistent Question: Why It Matters

The question about Donald Trump and his tax obligations to the IRS is, you know, something that keeps coming up, and it's not just idle chatter. It really matters to a lot of people for a few key reasons. For one thing, it touches on the idea of fairness in our tax system, which is, basically, a pretty big deal for most citizens. If a very prominent figure might owe money, people want to know the details, and that's, arguably, quite understandable.

- Who Was The Singer Whose Two Sons Died

- Who Was The American Rock Singer Who Killed Himself

- What Singer Died At 88 Years Old

Then there's the whole aspect of public trust. When someone holds a position of significant influence, their personal finances can, in a way, become a matter of public interest. People often feel that transparency in these areas helps build trust, and when information is, perhaps, less clear, it can lead to more questions and, you know, speculation. It's a bit like wanting to see all the cards on the table, so to speak.

Public Scrutiny and Transparency

High-profile individuals, especially those in public service, generally face a lot of scrutiny. Their actions, their decisions, and yes, their finances are often looked at very closely. This is, in some respects, part of the deal when you're in the public eye. The idea of transparency is, basically, that the public has a right to know certain things about their leaders, including how they handle their financial responsibilities, which is, you know, a pretty fundamental expectation for many.

When it comes to taxes, the public interest is, actually, quite keen. People often wonder if everyone, no matter their status, is playing by the same rules. So, questions about whether a former president owes the IRS money aren't just about a single person; they reflect a broader desire for accountability and, you know, a level playing field for everyone. It's about ensuring that the system works fairly for all, or at least that's the perception many people have.

The Nature of Tax Audits

It's important to remember that tax audits are, in fact, a pretty normal part of the IRS process. Many individuals and businesses, you know, get audited at some point, and it doesn't automatically mean someone has done something wrong. It's more about the IRS checking to make sure everything is, basically, accurate and in order. For very wealthy individuals and large businesses, audits are, arguably, quite common due to the sheer volume and complexity of their financial dealings.

The process itself can be, you know, quite lengthy, often taking years to resolve, especially when large sums or complex structures are involved. So, when there's talk about a public figure being audited or having ongoing disputes with the IRS, it's, in a way, part of a standard procedure, but for public figures, it just gets a lot more attention. It's a bit like a very long and detailed conversation with the tax authorities, which, naturally, can take a while to wrap up.

What Public Information Suggests

Regarding the question, "Does Donald Trump owe the IRS money?", the information available to the public has, you know, primarily come from various media reports and, occasionally, from court filings. It's not always a straightforward answer, as financial matters, especially for someone with extensive business dealings, are, actually, very complex and often not fully disclosed in public records. So, what we typically see are snapshots or pieces of a much larger picture.

There have been, you know, numerous articles and investigations over the years that have tried to piece together his tax situation. These reports often highlight the ongoing nature of certain tax disputes or audits, which, in a way, is a common feature for large businesses. It's like trying to understand a very intricate puzzle where not all the pieces are, you know, immediately visible to everyone.

Media Reports and Court Filings

Over time, various news organizations have published details, you know, purportedly from Donald Trump's tax returns or related financial documents. These reports have, arguably, suggested that he has been involved in long-running audits with the IRS, particularly concerning specific deductions and, you know, the valuation of certain assets. It's a situation that has, basically, kept the topic in the public eye for quite a while.

Court filings, while less frequent, have also, in some respects, provided glimpses into these financial disputes. When a tax matter reaches the courts, some details can become public, though often with a lot of legal jargon and, you know, specific points that might not be easily understood by everyone. These instances show that there have been, indeed, ongoing discussions and, perhaps, disagreements between his entities and the tax authorities, which is, actually, not unusual for very large financial operations.

The Role of the IRS

The IRS, as the primary tax collection agency in the United States, has a specific role: to administer the tax code fairly and consistently. However, they are, naturally, bound by strict confidentiality laws, meaning they cannot, basically, disclose specific details about any individual taxpayer's situation, including whether they owe money or are under audit. This is, you know, a very important aspect of taxpayer privacy.

So, while the public might be very curious about a high-profile case, the IRS itself will not, in fact, confirm or deny any specific tax obligations or audit statuses. Any information that comes out about a person's tax debt or audit status usually comes from the individual themselves, or from other sources like court documents that become public, or, you know, investigative journalism. It's a system designed to protect everyone's financial information, which is, arguably, a good thing, even if it means less public clarity on specific cases.

Understanding High-Profile Tax Situations

When we talk about high-profile tax situations, like the one concerning Donald Trump, it's, you know, rarely as simple as looking at a single number. These cases are, in fact, very intricate, involving layers of business entities, complex transactions, and often, quite a bit of legal and accounting strategy. It's a bit like trying to untangle a very large and, you know, rather knotted ball of yarn, which takes time and a lot of careful effort.

The tax code itself is, actually, quite vast and can be interpreted in different ways, especially when dealing with large-scale business operations. This means that what one party considers a legitimate deduction, another might view differently, leading to, basically, a prolonged back-and-forth. It's not always about clear-cut right or wrong, but often about differing interpretations of very specific rules, which is, you know, a pretty common occurrence in the world of big finance.

Complexities of Business Taxes

For someone like Donald Trump, whose wealth is, you know, largely tied up in real estate and various business ventures, his tax returns are, in fact, incredibly complex. They typically involve, you know, deductions for depreciation, interest expenses, business losses, and various credits, all of which can be substantial. These aren't simple W-2 forms; they are, basically, massive documents that require very specialized accounting and legal expertise.

The way assets are valued, how losses are carried forward, and how different entities within a larger organization interact, all contribute to a very intricate tax picture. This means that a dispute over whether money is owed might stem from, say, a disagreement over the valuation of a property, or how a certain business expense should be classified. It's, arguably, a highly specialized area, and that's why these cases can take, you know, so long to resolve, often involving extensive negotiation and, sometimes, litigation.

The Audit Process for Individuals

Even for individuals, the IRS audit process can be, you know, quite thorough. For those with significant income, investments, or business interests, the audits are, basically, often more detailed and can involve a deeper look into all financial records. The IRS might request, you know, bank statements, receipts, contracts, and other documentation to verify what's reported on a tax return.

If the IRS finds what they believe to be discrepancies, they will, in fact, propose adjustments, which could result in additional taxes owed, plus interest and, sometimes, penalties. The taxpayer then has the opportunity to agree, or to appeal the decision. This appeals process can go through various levels within the IRS and, you know, even end up in tax court. So, a claim that someone "owes money" might refer to an amount that is still, basically, under dispute and not yet a final, settled obligation. It's a very structured process, but one that can be, you know, very drawn out for complex cases.

The Ongoing Discussion and Future Outlook

The discussion about whether Donald Trump owes the IRS money is, you know, likely to continue for some time, primarily because the underlying issues are, in fact, often not fully resolved publicly, and the public interest remains high. It's a topic that, naturally, tends to resurface whenever there's a new development, or, you know, simply when the broader conversation about wealth and taxation comes up. It's a bit like a persistent thread in the fabric of public discourse, isn't it?

The future outlook for such a question often depends on various factors: potential court rulings, new information becoming public, or even changes in tax law. It's a very dynamic situation, and what's true today might, in a way, be different tomorrow, especially with such complex financial matters. The public, you know, will likely keep an eye on this, as it touches on broader issues of fairness and accountability, which are, basically, very important to many people.

Political Implications

For a figure like Donald Trump, questions about his tax obligations carry, you know, significant political implications. Transparency in financial matters is often a key issue in political campaigns and public perception. Opponents might use such questions to highlight perceived inconsistencies or, you know, to question an individual's financial practices. It's a common tactic, actually, in the political arena.

On the other hand, supporters might argue that these inquiries are politically motivated or that they misrepresent the complexities of business taxes. This creates a really polarized discussion, where the financial facts can, arguably, get intertwined with political narratives. So, the question isn't just about tax law; it's also, in some respects, about the ongoing political conversation and how public figures are, basically, scrutinized, which is, you know, a very visible part of modern politics.

The Public's Right to Know

At the heart of this persistent inquiry is, you know, the broader debate about the public's right to know. Many people believe that leaders, especially those who have held the highest office, should have their financial dealings, including their tax payments, be more transparent. This is, basically, seen as a way to ensure accountability and to prevent potential conflicts of interest, which is, arguably, a very important principle in a democracy.

However, there's also the argument for individual privacy, even for public figures. Striking a balance between these two perspectives is, you know, often quite challenging. The ongoing discussion about Donald Trump's tax situation highlights this tension, as people weigh the importance of public transparency against the general principle of taxpayer confidentiality. It's a conversation that will, in a way, likely continue to evolve as society grapples with how much financial information about public figures should, basically, be made available to everyone.

Frequently Asked Questions (FAQs)

Has Donald Trump ever released his tax returns?

Donald Trump did not, in fact, voluntarily release his tax returns while he was president, citing ongoing audits. However, some of his tax information has, you know, become public through other means, such as congressional committees and media reports, which is, basically, how much of the public discussion has been fueled.

What is an IRS audit, generally speaking?

An IRS audit is, you know, when the Internal Revenue Service reviews a taxpayer's financial information to make sure that the reported income, deductions, and credits are accurate. It's a way for the IRS to verify the information on a tax return, and it's, basically, a pretty common process for many individuals and businesses, especially those with very complex finances.

Why is there so much public interest in Donald Trump's tax situation?

The significant public interest stems from, you know, several factors: his prominence as a businessman and former president, the sheer complexity of his financial empire, and the broader societal interest in tax fairness and transparency for high-profile individuals. It's, in a way, a convergence of political, economic, and social curiosities that keeps the topic, basically, in the public eye.

Conclusion

The question, "Does Donald Trump owe the IRS money?" is, you know, a really persistent one that reflects a lot of public curiosity and, arguably, a deeper interest in transparency. While definitive answers from official sources are, basically, often constrained by privacy laws, the public discussion continues, shaped by media reports and general insights into how complex tax systems work. It's a topic that, naturally, connects to broader conversations about accountability and the financial dealings of those in the public eye.

Understanding these discussions means looking at the nuances of tax law, the nature of audits, and the interplay between private finances and public scrutiny. For more general information on how tax matters are reported and discussed in the public sphere, you might find it helpful to look at reports from reputable financial news outlets, like this major news agency. And, of course, you can always learn more about general financial topics on our site, or even link to this page for more detailed articles on public finance discussions.

- What Was The Room Whitney Died In

- What Happened To Mariah Careys Voice

- Are The Golfers In Happy Gilmore 2 Real Golfers

Do vs. Does: How to Use Does vs Do in Sentences - Confused Words

Do Vs Does: How To Use Them Correctly In English

Using Do and Does, Definition and Example Sentences USING DO AND DOES